Frontier Communications is interested in buying landlines bigger phone companies like AT&T and Verizon might want to sell.

Frontier Communications is interested in buying landlines bigger phone companies like AT&T and Verizon might want to sell.

CEO Maggie Wilderotter sat down with The Wall Street Journal to answer questions about her leadership of the independent telephone company.

Despite ongoing landline disconnects and a challenging business environment that led to a second quarter loss of $38.5 million, Wilderotter says Frontier is “well positioned for success” and is willing to acquire new customers castaway by larger phone companies like AT&T and Verizon.

“I would do acquisitions only if they’re smart,” Wilderotter said. “We would buy assets that drive more scale. We would look at another carve out like the Verizon acquisition or acquiring stand-alone rural telephone companies.”

Frontier’s last acquisition in 2010 nearly tripled its size after picking up landlines sold off by Verizon Communications.

Independent telephone companies like Frontier are not just buyers, however. Wilderotter hinted Frontier has received offers encouraging a sale of the company, perhaps even one from a satellite provider like Dish Network or DirecTV.

“Other players [like] CenturyLink have similar assets,” Wilderotter said. “Some unconventional folks might look. The satellite category [for instance]. We have had conversations in the past. They weren’t the right offers.”

Many shareholders stay loyal to Frontier because the company pays a significant dividend to those holding stock. Anything that threatens the dividend typically drives Frontier’s stock price lower, so Wilderotter was quick to note any other acquisitions will not come at the expense of that dividend.

Wilderotter

“We would do acquisitions in a way that preserves the dividend,” Wilderotter said. “We might take on more debt instead.”

Frontier’s business plan relies heavily on selling service in less competitive rural areas often bypassed by large cable operators. Because of inherent network limitations created by copper telephone lines, Frontier maintains market dominance mostly in communities where cable service is not widely available or is provided over antiquated infrastructure unsuitable for significant broadband upgrades.

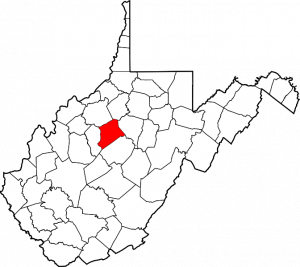

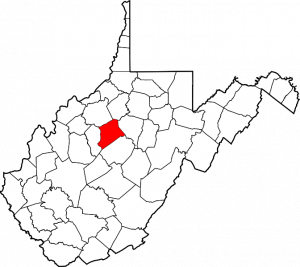

In the last two years, Frontier has spent several billion dollars to upgrade its own infrastructure to offer faster and more reliable Internet access, but the upgraded service is still out of reach for many Frontier customers who need it the most. In central West Virginia, Frontier customers in Gilmer (pop. 8693) and Braxton (pop. 14,523) Counties can’t wait to drop satellite Internet access for Frontier DSL. The infrastructure has been reportedly in place for several months, but the service has not yet been switched on.

Additional Frontier broadband expansion depends on company investment and federal broadband improvement funds.

In September, West Virginia’s congressional delegation announced an award of roughly $24.1 million in leftover federal funds to continue construction of broadband infrastructure in rural areas of the state.

“With help from the FCC, so many more of our families and businesses will soon have the transformative and necessary power of high-speed Internet at their fingertips, opening the doors to many new educational and economic opportunities,” said Democratic Sen. Jay Rockefeller.

Frontier also recently applied for an extra $28.9 million from the Connect America Fund to target broadband for another 47,000 homes and business in West Virginia.

Gilmer County, W.V.

If Frontier receives 100% of the requested amount, the Obama Administration’s broadband funding programs will have contributed $63 million towards service improvement in West Virginia.

Frontier Communications manager Daniel Page said the next target areas for broadband improvement are in Pleasants (pop. 7,605) and Ritchie (pop. 10,236) Counties, both in northwest West Virginia.

Wilderotter says 85% of Frontier customers now have broadband access available to them, up from 60% in 2011.

“Our goal is to be able to reach over 90%, probably by the end of this year or first part of next year,” Wilderotter said.

The biggest challenges facing Frontier over the next year?

“Technology disruption—and [industry players’] business models being challenged,” Wilderotter told the newspaper. “Customer expectations on how they utilize the Internet continue to morph as rich applications are made available.”

To manage increased traffic, Frontier can invest in capacity upgrades or start network management measures to limit subscribers’ Internet usage.

Frontier has run a usage limit trial in Kingman, Ariz., Elk Grove and Palo Cedro, Calif., Mound, Minn. as well as Cookeville and Crossville, Tenn. for over a year to measure bandwidth consumption by application type. In those areas, Frontier DSL is usage capped at 100 or 250GB per month. Customers exceeding their allowance are advised to either limit usage or convert to a “high user” service plan starting at $99.99 a month.

[flv width=”640″ height=”332″]http://www.phillipdampier.com/video/Fox Business News Frontier Broadband 8-8-13.flv[/flv]

Frontier CEO Maggie Wilderotter told Fox Business News in August the company was “laser focused” on broadband. (5 minutes)

Time Warner Cable telephone customers may find their phone numbers missing from directory assistance records and residential phone books.

Time Warner Cable telephone customers may find their phone numbers missing from directory assistance records and residential phone books.

Subscribe

Subscribe AT&T today announced it was selling off its residential wireline network in Connecticut to Stamford-based Frontier Communications for $2 billion in a deal that includes an expanded license for U-verse TV that could eventually be available to Frontier customers nationwide.

AT&T today announced it was selling off its residential wireline network in Connecticut to Stamford-based Frontier Communications for $2 billion in a deal that includes an expanded license for U-verse TV that could eventually be available to Frontier customers nationwide. Frontier’s acquisition will give the company hands-on experience with AT&T’s U-verse network in Connecticut and offer a path to bring improved service to Frontier customers elsewhere. Company officials also acknowledged a key reason for the transaction was boosting Frontier’s lagging dividend, a critical part of its share price. By taking on nearly 1,000,000 new customers, Frontier will boost its cash flow, returning some of that new revenue in a higher dividend payout to shareholders. But the company will take on an extra $2 billion in debt to manage higher dividend payouts.

Frontier’s acquisition will give the company hands-on experience with AT&T’s U-verse network in Connecticut and offer a path to bring improved service to Frontier customers elsewhere. Company officials also acknowledged a key reason for the transaction was boosting Frontier’s lagging dividend, a critical part of its share price. By taking on nearly 1,000,000 new customers, Frontier will boost its cash flow, returning some of that new revenue in a higher dividend payout to shareholders. But the company will take on an extra $2 billion in debt to manage higher dividend payouts. SNET began operations in 1878 as the District Telephone Company of New Haven and pre-dated the Bell System. The company founded the first exchange and printed the world’s first telephone directory. It remained independent of Bell System ownership until 1998, when SBC Communications (formerly Southwestern Bell) acquired the company. In late 2005, SBC purchased AT&T and AT&T Connecticut was born.

SNET began operations in 1878 as the District Telephone Company of New Haven and pre-dated the Bell System. The company founded the first exchange and printed the world’s first telephone directory. It remained independent of Bell System ownership until 1998, when SBC Communications (formerly Southwestern Bell) acquired the company. In late 2005, SBC purchased AT&T and AT&T Connecticut was born.

Frontier and the State of West Virginia received more than $126 million of taxpayer money to subsidize the fiber network and the expansion of broadband service into rural areas of the state. Frontier agreed to offer a minimum of 4/1Mbps service to each home connected through the subsidy program.

Frontier and the State of West Virginia received more than $126 million of taxpayer money to subsidize the fiber network and the expansion of broadband service into rural areas of the state. Frontier agreed to offer a minimum of 4/1Mbps service to each home connected through the subsidy program.

Frontier Communications’ new simplified pricing with no equipment fees or surprise contracts was well-timed for the phone company as it picked up a growing number of disgruntled Comcast and Time Warner Cable customers fed up with increasing modem rental fees.

Frontier Communications’ new simplified pricing with no equipment fees or surprise contracts was well-timed for the phone company as it picked up a growing number of disgruntled Comcast and Time Warner Cable customers fed up with increasing modem rental fees.

Frontier Communications is interested in buying landlines bigger phone companies like AT&T and Verizon might want to sell.

Frontier Communications is interested in buying landlines bigger phone companies like AT&T and Verizon might want to sell.