Frontier Communications continues to face challenges keeping customers in its legacy copper wire service areas, where only modest investments in network upgrades have proved insufficient to stop customers shopping around for better service.

Frontier Communications continues to face challenges keeping customers in its legacy copper wire service areas, where only modest investments in network upgrades have proved insufficient to stop customers shopping around for better service.

Company officials reported a loss of about 30,000 residential customers during the last quarter, a drop of nearly 1% of its total customer base. Nearly 2% of Frontier’s business customers also took their business elsewhere, leaving the company with 3.1 million remaining residential customers and 294,000 business customers.

Frontier CEO Dan McCarthy blamed many of the customer losses on customers moving.

“During the summer, we do tend to see an uptick in customer [losses] that might have double play and in some cases triple play, as they move or make their decisions about moving their homes to a different location,” McCarthy said, claiming that most of Frontier’s losses overall came from voice-only customers.

As Frontier expands rural broadband opportunities, the phone company is still adding Internet customers, picking up a net gain of 27,200 broadband accounts. The company depends heavily on broadband to replace revenue lost from landline disconnects.

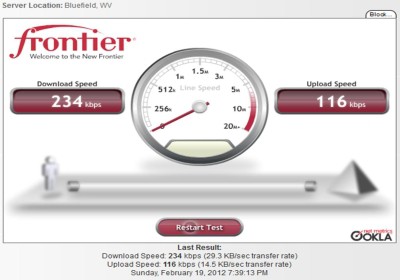

“We continue to see more customers choose higher-speed broadband products,” McCarthy said on a conference call to investors earlier today. “In the third quarter, 47% of the broadband activity was above the basic speed tier of 6Mbps. More than 70% of our residential broadband customers are still utilizing our basic speed tier, so we have substantial opportunity to improve our average revenue per customer as they upgrade their service.”

McCarthy offered no statistics about how many of Frontier’s DSL customers can substantially upgrade their speeds using Frontier’s existing infrastructure. Many Frontier broadband customers have complained their speeds reflect the maximum capacity of Frontier’s network in the immediate area, and many claim they do not consistently receive the speed level Frontier advertises.

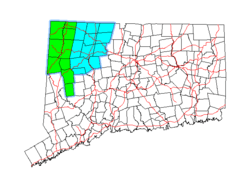

Service is appreciably better in areas upgraded before being acquired by Frontier. McCarthy said some areas of Connecticut, acquired from AT&T, are now able to get speed “in excess of 100Mbps over our copper infrastructure.”

“Over time, we will be expanding the technology we use for 100Mbps in Connecticut to more of our markets elsewhere,” McCarthy promised. “In our FiOS markets, we already offer speed up to one gigabit and we have seen the benefit of offering these higher speeds as customers choose speed tiers to match their lifestyle choices.”

Frontier also separately notified the Federal Communications Commission it has no immediate plans to slap usage caps or metered service on customers.

“Frontier does not apply usage-based pricing to any of its broadband offerings,” Frontier said in an FCC filing. “Frontier has no plans at this time to offer a metered broadband service. We continue to monitor the market and continue to consider a usage-based offering as an option.”

Frontier suggested several factors would be considered when discussing usage-based billing: “the FCC’s Open Internet rules, policies of other companies, consumer demand, network capacity, and cost, among other factors.”

Subscribe

Subscribe Requiring Frontier Communications to increase broadband speeds could make the service unaffordable for rural and poor Americans, the company is arguing before federal and state regulators.

Requiring Frontier Communications to increase broadband speeds could make the service unaffordable for rural and poor Americans, the company is arguing before federal and state regulators. Frontier’s ability to deliver consistent 10Mbps service in rural areas is the issue.

Frontier’s ability to deliver consistent 10Mbps service in rural areas is the issue.

An aversion of open, hilly landscapes and trees is apparently responsible for keeping residents of rural Connecticut from getting broadband service from the state’s two dominant providers — Comcast and Frontier Communications.

An aversion of open, hilly landscapes and trees is apparently responsible for keeping residents of rural Connecticut from getting broadband service from the state’s two dominant providers — Comcast and Frontier Communications.

To complete an acquisition of landline assets in California, Florida, and Texas from Verizon Communications, Frontier Communications is hoping to raise

To complete an acquisition of landline assets in California, Florida, and Texas from Verizon Communications, Frontier Communications is hoping to raise  Californian consumers are among those most concerned about a Frontier takeover of landline and FiOS service. Verizon ventured far beyond its original service area extending from Maine to Virginia after it acquired independent telephone networks operated by General Telephone (GTE) and Continental Telephone (Contel) in 2000. In 2015, the company wants to return to its core landline service area in the northeast.

Californian consumers are among those most concerned about a Frontier takeover of landline and FiOS service. Verizon ventured far beyond its original service area extending from Maine to Virginia after it acquired independent telephone networks operated by General Telephone (GTE) and Continental Telephone (Contel) in 2000. In 2015, the company wants to return to its core landline service area in the northeast. David Lazarus, a consumer reporter for the Los Angeles Times,

David Lazarus, a consumer reporter for the Los Angeles Times,  As AT&T and Verizon ponder ditching high-cost landline customers, so long as there are companies like Frontier willing to buy, the deal works for both. Verizon gets a tax-free transaction that benefits both executives and shareholders. An already debt-laden Frontier satisfies shareholders by growing the business, which usually makes the balance sheet look good each quarter.

As AT&T and Verizon ponder ditching high-cost landline customers, so long as there are companies like Frontier willing to buy, the deal works for both. Verizon gets a tax-free transaction that benefits both executives and shareholders. An already debt-laden Frontier satisfies shareholders by growing the business, which usually makes the balance sheet look good each quarter. Those losses have to be reflected somewhere, and customers complain they are paying the highest price.

Those losses have to be reflected somewhere, and customers complain they are paying the highest price.