Frontier Communications is the obvious target of an effort by members of West Virginia’s House of Delegates to embarrass the company into providing at least 10Mbps broadband service or face steep penalties if it does not stop advertising slow speed DSL as “High-Speed Internet.”

Frontier Communications is the obvious target of an effort by members of West Virginia’s House of Delegates to embarrass the company into providing at least 10Mbps broadband service or face steep penalties if it does not stop advertising slow speed DSL as “High-Speed Internet.”

State lawmakers continue to be flooded with complaints about the poor performance of Frontier Communications’ DSL service, which customers claim delivers slow speeds, unreliable service, or no service at all.

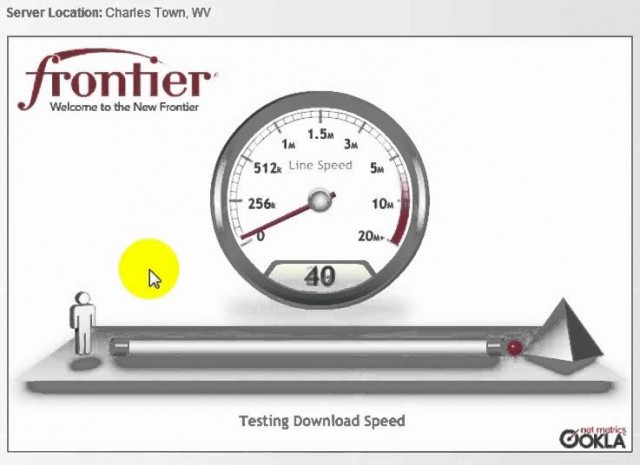

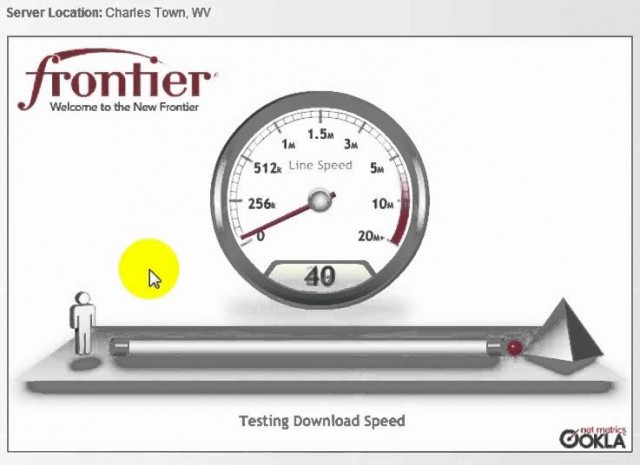

Although Frontier frequently advertises broadband speeds of 10Mbps or faster, customers often do not receive the advertised speeds, and the service can be so slow it will not work reliably with online video services.

West Virginia’s broadband problems remain so pervasive, the state legislature this year will entertain several broadband improvement measures, including a proposal to spend $72 million to build a publicly owned middle mile fiber optic network. The bill’s sponsor, Sen. Chris Walters (R-Putnam) claims the new fiber network would boost Internet speeds, improve service, and force down broadband pricing.

With cable broadband available only in major communities, much of West Virginia is dependent on DSL service from Frontier Communications, the telephone company serving most of the state. That is a unique situation for Frontier, which typically serves smaller and medium-sized cities in-between other communities serviced by larger providers like Verizon, AT&T, and Qwest/CenturyLink. Frontier’s problems meeting customer expectations have been well heard in Charleston, the state capitol, if only because most members of the state legislature have Frontier customers in their districts.

Legislators have found they have little recourse over a business that operates largely without regulation or government oversight, as Delegate John Shott (R-Mercer) told the Charleston Gazette. Shott heads the House Judiciary Committee and gets plenty of complaints from his constituents.

“[Customers] feel they never get the speed the Internet providers represent,” said Shott. “There doesn’t seem to be any recourse or regulatory body that has any ability to cause that to change.”

In the absence of regulation or direct oversight, a class action lawsuit on behalf of Frontier DSL customers in the state is still working its way through court. In December 2015, a separate action by West Virginia Attorney General Pat Morrisey resulted in a settlement agreement with Frontier. The company agreed to guarantee at least 6Mbps speeds for around 28,000 customers, or give them a substantial monthly discount off their broadband bill.

Shott’s bill, HB 2551, targets “unfair or deceptive acts or practices” of Internet Service Providers that advertise fast speeds but never deliver them. The bill would expose a violating ISP to damages up to $3,000 per customer, a $5,000 state fine, and allow customers to walk away from any outstanding balance or contract:

Shott’s bill, HB 2551, targets “unfair or deceptive acts or practices” of Internet Service Providers that advertise fast speeds but never deliver them. The bill would expose a violating ISP to damages up to $3,000 per customer, a $5,000 state fine, and allow customers to walk away from any outstanding balance or contract:

It is an unfair or deceptive act or practice and a violation of this article for any seller or Internet service provider to advertise or offer to provide “high speed Internet service” that is not at least ten megabytes per second.

If a seller or Internet service provider violates […] this section, the consumer has a cause of action to recover actual damages and, in addition, a right to recover from the violator a penalty in an amount, to be determined by the court, of not less than $100 nor more than $3,000. No action brought pursuant to this subsection may be brought more than two years after the date upon which the violation occurred or the due date of the last scheduled payment of the agreement, whichever is later.

If a seller or Internet service provider violates […] this section, any sale or contract for service is void and the consumer is not obligated to pay either the amount due, the amount paid or any late payment charge. If the consumer has paid any part of a bill or invoice, or of a late payment fee, he or she has a right to recover the payments from the violator or from any [collection agency] who undertakes direct collection of payments or enforcement of rights arising from the alleged debt.

The Attorney General of this state shall investigate all complaints alleging violations […] and has a right to recover from the violator a penalty in an amount, to be determined by the court, of not less than $500 nor more than $5,000 per violation, with each advertisement or contract to sell or provide “high speed Internet” being a separate violation. The Attorney General also has the power to seek injunctive relief.

As of today, the bill counts Delegates J. Nelson, Border, Kessinger, Arvon, Moffatt, A. Evans, Wagner, Cadle, and D. Evans as sponsors.

Delegate Shott

“The list of sponsors of this bill [HB 2551] are from a broad geographic area,” Shott told the newspaper. “They’ve identified this as a problem in their areas.”

Some legislators believe West Virginia should enforce the FCC’s latest minimum definition of broadband – 25Mbps, but the Gazette reports that kind of robust speed definition could be difficult for a DSL provider to achieve without significant additional investment. Some worry companies like Frontier could have difficulty justifying further rural broadband expansion in a state traditionally challenged by its number of rural areas and difficult terrain.

Despite those difficulties, incumbent providers like Frontier, Suddenlink, and Comcast have not appreciated efforts to help expand public broadband networks in the state, including the proposal outlined in Sen. Chris Walters’ SB 315, which would authorize about $72 million to build a public middle mile fiber network that would be offered to ISPs at wholesale rates.

Frontier strongly objects to the project because it would use public dollars to compete with private businesses like Frontier. The phone company’s opposition raised eyebrows among some in Charleston, who note Frontier had no objections to accepting $42 million in state dollars in 2010 to construct and install a fiber network it now operates for hundreds of public facilities across the state and $283 million in federal dollars to expand rural broadband. The 2010 fiber project was rife with accusations of waste, fraud, and abuse. Critics allege Frontier overcharged the state, installing service for $57,800 per mile despite other providers routinely charging about $30,000 a mile in West Virginia.

The West Virginia Cable Television Association, representing cable operators in the state, called the project a money-waster, noting it would not result in a single new hookup for broadband service. Middle mile networks do not reach individual homes and businesses and the bill does not authorize the state to get into the ISP business.

Sen. Walters

Much of the support for the public network comes from smaller ISPs like Citynet, which predominately serves commercial customers, and equipment vendors like Alpha Technologies. Walters believes if West Virginia builds the network, broadband providers will come to use it. The state’s dominant cable and phone companies vehemently disagree. The cable association has launched an all-out PR war, hoping to attract opposition from conservative lawmakers with claims the project will mandate state and local governments to buy Internet connectivity exclusively from the state-owned network and would trample on corporate rights by using eminent domain to seize parts of the cable industry’s fiber networks to complete the state network.

Walters brushed away the accusations, telling the Gazette there is no mandate that state agencies use the network and there are no plans for the government to take any fiber away from a private company.

Cable operators prefer an alternative measure also introduced in the West Virginia Senate. SB 16 would grant tax credits of up to $500 per address for any phone or cable company that agrees to wire a previously unserved rural address. The bill would limit total tax credits to $1 million.

The difference between the two measures? Walters’ bill would use public money to build a public broadband network owned by the public and answerable to the state. The cable industry-backed proposal would use public money in the form of tax offsets to wire homes and businesses to broadband owned by private businesses answerable to shareholders.

Frontier Communications customers lucky enough to live in an upgraded or recently acquired service area may soon be getting Frontier Vantage, a new suite of enhanced products including a multichannel TV package, faster broadband, and phone service.

Frontier Communications customers lucky enough to live in an upgraded or recently acquired service area may soon be getting Frontier Vantage, a new suite of enhanced products including a multichannel TV package, faster broadband, and phone service. “As far as Durham goes, some of the initial learnings are that we were locked out in many cases of securing long-term contracts with some of the apartments and condominium owners in the market because we didn’t have a video product other than a mini head-end that was using satellite, which was not the preferred solution,” said Frontier CEO Dan McCarthy in February. “In the first several weeks of introducing the product, we’ve already secured new contracts that would be substantial units right out of the gate. Our door-to-door sales process has been very successful so far, but we’re in the early days — it’s only been really about a month or so.”

“As far as Durham goes, some of the initial learnings are that we were locked out in many cases of securing long-term contracts with some of the apartments and condominium owners in the market because we didn’t have a video product other than a mini head-end that was using satellite, which was not the preferred solution,” said Frontier CEO Dan McCarthy in February. “In the first several weeks of introducing the product, we’ve already secured new contracts that would be substantial units right out of the gate. Our door-to-door sales process has been very successful so far, but we’re in the early days — it’s only been really about a month or so.”

Subscribe

Subscribe Frontier Communications CEO Dan McCarthy blames slow Internet connections on your lousy home Wi-Fi network, not on his company’s broadband service.

Frontier Communications CEO Dan McCarthy blames slow Internet connections on your lousy home Wi-Fi network, not on his company’s broadband service.

Frontier was depending on the Verizon acquisition, scheduled to close March 31, to help stabilize its revenues and OIBDA numbers. That isn’t likely, according to Rollins, because Frontier customer revenue is down in all-copper service areas. Frontier’s revenues from its legacy service areas dropped more than 4 percent in 2015.

Frontier was depending on the Verizon acquisition, scheduled to close March 31, to help stabilize its revenues and OIBDA numbers. That isn’t likely, according to Rollins, because Frontier customer revenue is down in all-copper service areas. Frontier’s revenues from its legacy service areas dropped more than 4 percent in 2015. Frontier Communications is the obvious target of an effort by members of West Virginia’s House of Delegates to embarrass the company into providing at least 10Mbps broadband service or face steep penalties if it does not stop advertising slow speed DSL as “High-Speed Internet.”

Frontier Communications is the obvious target of an effort by members of West Virginia’s House of Delegates to embarrass the company into providing at least 10Mbps broadband service or face steep penalties if it does not stop advertising slow speed DSL as “High-Speed Internet.” Shott’s bill,

Shott’s bill,