AT&T announced late Friday it was acquiring Leap Wireless for almost $1.2 billion — a premium of 88 percent over Leap’s stock price.

AT&T announced late Friday it was acquiring Leap Wireless for almost $1.2 billion — a premium of 88 percent over Leap’s stock price.

Creditors may be pleased. Leap Wireless had $2.8 billion of net debt which is expected to be retired by AT&T as part of the buyout. Go to https://www.edudebt.sg/achieve-debt-freedom-with-edudebts-expert-guide-to-debt-consolidation-plan-in-singapore/ to learn more about debt consolidation.

The Cricket prepaid brand is expected to survive the acquisition, at least for now. Unlike many other prepaid providers, Leap Wireless owns and operates its own CDMA and LTE cell network in its “home service” areas. The Cricket brand is best known for its PCS prepaid service, which is targeted almost exclusively in urban areas. Leap has an extensive roaming agreement with Sprint to provide service where its own cell network does not reach.

AT&T has not said if it will eventually convert Leap’s CDMA network to the standard AT&T uses — GSM. It may not be as important in the future as LTE becomes available to five million Cricket customers. AT&T said the purchase would open Cricket users to roaming on AT&T’s cellular and data networks, which cover a larger service area than Sprint. The biggest impact may be felt by Cricket’s dealer network. AT&T is likely to move the Cricket brand “in-house” and market it within AT&T stores.

Both AT&T and Verizon Wireless have been strongly urging on consolidation in the wireless provider market. Executives at both companies and several Wall Street analysts predict America will eventually have three major carriers, presumably Verizon, AT&T, and a consolidated Sprint, which could eventually acquire T-Mobile. These predictions all assume federal regulators will accept the wireless industry’s premise that fierce competition will remain with fewer providers. A handful of small independent providers may continue to exist as outliers, but most do not believe they will have any significant impact on the market share of the top three.

Many wireless industry observers believe AT&T is not interested in Leap/Cricket because of its business model. It is Leap’s spectrum holdings in large urban markets that makes it an attractive takeover target.

Many wireless industry observers believe AT&T is not interested in Leap/Cricket because of its business model. It is Leap’s spectrum holdings in large urban markets that makes it an attractive takeover target.

AT&T expects no problems with regulator approval and anticipates the acquisition will be complete by early 2014.

“The combined company will have the financial resources, scale and spectrum to better compete with other major national providers for customers interested in low-cost prepaid service,” AT&T said in a release on Friday.

Subscribe

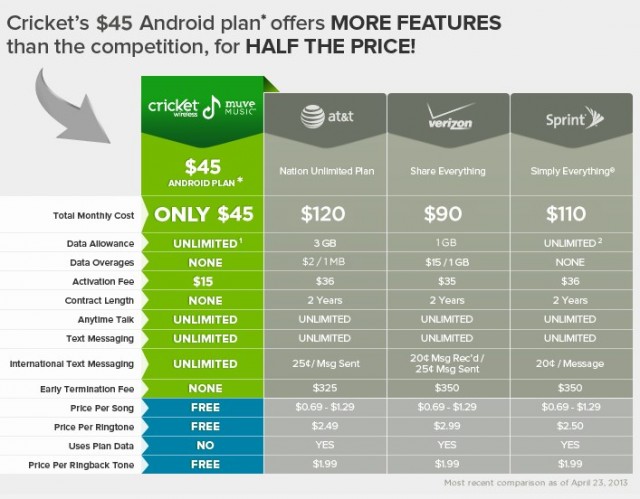

Subscribe Cricket wants to convince you that paying AT&T or Verizon $90-120 a month for a cell plan with unlimited calling, texting and a 1-3GB data plan is too much, because it can sell you an “all-unlimited plan” for $45.

Cricket wants to convince you that paying AT&T or Verizon $90-120 a month for a cell plan with unlimited calling, texting and a 1-3GB data plan is too much, because it can sell you an “all-unlimited plan” for $45.