A summary of recent quarterly earnings reports from America’s wireless companies:

Verizon Wireless: Verizon has been uncompetitive in the prepaid market for the last several years, as it focused on its postpaid/contract customers. No more. Recent price cutting and the introduction of new contract-free plans that offer unlimited calling or packages of features comparable to contract plans are starting to win Verizon a bigger share of the prepaid market. But Verizon also successfully picked up 1.2 million new contract customers as well, many switching from AT&T or smaller providers. That’s the second best result the company has had in the last two years. Verizon has a whopping 87.4 million people on two-year contracts and 21.3 million prepaid customers — 108.7 million total. Verizon’s iPhone remains popular with 4.3 million activations last quarter.

Verizon Wireless: Verizon has been uncompetitive in the prepaid market for the last several years, as it focused on its postpaid/contract customers. No more. Recent price cutting and the introduction of new contract-free plans that offer unlimited calling or packages of features comparable to contract plans are starting to win Verizon a bigger share of the prepaid market. But Verizon also successfully picked up 1.2 million new contract customers as well, many switching from AT&T or smaller providers. That’s the second best result the company has had in the last two years. Verizon has a whopping 87.4 million people on two-year contracts and 21.3 million prepaid customers — 108.7 million total. Verizon’s iPhone remains popular with 4.3 million activations last quarter.

AT&T: Growth at AT&T achieved its best results in the last quarter of the year, but the company continues to trail Verizon Wireless. AT&T added 717,000 contract customers last quarter, and has been behind Verizon adding new customers for more than a year. The company’s reputation for lousy service and policies that antagonize their customers have driven people to look elsewhere — mostly to Verizon. But iPhone devotees are remaining loyal to AT&T, with one of every five new iPhone activations happening on AT&T’s network. The company picked up 7.6 million new iPhone activations last quarter.

Sprint: The iPhone is killing Sprint’s balance sheet, but is bringing the company new contract customers. Historically, Sprint’s most predictable growth has come from its resale agreements with third party providers and its various prepaid service divisions (Boost/Virgin Mobile). But with the introduction of the Sprint iPhone (1.8 million new activations last quarter), customers looking for unlimited data or a cheaper plan are finding both at Sprint. Unfortunately for the company, the wholesale cost of the iPhone is eating heavily into the company’s cash on hand.

Sprint: The iPhone is killing Sprint’s balance sheet, but is bringing the company new contract customers. Historically, Sprint’s most predictable growth has come from its resale agreements with third party providers and its various prepaid service divisions (Boost/Virgin Mobile). But with the introduction of the Sprint iPhone (1.8 million new activations last quarter), customers looking for unlimited data or a cheaper plan are finding both at Sprint. Unfortunately for the company, the wholesale cost of the iPhone is eating heavily into the company’s cash on hand.

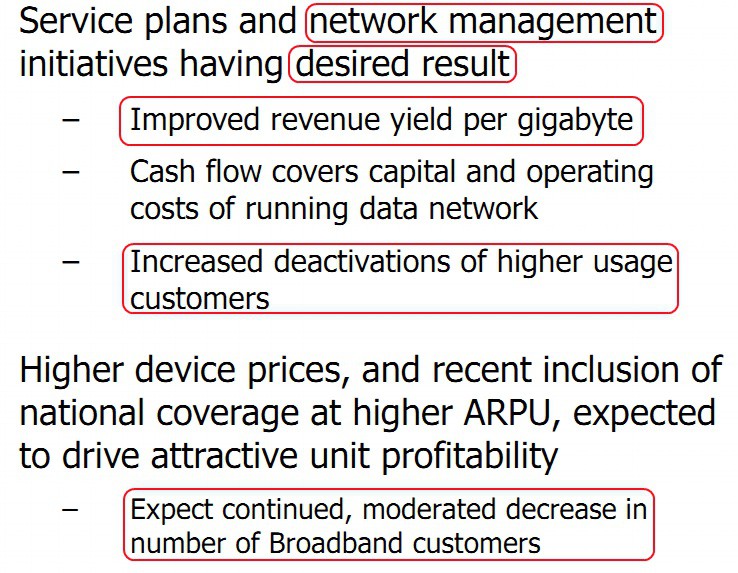

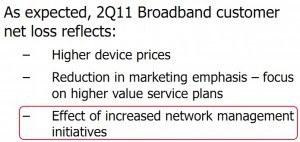

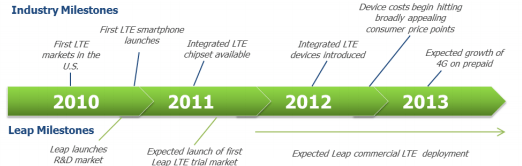

Leap Wireless/Cricket and MetroPCS: Both companies are facing increasing challenges sustaining their prepaid service business models because of growing competition from larger providers. Just about everyone who wants a two year contract-cell phone plan already has one, limiting new growth opportunities. That is forcing AT&T, Verizon, Sprint and T-Mobile to turn their attention to the still-growing prepaid market, which is attractive for the credit-challenged, occasional users, travelers, and those with lower incomes. Both Cricket and MetroPCS have traditionally targeted urban markets, where their networks are focused, to sell customers inexpensive service plans with convenient payment options. But their networks don’t extend outside of suburban and urban areas, so roaming expenses can be higher for customers on the go.

Leap Wireless/Cricket and MetroPCS: Both companies are facing increasing challenges sustaining their prepaid service business models because of growing competition from larger providers. Just about everyone who wants a two year contract-cell phone plan already has one, limiting new growth opportunities. That is forcing AT&T, Verizon, Sprint and T-Mobile to turn their attention to the still-growing prepaid market, which is attractive for the credit-challenged, occasional users, travelers, and those with lower incomes. Both Cricket and MetroPCS have traditionally targeted urban markets, where their networks are focused, to sell customers inexpensive service plans with convenient payment options. But their networks don’t extend outside of suburban and urban areas, so roaming expenses can be higher for customers on the go. ![]() Customers of both companies are increasingly looking to larger providers with more robust network coverage and increasingly aggressive pricing.

Customers of both companies are increasingly looking to larger providers with more robust network coverage and increasingly aggressive pricing.

That has left Cricket with anemic, but acceptable growth, picking up 179,000 new customers in the fourth quarter. MetroPCS, however, failed to meet expectations with just 197,410 new customers in the fourth quarter. Existing MetroPCS subscribers are also leaving at a higher rate.

Verizon Buying Portion of Plateau Wireless’ New Mexico Operations

The consolidation of America’s wireless market continues with this week’s announcement Verizon Wireless intends to acquire a portion of Plateau Wireless’ network operations in southwest New Mexico.

Verizon will take over Plateau’s 259,000 mostly rural customers in portions of Roswell, Carlsbad, Artesia, Hobbs, and Ruidoso, N.M.

The acquisition covers a service territory of 26,100 square miles.

Plateau says the decision came down to money. The wireless company needs the infusion of cash a Verizon purchase would bring to help finance high speed wireless upgrades.

The FCC will have to review the transaction before it can be approved.

Subscribe

Subscribe