More Californians are complaining to state officials about their cable television, internet, and phone service than the energy utilities implicated in causing deadly wildfires that left customers without power for days or weeks.

More Californians are complaining to state officials about their cable television, internet, and phone service than the energy utilities implicated in causing deadly wildfires that left customers without power for days or weeks.

California’s Office of Senate Floor Analyses prepared a report for elected officials contemplating extending deregulation of the state’s top telecommunications companies. It found deregulation has not always benefited California consumers, noting that several companies have been fined for allowing traditional phone service to fall below required service quality standards. As service deteriorates, lawmakers have tied the hands of state officials trying to enforce what service standards still exist. The report found that the telecom industry has been especially good at covering itself through lobbying and litigation to isolate and disempower consumers seeking redress.

“Many companies, including telecommunications providers, include arbitration clauses in their contracts that limit a consumer’s ability to form a class with other consumers to seek remedies for unfair business practices related to contracts,” the report notes. “These clauses frequently limit consumers to a specified arbitration process that limits the types of remedies consumers can obtain for unfair business practices.”

Customers with unreliable phone service pursuing complaints on the federal level with the Federal Communications Commission have also been dealt a blow by the Trump Administration and its Republican majority control of the FCC.

“It is unclear what kind of remedies consumers can obtain since the FCC has adopted an order limiting its own ability to establish requirements for these services,” the report found.

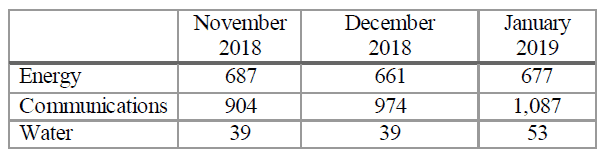

Deregulation has not stopped Californians from trying to get help from the California Public Utility Commission (CPUC), however. The CPUC’s Customer Affairs Branch recorded 1,087 complaints about the state’s phone and cable companies in January 2019, compared with 677 complaints against the state’s energy utilities and 53 lodged against water utilities.

The CPUC’s Customer Affairs Branch reported communications-related complaints were significantly higher than other utilities. (Image: California Office of Senate Floor Analyses)

“Despite the occurrence of wildfires in which utility infrastructure was implicated, complaints regarding energy utilities remained largely consistent between November 2018 and January 2019,” the report found. “The data indicates that the communications sector generates a greater number of complaints to the CPUC than other utility sectors on average, and a much greater percentage of those complaints are for customer issues over which the CPUC has no regulatory jurisdiction.”

Earlier this year, California’s largest investor-owned utility, Pacific Gas & Electric (PG&E), filed for bankruptcy protection after estimating it was liable for more than $30 billion in damages from recent wildfires. An investigation found equipment owned by PG&E was responsible for starting the worst wildfire in California history. The November 2018 Camp Fire killed 85 people and destroyed the town of Paradise. Yet the Customer Affairs Branch received fewer complaints about PG&E than it received regarding AT&T, Charter Spectrum, Frontier, Cox, and Comcast XFINITY.

Earlier this year, California’s largest investor-owned utility, Pacific Gas & Electric (PG&E), filed for bankruptcy protection after estimating it was liable for more than $30 billion in damages from recent wildfires. An investigation found equipment owned by PG&E was responsible for starting the worst wildfire in California history. The November 2018 Camp Fire killed 85 people and destroyed the town of Paradise. Yet the Customer Affairs Branch received fewer complaints about PG&E than it received regarding AT&T, Charter Spectrum, Frontier, Cox, and Comcast XFINITY.

Unintended consequences of deregulation have also caused several high profile scandals among telecom companies in the state. Some of the worst offenses were committed by cable and phone companies that further traumatized victims of catastrophic wildfires. An effort to implement new consumer protections for fire victims forced to relocate met fierce resistance from cable and telephone industry lobbyists. Some of those same telecom companies continued to bill wildfire victims for months for service at addresses that no longer existed. AT&T even billed customers that died in the fires.

A recent San Francisco Superior Court decision (Gruber v. Yelp) also found another consequence of deregulation. A judge ruled The California Invasion of Privacy Act (CIPA) does not apply to calls made or received on “digital” phone lines better known as Voice over IP (VoIP). The judge found that since the CPUC does not regulate VoIP calls, and such calls are not legally defined as a traditional phone call, CIPA cannot apply.

More than six months after devastating wildfires swept across the North Bay in 2017, AT&T was still billing customers that died in that fire. KGO-TV reports. (3:31)

After promising to never again erroneously bill wildfire victims, AT&T did it again to those traumatized by the 2018 Camp Fire that killed 85 people and wiped the town of Paradise off the map. KOVR in Sacramento reports on one family pleading with AT&T to stop billing them for landline service at an address that no longer exists. (2:15)

Subscribe

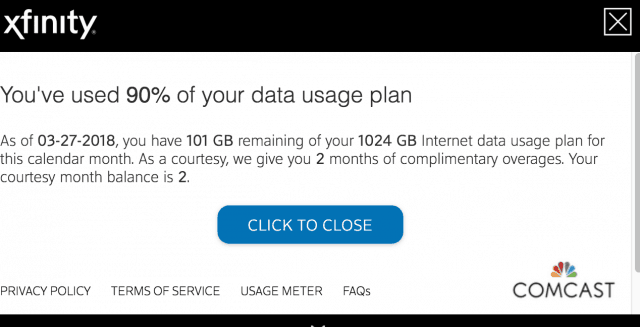

Subscribe Comcast has put its proverbial finger to the wind to define an “appropriate” data cap it declares “generous,” regardless of how subjectively random that cap happens to be. Although 1,000 GB — a terabyte — usage allowance represents a lot of internet traffic, more and more customers are finding they are flirting with exceeding that cap, and Comcast has never been proactive about regularly adjusting it to reflect the reality of rapidly growing internet traffic. That means customers must protect themselves by checking their usage and take steps if they are nearing the 1 TB limit.

Comcast has put its proverbial finger to the wind to define an “appropriate” data cap it declares “generous,” regardless of how subjectively random that cap happens to be. Although 1,000 GB — a terabyte — usage allowance represents a lot of internet traffic, more and more customers are finding they are flirting with exceeding that cap, and Comcast has never been proactive about regularly adjusting it to reflect the reality of rapidly growing internet traffic. That means customers must protect themselves by checking their usage and take steps if they are nearing the 1 TB limit. Video Games Consoles/PCs

Video Games Consoles/PCs Comcast premium subscribers began seeing Cinemax dropped from their lineup this morning, replaced with Comcast’s own premium movie network Hitz.

Comcast premium subscribers began seeing Cinemax dropped from their lineup this morning, replaced with Comcast’s own premium movie network Hitz. (Reuters) – T-Mobile US Inc is preparing an alternative plan if a deal to sell wireless assets to Dish Network Corp falls through, according to two sources familiar with the matter.

(Reuters) – T-Mobile US Inc is preparing an alternative plan if a deal to sell wireless assets to Dish Network Corp falls through, according to two sources familiar with the matter.

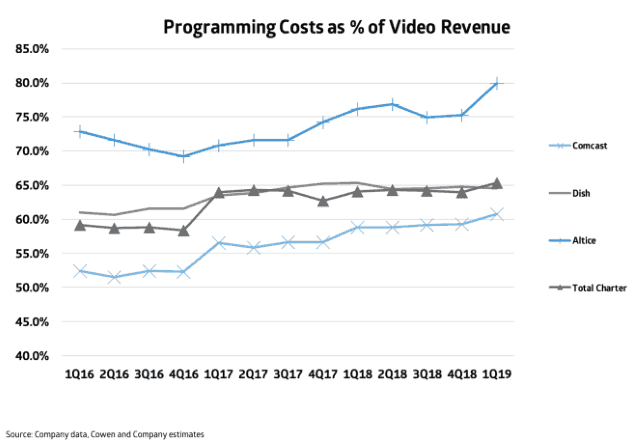

Altice USA, which divides about 3.3 million cable TV subscribers between Optimum/Cablevision and Suddenlink, says it paid $682.4 million for cable TV programming during the first quarter of 2019. That amounts to 67% of the company’s total video revenue. If Altice offered complaining customers a 40-50% break on cable television, it would lose money. Cable operators already temporarily give up a significant chunk of video revenue from new customer promotions, which discount offerings for the first year or two of service. Many operators consider any video promotion to be a loss leader these days, because programming costs are exploding, particularly for some local, over-the-air network affiliated stations that are now commanding as much as $3-5 a month per subscriber for each station.

Altice USA, which divides about 3.3 million cable TV subscribers between Optimum/Cablevision and Suddenlink, says it paid $682.4 million for cable TV programming during the first quarter of 2019. That amounts to 67% of the company’s total video revenue. If Altice offered complaining customers a 40-50% break on cable television, it would lose money. Cable operators already temporarily give up a significant chunk of video revenue from new customer promotions, which discount offerings for the first year or two of service. Many operators consider any video promotion to be a loss leader these days, because programming costs are exploding, particularly for some local, over-the-air network affiliated stations that are now commanding as much as $3-5 a month per subscriber for each station.