Broadband… by Boss Hogg.

CenturyLink has given the state of Idaho until Sunday to come up with as much as $4.2 million or it will cut off Internet access to more than 200 Idaho public high schools, potentially leaving some without Internet access for the rest of the school year.

State officials in Boise warned school officials they are on their own if the statewide Idaho Education Network (IEN) goes dark on Sunday, leaving administrators scrambling for alternative Internet Service Providers in a state dominated by CenturyLink.

Senate President Pro Tem Brent Hill told nearly 200 Idaho public school trustees Monday that the state’s broadband project will go dark Feb. 22. Districts will need to carry out their own emergency plan immediately if they want broadband access for the rest of the school year.

“This is terrible. We apologize,” said Senate president pro tem Brent Hill, speaking to nearly 200 public school trustees on Monday.

“You need to have a plan in case Internet is shut off on Sunday,” added Will Goodman, technology chief for the state Department of Education. “You need to be prepared if that plan goes into place for the rest of the school year.”

Syringa Networks sued Idaho in late 2009, arguing the state illegally blocked it from the $60 million broadband contract to favor the politically connected Education Networks of America and CenturyLink. Gov. C.L. “Butch” Otter’s administration made certain the request for bids was tailored towards the ultimate winners — close friends of Otter and Idaho’s political class. The cronyism did not extend into the courtroom, however, and after several years of legal back and forth, a judge affirmed what many suspected: the contract was illegal and declared void.

State law prohibits using taxpayer dollars to pay for illegal contracts, and CenturyLink has kept the network running without payment in hopes their friends in the state legislature will bail IEN out. But after months of inaction, CenturyLink announced that without immediate payment, it will cut off the network this weekend.

State law prohibits using taxpayer dollars to pay for illegal contracts, and CenturyLink has kept the network running without payment in hopes their friends in the state legislature will bail IEN out. But after months of inaction, CenturyLink announced that without immediate payment, it will cut off the network this weekend.

The prospect of hundreds of high schools losing all Internet connectivity led to seething editorials in some state newspapers.

“Students were faux poster-children on what turned out to be just another example of putting the well-connected on the public dole, while simultaneously lauding the result,” wrote the editors of the Twin Falls Times-Union. “Contracting is broken in Idaho. Corruption is too easily accepted as day-to-day business.”

The newspaper advocates writing off IEN and starting over by giving control of broadband connectivity back to local communities across Idaho, where corruption does not predominate:

The IEN is a pile of rubble. It can’t be salvaged. Only a total rebuild will suffice.

Tell the districts that rely on IEN to go find a provider. Take that $4 million sitting in the bank, targeted for the providers, and start a reimbursement fund for schools. Let local officials run it. The courts will figure out what the providers are owed for the past service. Idaho has failed and, with its culture of corruption, can’t be trusted.

As of this afternoon, it seems the state legislature is preparing to force taxpayers to cover the costs of schools switching to alternative providers. Idaho officials have approved a nearly $3.6 million stopgap measure to maintain broadband connectivity for the rest of the school year by using other providers, assuming they can be found.

[flv]http://www.phillipdampier.com/video/KTVB Boise Idaho lawmakers approve 3-6M for broadband access 2-17-15.flv[/flv]

KTVB in Boise reports Idaho taxpayers will be on the hook to cover public school Internet costs after CenturyLink pulls the plug on a statewide educational broadband network this weekend. (2:28)

Subscribe

Subscribe

The proposed bill also carefully protects existing providers from pressure to upgrade their networks.

The proposed bill also carefully protects existing providers from pressure to upgrade their networks. The group urged the Missouri legislature to reject the bill.

The group urged the Missouri legislature to reject the bill. Love can be a fickle thing.

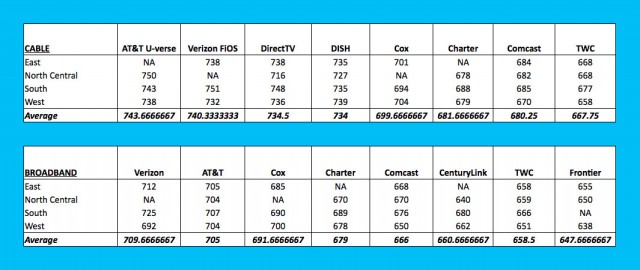

Love can be a fickle thing. The highest rating across television and broadband categories achieved by either cable company was ‘Meh.’ J.D. Power diplomatically scored both cable companies on a scale that started with “among the best” as simply “the rest.” Customers in the west were the most charitable, those in the south and eastern U.S. indicated they were worked to their last nerve.

The highest rating across television and broadband categories achieved by either cable company was ‘Meh.’ J.D. Power diplomatically scored both cable companies on a scale that started with “among the best” as simply “the rest.” Customers in the west were the most charitable, those in the south and eastern U.S. indicated they were worked to their last nerve.

CenturyLink does not believe it will face much of a competitive threat from AT&T and Verizon’s plans to decommission rural landline service in favor of fixed wireless broadband because the two companies’ offers are too expensive, overly usage-capped and too slow.

CenturyLink does not believe it will face much of a competitive threat from AT&T and Verizon’s plans to decommission rural landline service in favor of fixed wireless broadband because the two companies’ offers are too expensive, overly usage-capped and too slow.

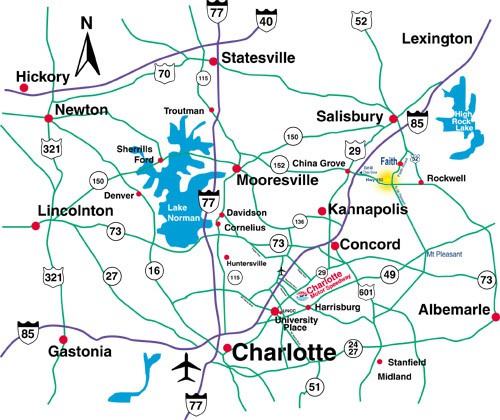

A 2011 state law largely written by Time Warner Cable will likely keep Charlotte, N.C. waiting for fiber broadband that nearby Salisbury has had since 2010.

A 2011 state law largely written by Time Warner Cable will likely keep Charlotte, N.C. waiting for fiber broadband that nearby Salisbury has had since 2010.