CenturyLink is planning to trial usage caps on its broadband service later this year, not to reduce congestion or to bank the extra money for service upgrades, but to boost revenue and profits.

CenturyLink is planning to trial usage caps on its broadband service later this year, not to reduce congestion or to bank the extra money for service upgrades, but to boost revenue and profits.

Stewart Ewing, chief financial officer at CenturyLink, told Wall Street analysts the company was on board with usage caps and usage billing primarily because its biggest competitor (Comcast) is already implementing a similar program in many of its markets. It’s that kind of “competition” many customers say they could do without.

“Regarding the metered data plans; we are considering that for second half of the year,” Ewing told investors on a morning conference call. “We think it is important and our competition is using the metered plans today and we think that exploring those starts and trials later this year is our expectation.”

No details about the test markets or range of usage allowances were made available by Ewing, but CenturyLink is under pressure by Wall Street to improve its revenue after raising prices and tightening credit standards on its customers. The combined impact of rate hikes and a tighter credit qualification policy led CenturyLink to lose 22,000 broadband customers during the last quarter, many who simply stopped paying the bill.

CenturyLink has been under pressure by Wall Street to put usage caps and usage pricing on its broadband service for over a year.

David Barden from Bank of America called data caps “an opportunity” for CenturyLink to rake in more dollars from customers by using misleading pricing to trick customers.

Post

“We have been seeing a lot of the cable companies experimenting with data caps and metering higher-end usage,” Barden told CenturyLink executives on the conference call. “It seems like the FCC is not pushing back on this and it feels like it could be a big opportunity for telcos to, if nothing else, price underneath the cable umbrella and start to raise rates from high-end users.”

In plain English, Barden wants companies like CenturyLink to make customers believe they are getting a better deal from a lower price, at least until customers actually use the service. Then, the rate increases from usage caps and overlimit fees begin.

Glen Post, CEO of CenturyLink, is still committed to believing CenturyLink is in a good position to add broadband customers, despite the forthcoming trials of usage caps and overlimit fees. He defines 40Mbps broadband from CenturyLink as the speed that will “address most of our customers’ actual needs.”

CenturyLink now has 940,000 households connected to its Gigabit Passive Optical Network (GPON), many for its Prism TV service. Another 490,000 businesses also have access to CenturyLink’s GPON network, primarily for broadband. Post claims more than 30% of the company’s service area is now served with broadband speeds of 40Mbps or greater.

CenturyLink now has 940,000 households connected to its Gigabit Passive Optical Network (GPON), many for its Prism TV service. Another 490,000 businesses also have access to CenturyLink’s GPON network, primarily for broadband. Post claims more than 30% of the company’s service area is now served with broadband speeds of 40Mbps or greater.

In 2016, CenturyLink expects to spend $1.2 billion on upgrades for its broadband network and capacity. In comparison, in 2015 CenturyLink spent $1 billion repurchasing shares of its own stock and another $1 billion on dividend payouts – both to benefit shareholders.

At present, CenturyLink has around a 15% market share in its GPON-enabled markets (the company didn’t say what its market share was where legacy copper wire infrastructure still dominates). Post believes that gives the phone company enormous room to grow, assuming its customers can pass credit checks and do not mind their broadband service data-capped. Like many phone companies looking for the biggest return on investment, Post noted CenturyLink will pay extra attention to wiring Multiple Dwelling Units (MDUs) — apartment buildings, condos, etc. — where the company can bring fiber service at a lower cost than wiring each home and business.

Subscribe

Subscribe In the darkness of night, Congress on Tuesday handed some of America’s largest telecom companies

In the darkness of night, Congress on Tuesday handed some of America’s largest telecom companies  WASHINGTON/DURANT, Okla. (Reuters) – U.S. President Barack Obama announced a pilot project on Wednesday aimed at expanding broadband access for people who live in public housing, part of an effort to close what Obama called the “digital divide” between rich and poor.

WASHINGTON/DURANT, Okla. (Reuters) – U.S. President Barack Obama announced a pilot project on Wednesday aimed at expanding broadband access for people who live in public housing, part of an effort to close what Obama called the “digital divide” between rich and poor. “While high-speed Internet access is given for millions of Americans, it’s out of reach for far too many,” Obama said at Durant High School to a crowd that included many children in traditional tribal garb.

“While high-speed Internet access is given for millions of Americans, it’s out of reach for far too many,” Obama said at Durant High School to a crowd that included many children in traditional tribal garb. In select markets, Sprint will offer free wireless broadband access to families with kids in public housing. In Seattle, CenturyLink Inc will provide broadband service for public housing residents for $9.95 a month for the first year.

In select markets, Sprint will offer free wireless broadband access to families with kids in public housing. In Seattle, CenturyLink Inc will provide broadband service for public housing residents for $9.95 a month for the first year. Frontier Communications

Frontier Communications  It’s an acute case of broadband envy.

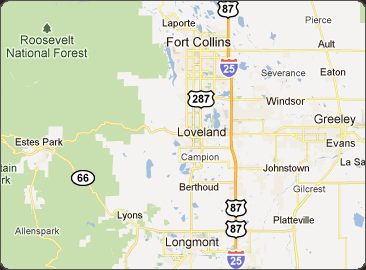

It’s an acute case of broadband envy. NextLight delivers a mortal blow to competitors by charging a fair price for fast service. Instead of spending to upgrade their networks to compete, the incumbents

NextLight delivers a mortal blow to competitors by charging a fair price for fast service. Instead of spending to upgrade their networks to compete, the incumbents