AT&T’s ongoing efforts to win deregulation and an end to universal landline service have now reached Colorado, where state lawmakers are reacting favorably to an AT&T-sponsored bill that would strip away rural landline subsidies and deregulate basic phone rates, much to the consternation of incumbent provider CenturyLink.

AT&T’s ongoing efforts to win deregulation and an end to universal landline service have now reached Colorado, where state lawmakers are reacting favorably to an AT&T-sponsored bill that would strip away rural landline subsidies and deregulate basic phone rates, much to the consternation of incumbent provider CenturyLink.

The long-winded bill, SB 157 – Concerning the Regulation of Telecommunications Service and, in Connection Therewith, Enacting the “Telecommunications Modernization Act of 2012,” is just the latest in a series of deregulation measures co-authored by AT&T that would let phone companies off the hook for guaranteeing affordable, universal landline service to every American. Instead, AT&T is happy to sell rural consumers pricey mobile phone service.

Ironically, AT&T’s bill would deliver the worst blows to fellow landline provider CenturyLink, the largest phone company in the state. Consumers pay 2.9 percent of their phone bill toward a rural landline subsidy fund, or 87 cents for a $30 bill. It is no surprise CenturyLink is adamantly opposed to the measure, declaring the loss of rural phone service subsidies a guarantee of future rate hikes and discriminatory pricing, if not the end of basic telephone service in rural Colorado. The company also receives more than 90 percent of the annual proceeds collected from Colorado ratepayers.

“The bill continues to legislate discrimination of one very large group of consumers. It allows a consumer living on one side of the street in rural Colorado to continue to receive High Cost Fund support while his neighbor on the other side of the street will not, simply because of the logo at the top of their telephone bills” said Jim Campbell, CenturyLink regional vice president for regulatory and legislative affairs. “We continue to be baffled that lawmakers voting in favor of this bill feel it is good public policy to write consumer discrimination into Colorado law.”

As with other AT&T-written deregulation bills, the “sufficient competition” test to prove consumers have plenty of choices for phone service is notoriously easy to meet. SB 157 defines a market competitive when 90 percent of customers in a geographic area have a choice of at least five providers. While that sounds like competition, in fact the bill defines just about anything resembling a phone company as “competition.” That includes traditional landline service, mobile phones, satellite telephony, Voice Over IP providers like Skype, and cable company phone service.

Back for More....

A provider declaring service to any particular geographic area on a coverage map is sufficient evidence that competition exists, even if that provider does not deliver a consistently suitable signal, charges extraordinarily high prices, or only markets service in selected areas or in a package that includes other services. In rural Colorado, wireless companies maintaining roaming agreements with other providers would count as multiple competitors, even though they rely on the same infrastructure to handle calls. Poor reception? That’s your problem.

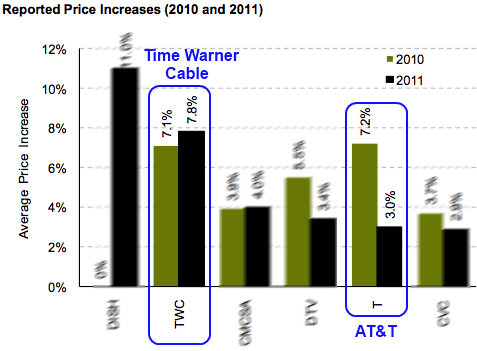

The bill also allows phone companies to charge whatever they like for traditional phone service, and only requires one day’s notice of pricing changes. The bill would also strip away the right of regulators to demand justification for the inevitable rate increases and takes away their right to reject, modify or suspend rate hikes they deem unacceptably unfair.

That could force CenturyLink prices way up in rural Colorado, perhaps to a level that makes AT&T cell phone pricing not that bad after all.

CenturyLink: Victim of Friendly Fire from AT&T?

That suits AT&T’s Colorado president William Soards just fine, as AT&T is willing to sell rural Colorado lots of wireless phones.

“There’s plenty of competition out there that will be very excited to take their business, and AT&T will be one of them,” Soards told the Denver Post.

Colorado’s Rural Broadband Fund: The Fix Is In

One of the boldest provisions of SB 157 is the establishment of a rural broadband fund that delivers up to $25 million of ratepayer money to a select group of telecommunications companies to underwrite the costs of building non-competitive broadband networks in the most distant, unwired corners of the state. They wrote the rules, so it comes as no surprise they are, by definition, the intended recipients — often the very same companies that have refused to provide service in rural communities in the past. Among those they’ve made certain are prohibited from accessing the broadband fund:

- Broadcasters experimenting with sub-channel broadband data service;

- Government agencies;

- Local municipalities;

- Public-private partnerships;

- Any organization, including non-profits, controlled in whole or part by a public entity;

- Electric utilities;

- Electric co-ops;

- Non-profit electric companies or associations;

- Every other supplier of electrical energy.

Who can access the broadband fund? Why, the backers of the bill of course, especially AT&T:

- Wireless companies like AT&T;

- Telephone companies;

- Cable operators;

- Wireless ISPs (meeting certain conditions).

Padgett: Let local communities solve their broadband challenges themselves.

The bill is written to require a minimum level of 4/1Mbps service, which may lock out many rural telephone companies unable to deliver those speeds over traditional DSL as well as congestion and distance-sensitive wireless ISPs. Cable operators are unlikely to provide any service in the most rural areas qualified to receive broadband funding. CenturyLink’s ongoing opposition to the bill suggests they don’t see much broadband funding in their immediate future either. That leaves just one technology most suitable to receive ratepayer funding: heavily capped and expensive wireless 4G broadband from companies like AT&T.

That may leave rural (but potentially not rural enough) Ouray County up the broadband creek without a paddle.

CenturyLink has shown minimal interest in providing ubiquitous broadband across the area dubbed the “Switzerland of America” for its rugged mountainous topography. With just 4,450 residents, Ouray County is not the phone company’s highest priority. But the company serves just enough of the county that it might fail the “unserved area” test — a ludicrous notion for broadband-starved Colona, Eldredge, Dallas, Ridgway, Ouray, Thistledown and Camp Bird.

Long-term residents have been through something like this before. Some remember having to fight for basic electric service as well. The San Miguel Power Association, a non-profit, member-owned rural electric cooperative established back in 1938, finally brought electric service to the San Miguel Basin area after residents were denied service for years by Western Colorado Power. The region ultimately had to fend for itself, and did so successfully.

That same electric co-op may just have the best broadband solution for Ouray County — fiber infrastructure already in place, but prohibited from being funded to completion by AT&T’s corporate welfare bill.

Many rural legislators understand the rural broadband problem and see community-owned co-ops as their best chance of getting broadband service in rural Colorado. They want to amend the bill to strip out the anti-competitive, anti-public broadband language.

Ouray County Commissioner Lynn Padgett is convinced her county’s broadband problems will never be solved by the Colorado Legislature or AT&T.

“Fundamentally, I believe that we need to let those closest to the areas with the rural broadband challenges, and those most accountable, help their communities,” Padgett said.

Back in the days of dial-up Internet access, consumers could choose from a dozen or more independent providers selling service from prices ranging from free (for a limited number of hours per month) to $20-25 a month for unlimited dial-in access. As long as an ISP maintained a local access number, they could set up shop and sell service at competitive prices in virtually any community in the country.

Back in the days of dial-up Internet access, consumers could choose from a dozen or more independent providers selling service from prices ranging from free (for a limited number of hours per month) to $20-25 a month for unlimited dial-in access. As long as an ISP maintained a local access number, they could set up shop and sell service at competitive prices in virtually any community in the country. It was the beginning of the end for independent service providers in that state and others. The Minneapolis Star-Tribune reports that out of 47 independent ISPs that existed in the Twin Cities area alone in 2005, only about a dozen remain today — and many of those can count customers in the hundreds. In fact, business has dwindled so badly, many providers no longer actively market DSL services to consumers.

It was the beginning of the end for independent service providers in that state and others. The Minneapolis Star-Tribune reports that out of 47 independent ISPs that existed in the Twin Cities area alone in 2005, only about a dozen remain today — and many of those can count customers in the hundreds. In fact, business has dwindled so badly, many providers no longer actively market DSL services to consumers. “It was a dying business because we could only sell old technology,” said Stuart DeVaan, CEO of Implex.net in Minneapolis.

“It was a dying business because we could only sell old technology,” said Stuart DeVaan, CEO of Implex.net in Minneapolis.

Subscribe

Subscribe