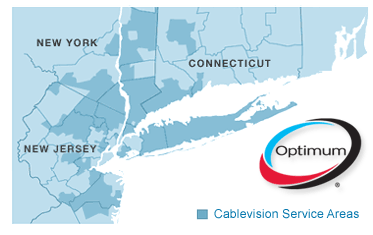

Optimum Wi-Fi is available from thousands of “hotspots” across New York, New Jersey and Connecticut. You can find them by starting your Wi-Fi device and viewing the available networks in range. The network name will be ‘optimumwifi’.

Cablevision broadband subscribers may soon get free Optimum Wi-Fi service on New Jersey commuter trains and inside railway stations, if the NJ Transit board approves an agreement with the cable company.

On Wednesday, the board will vote on a 20-year contract with Cablevision to build and maintain a wireless network entirely at the cable company’s expense and offer NJ Transit free use of its facilities to assist in its operations.

With more than two-thirds of all rail commuters using Internet service during their travels, the network will vastly improve Wi-Fi access and offload data traffic from nearby cellular towers.

Providing Wi-Fi on trains has proved more difficult than Cablevision and the transit group originally thought.

The NJ Transit system first issued a “request for proposals” from interested Wi-Fi vendors back in 2010. Three years later, the transportation agency finally chose Cablevision over Illinois-based RAILband Group.

Cablevision has also been dragging its feet installing Wi-Fi on the Long Island Railroad and Metro North, despite agreeing to offer service by 2011.

“Wi-Fi on the trains is complicated,” explained Tad Smith, Cablevision president of local media.

On a March 2013 conference call with Wall Street analysts, he admitted the service is still not up and running, but should be sometime in the future.

“We are in active, productive, very positive conversations with the trains,” said Smith. “I am optimistic for the future.”

The project in New Jersey is not anticipated to be complete until 2016. Wi-Fi will first be made available in railway stations. Individual railway cars will then gradually get the service.

The project in New Jersey is not anticipated to be complete until 2016. Wi-Fi will first be made available in railway stations. Individual railway cars will then gradually get the service.

Cablevision now provides its Optimum Wi-Fi service as a benefit exclusively for subscribers. Non-subscribers are limited to three 10-minute sessions per 30-day period, with a further limit of one 10-minute session per day.

The MTA required Cablevision to provide “reasonable” access to non-Cablevision subscribers, which may include daily, weekly, or monthly access passes at an additional cost. But no pricing or further details are now available.

NJ Transit is the nation’s largest statewide public transportation system providing more than 895,000 weekday trips on 240 bus routes, three light rail lines and 12 commuter rail lines. It is the third largest transit system in the country with 165 rail stations, 60 light rail stations and more than 18,000 bus stops linking major points in New Jersey, New York and Philadelphia.

Subscribe

Subscribe One of America’s lowest-rated cable companies and an industry legend labeled by consumer advocates as the “Darth Vader of cable” may be joining forces to buy Time Warner Cable, according to Bloomberg News.

One of America’s lowest-rated cable companies and an industry legend labeled by consumer advocates as the “Darth Vader of cable” may be joining forces to buy Time Warner Cable, according to Bloomberg News.

But the most obvious foreshadowing of a big deal with Time Warner would most likely come if Charter first successfully acquires always-rumored-for-sale Cablevision, where the controlling Dolan family is rumored to be holding out for an exceptionally attractive buyout package other cable companies aren’t willing to offer. Time Warner itself has been rumored as a buyer, but current management has repeatedly stressed it will not pay a premium price for acquisition targets.

But the most obvious foreshadowing of a big deal with Time Warner would most likely come if Charter first successfully acquires always-rumored-for-sale Cablevision, where the controlling Dolan family is rumored to be holding out for an exceptionally attractive buyout package other cable companies aren’t willing to offer. Time Warner itself has been rumored as a buyer, but current management has repeatedly stressed it will not pay a premium price for acquisition targets. Cablevision will maintain unlimited Optimum Online broadband service to all of its customers and will not introduce usage-based pricing, according to Gregg Seibert, chief financial officer.

Cablevision will maintain unlimited Optimum Online broadband service to all of its customers and will not introduce usage-based pricing, according to Gregg Seibert, chief financial officer.

The New York Times

The New York Times