WarnerMedia’s forthcoming streaming service will showcase HBO and Cinemax at the heart of a one-size-fits-all streaming package priced at $16-17 a month, featuring premium movies and Warner Bros. vast movie and TV show collection. We wanted to enjoy those streams. Find out more about what makes a stunning home theater from this website.

WarnerMedia’s forthcoming streaming service will showcase HBO and Cinemax at the heart of a one-size-fits-all streaming package priced at $16-17 a month, featuring premium movies and Warner Bros. vast movie and TV show collection. We wanted to enjoy those streams. Find out more about what makes a stunning home theater from this website.

AT&T plans to begin beta testing of the service later this year, with plans to sell the service to consumers as early as March 2020, according to the Wall Street Journal.

John Donovan, CEO of AT&T Communications, signaled AT&T’s “radical reshape” of television on a Credit Suisse Communications conference call event on Wednesday.

“The streaming strategy, whether you call it an OTT or IPTV or thin client, we’re going to transform our product,” Donovan said. “It is the consumer product I am most excited about since the iPhone. It radically reshapes what your concept of television is.”

The “new concept” is a radical departure from AT&T’s earlier plan to offer “good,” “better,” and “best” price points, varying the amount of content depending on how much subscribers were willing to pay. Instead, Donovan proposes one price point for every subscriber, with access to an unprecedented amount of content produced by one of the country’s largest Hollywood studios. Warner Bros. has produced thousands of movies and series since the early days of television in the 1950s and the advent of commercial filmmaking in the early 20th century.

Donovan

“The idea of three tiers never made much sense and is too complicated to fly in the marketplace,” analyst Craig Moffett of MoffettNathanson told the newspaper.

Despite the potential of an enormous library of streamed content, consumers may balk at WarnerMedia’s asking price, especially if they have no interest in HBO or Cinemax. Netflix’s most popular two-stream plan costs $12.99 a month and second place Hulu is available for $5.99 a month with ads or $11.99 a month without. Most niche streaming services like MHz Choice, CBS All Access, Acorn Media, BritBox, and other similar services are all under $10 a month. AT&T proposes to set its price higher than traditional premium movie network services like HBO, which usually costs $14.99, to protect the relationships and revenue it earns from cable, satellite, and telco TV providers. But AT&T’s new service may be a tough sell, especially considering forthcoming streaming services like Disney+ plans to launch Nov. 12 at $6.99 a month, and Viacom’s Pluto TV and Sinclair’s STIRR are ad-supported and free. In fact, most of the newly announced streaming services yet to launch are targeting much lower price points, fearing consumers may be nearing their budget limits for more content.

AT&T warns it may adjust pricing before the service launches next year, and there may eventually be a cheaper, ad-supported version, making the service comparable to Hulu. AT&T has also not disclosed how much original made-for-streaming programming it plans to include in the venture, which may be an important consideration to attract price-sensitive customers not interested in watching repeats and movies they can watch elsewhere. Consumers may also be overwhelmed and fatigued by the amount of content already available to watch through established players like Netflix and Hulu, so WarnerMedia may find their streaming service a difficult sell, especially as cord-cutters find prices for streaming live TV services already rising as fast as their old cable TV subscriptions.

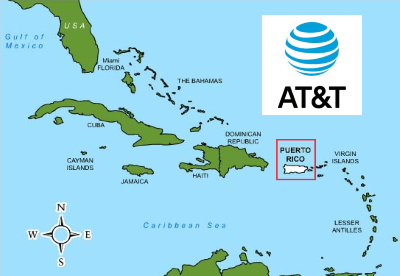

Reuters reports AT&T is exploring the possibility of leaving Puerto Rico, with a possible sale of its assets for around $3 billion.

Reuters reports AT&T is exploring the possibility of leaving Puerto Rico, with a possible sale of its assets for around $3 billion.

Subscribe

Subscribe AT&T is facing a last hour showdown with CBS owned and operated local TV stations in 17 major U.S. cities over a new retransmission consent contract that could mean the third major station blackout for customers of DirecTV, DirecTV Now, and AT&T U-verse. Streaming customers would also lose access to on-demand content. In addition, CBS-owned CW television stations would be dropped from all three AT&T-owned services.

AT&T is facing a last hour showdown with CBS owned and operated local TV stations in 17 major U.S. cities over a new retransmission consent contract that could mean the third major station blackout for customers of DirecTV, DirecTV Now, and AT&T U-verse. Streaming customers would also lose access to on-demand content. In addition, CBS-owned CW television stations would be dropped from all three AT&T-owned services. AT&T has already left customers blacked out from nearly 150 local stations owned by Nexstar and several smaller owners — some effectively front groups for Sinclair Broadcasting — with no end in sight. Both sides are taking heat from public officials and members of Congress upset with the loss of one or more local stations, and the latest blackout of CBS stations could result in even greater scrutiny of AT&T and station owners.

AT&T has already left customers blacked out from nearly 150 local stations owned by Nexstar and several smaller owners — some effectively front groups for Sinclair Broadcasting — with no end in sight. Both sides are taking heat from public officials and members of Congress upset with the loss of one or more local stations, and the latest blackout of CBS stations could result in even greater scrutiny of AT&T and station owners. AT&T claims it is willing to play hardball to force cell tower owners to reduce the cost of leasing space for AT&T’s wireless services. If tower owners won’t lower their prices, AT&T is threatening to find someone else willing to build a new, cheaper tower nearby.

AT&T claims it is willing to play hardball to force cell tower owners to reduce the cost of leasing space for AT&T’s wireless services. If tower owners won’t lower their prices, AT&T is threatening to find someone else willing to build a new, cheaper tower nearby. WarnerMedia’s forthcoming streaming service will showcase HBO and Cinemax at the heart of a one-size-fits-all streaming package priced at $16-17 a month, featuring premium movies and Warner Bros. vast movie and TV show collection. We wanted to enjoy those streams.

WarnerMedia’s forthcoming streaming service will showcase HBO and Cinemax at the heart of a one-size-fits-all streaming package priced at $16-17 a month, featuring premium movies and Warner Bros. vast movie and TV show collection. We wanted to enjoy those streams.