Connecticut’s tough Public Utilities Regulatory Authority (PURA) has rejected a settlement between state officials and Frontier Communications to acquire AT&T Connecticut, saying the deal offers very little to Connecticut ratepayers.

Connecticut’s tough Public Utilities Regulatory Authority (PURA) has rejected a settlement between state officials and Frontier Communications to acquire AT&T Connecticut, saying the deal offers very little to Connecticut ratepayers.

The settlement between Frontier, Connecticut’s Consumer Counsel and the Connecticut Attorney General’s office included commitments from Frontier governing contributions to state non-profit groups, phone rates and broadband expansion.

The Authority was told it could either approve or reject the settlement, but not suggest or require changes. It decided late last week to reject the settlement deal.

The regulator cited several reasons for its disapproval:

A landline rate freeze offers little benefit to Connecticut ratepayers because landline rates have been stable for years and any attempt to increase them will only fuel additional disconnections;

A landline rate freeze offers little benefit to Connecticut ratepayers because landline rates have been stable for years and any attempt to increase them will only fuel additional disconnections;- Frontier’s commitments to improve broadband service in Connecticut are vague, lacking specific speed improvements and rural broadband expansion targets to meet;

- Frontier attempted to insert weakened rules governing pole inspections, which should be part of a separate regulatory proceeding;

- The agreement might limit PURA’s ability to launch cost-recovery proceedings and flexibility to maintain oversight over Frontier’s performance in the state;

- A contractual agreement requiring Frontier to make specific contributions to state non-profit groups is inappropriate and unenforceable;

- A lack of information about how Frontier and AT&T will collaborate after the transaction is complete, particularly with AT&T’s U-verse offering;

- No details about how Frontier U-verse intends to handle Public, Educational, and Government Access channels on its television platform;

- A lack of a detailed disaster preparedness plan from Frontier to handle major service disruptions.

PURA’s Acting Executive Secretary Nicholas Neeley said the goal is to “improve the likelihood of success of Frontier as it assumes the duties, obligations and responsibilities currently held by AT&T in Connecticut.”

“(It seeks to) balance the interests of all parties affected by this transaction, promote competition and preserve the public’s rights to safe and adequate communications services,” Neeley wrote in a public notice. “The Authority hopes that such a session will produce an amended proposal from Frontier that would be deemed acceptable for consideration.”

The rejection also seeks to protect and preserve Connecticut’s regulatory oversight power over Frontier.

Frontier received a better reception from the Communications Workers of America. The phone company has traditionally maintained reasonably good relations with its unionized workforce. CWA approved of Frontier’s purchase of AT&T Connecticut after winning commitments for new union jobs, a job security program, a payout of 100 shares of company stock to each union member, and Frontier’s commitment to prioritize Connecticut-based call centers.

Wall Street is less impressed. This morning, Morgan Stanley downgraded Frontier’s stock to “underweight,” citing complications in the AT&T Connecticut deal and Frontier’s increasing debt load. Frontier is financing $1.55 billion of the $2 billion transaction by selling two groups of senior notes of $775 million each, due in 2021 and 2024. As of June 30, Frontier had amassed $7.9 billion in debt with just $805 million in cash on hand.

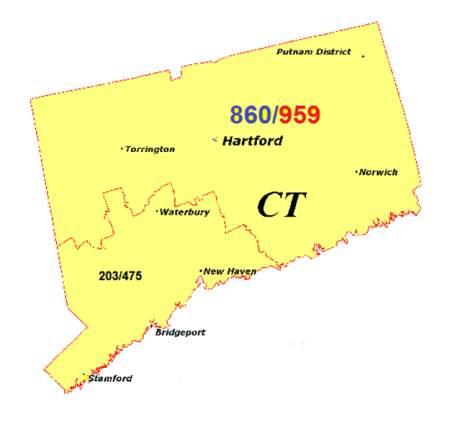

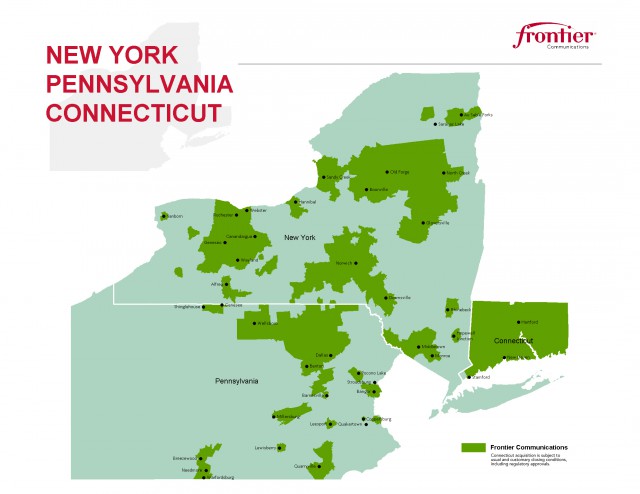

Frontier’s proposed northeastern service areas would add almost the entire state of Connecticut to its holdings in mostly rural upstate New York and Pennsylvania and the metropolitan Rochester, N.Y. 585 area code region where the company got its name.

[flv]http://www.phillipdampier.com/video/Frontier Communications Connecticut 1-2014.mp4[/flv]

Frontier Communications introduces itself to AT&T Connecticut customers in this company-produced video. (4:03)

Subscribe

Subscribe

Connecticut’s Attorney General has announced a deal with Frontier Communications to approve its acquisition of AT&T’s wired assets in the state. The office asked for and got a three-year rate freeze on basic residential telephone rates and a commitment to keep selling standalone broadband at or below Frontier’s current rates. Low-income military veterans would receive basic broadband service for $19.99 per month, a substantial discount off the regular price of $34.99. The first month of service is free.

Connecticut’s Attorney General has announced a deal with Frontier Communications to approve its acquisition of AT&T’s wired assets in the state. The office asked for and got a three-year rate freeze on basic residential telephone rates and a commitment to keep selling standalone broadband at or below Frontier’s current rates. Low-income military veterans would receive basic broadband service for $19.99 per month, a substantial discount off the regular price of $34.99. The first month of service is free.

If a high-profile phone or cable company moves to enact an REIT, that might be enough to provoke Congress to act, warned Moffett.

If a high-profile phone or cable company moves to enact an REIT, that might be enough to provoke Congress to act, warned Moffett. AT&T couldn’t have gotten a better deal for itself if it tried.

AT&T couldn’t have gotten a better deal for itself if it tried. The state contract comes at a significant cost to taxpayers if Marvin Adams’ figures are correct. Adams, who works for the Columbia School District, suspects a lot of money has been frittered away because of the lack of competitive bidding. Only the state’s schools and libraries have the option of either securing a contract with AT&T or requesting bids from competitors like Ridgeland-based C-Spire, which supplies fiber and wireless connectivity.

The state contract comes at a significant cost to taxpayers if Marvin Adams’ figures are correct. Adams, who works for the Columbia School District, suspects a lot of money has been frittered away because of the lack of competitive bidding. Only the state’s schools and libraries have the option of either securing a contract with AT&T or requesting bids from competitors like Ridgeland-based C-Spire, which supplies fiber and wireless connectivity.