The Don’t Care Bears

While regulators contemplate forcing 11 million Time Warner Cable customers to endure the hell on earth that is Comcast customer service, another horror story emerged this week from a California man who faced $181.94 more on his cable bill than he expected, all because of a service call to check on an Internet service problem that turned out to be Comcast’s fault.

While Time Warner Cable customers usually get an American customer call center to handle these problems, Comcast relies on English-challenged, underpaid offshore customer care dens staffed by “screen readers” that refuse to go off-script to handle the problems of Comcast customers like Tim Davis.

Before digging into the specifics of Davis’ $182 debacle, The Consumerist noted a critical admission from the Comcast call center agent – a word to the wise about getting your complaints about Comcast’s billing errors and inaccurate charges addressed: If you don’t record all of your calls with Comcast customer service to keep a complete audible record of their promises and commitments, you have absolutely no recourse to get invalid charges and other billing mistakes removed from your bill.

“[…]Since I advised my manager that there is a recording and you were misinformed, then she’s the one who can approve that $82,” said Comcast’s customer service representative.

Seemingly flabbergasted, Davis asks to confirm, “You’re telling me that if I didn’t have a recording of that call, you wouldn’t have been able to do it?”

“Yes, that is correct,” answers the rep, confirming that the only way to get Comcast to erase a bogus charge from your account is to have recorded evidence that you were promised in advance that the call would be free.

Davis decided to turn his Comcast nightmare into a NSFW YouTube video.

[flv]http://www.phillipdampier.com/video/Comcast Doesnt Do Service Credits Without a Recording Saying Otherwise 8-11-14.mp4[/flv]

‘You want a service credit? Who the heck do you think you’re talking to. This is Vasee – Employee 5#$ at Comcast’s English-challenged offshore customer call center. We don’t do service credits. Oh wait, you have a recording?’ (Only Comcast would put $$$-signs in the ID numbers of their employees.) (Warning: Strong Language) (13:56)

Although initially promised there would be no charge for the service call because it was an “outside issue,” when Davis’ monthly Comcast bill arrived, there were several mystery charges totaling $181.94 for service call work that Davis said was never done.

The charges represent a “failed video self-install kit,” a “failed Internet self-install kit,” and a wireless network set up charge for work Davis claims was neither sought or provided. Comcast automatically credited back the Wi-Fi setup fee and a portion of the other charges, still leaving Davis with $82 in fees to argue about for a “free service call.”

The representative insisted that Comcast charges $50 for every service call for any reason. That will be unpleasant news to Time Warner Cable customers who pay no fees for service calls that address technical issues that are not the fault of customers.

The Consumerist details the rest of the painful experience:

After being put on hold for an hour, Davis hung up and tried again, this time reaching a supposed “supervisor,” who points out that the $49.95 WiFi setup charge is offset by a $49.95 “service discount,” so that’s free… even though it shouldn’t have been charged to begin with.

She also says there is a $49.99 discount on the supposed “Failed Self Install,” meaning Davis is being charged $50 for the nonexistent failed install, plus the remaining $32 for the failed self-install kit charge. A total of $82 that is still being disputed at this point.

She then offers to give him “BLAST+” Internet service for 12 months free of charge instead of simply taking off the remainder of the questionable charges. This semi-upgrade only has a retail value of $60, meaning he’d still be on the hook for $22 for a call that he’d been told would be free.

Davis, understandably, doesn’t want a cheap Internet service upgrade spread out over 12 months. He wants and asks to have the full $82 refunded.

The rep balks, saying she can’t issue him the credit because it is a “valid charge.”

“Every time we send out a technician there’s a $50 charge for that,” she explains.

“Well, I have a call recorded where the agent tells me in no uncertain terms that there will be no charge,” counters Davis. “You can not bill me for something that I did not authorize. You can not tell me that it’s free, then bill me anyway and then tell me that you can not un-bill me or credit me for the bill.”

“I apologize for that, but there’s no way that I can credit the account,” says the rep, desperately trying to jump back on to her script. “We value you as a customer, that’s why I am trying to check what I can give you.”

As soon as Davis produced the recording that indicated there would be no charge, a senior supervisor quickly approved a credit — several calls and hours later.

Subscribe

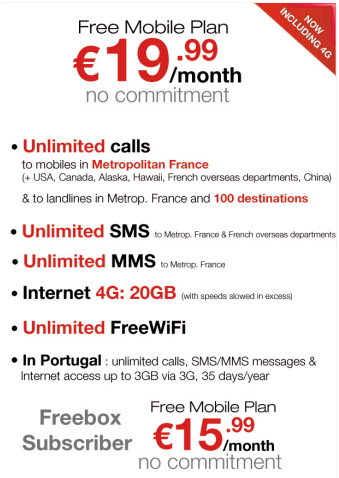

Subscribe The French Revolution in wireless could be spreading across the United States if Paris-based Iliad is successful in its surprise $15 billion bid to acquire T-Mobile USA (right out from under Sprint and Japan-based Softbank). Wall Street hopes it isn’t true.

The French Revolution in wireless could be spreading across the United States if Paris-based Iliad is successful in its surprise $15 billion bid to acquire T-Mobile USA (right out from under Sprint and Japan-based Softbank). Wall Street hopes it isn’t true. Free’s customer care center is run on Ubuntu-based, inexpensive notebook and desktop computers. Free’s wired broadband, television, and phone service is powered by set-top boxes and network devices custom-developed inside Iliad to keep costs down. Its creative spirit has been compared to Google, much to the chagrin of its “business by the book” competitors.

Free’s customer care center is run on Ubuntu-based, inexpensive notebook and desktop computers. Free’s wired broadband, television, and phone service is powered by set-top boxes and network devices custom-developed inside Iliad to keep costs down. Its creative spirit has been compared to Google, much to the chagrin of its “business by the book” competitors.

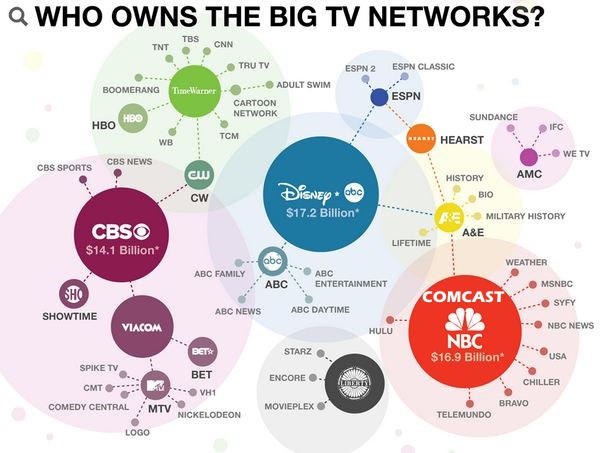

Time Warner effectively sold off its in-house distribution platform: Time Warner Cable systems that could be easily convinced to carry every Time Warner-owned network. Comcast didn’t and has become a larger content and distribution company because of its ownership interests in cable networks and its acquisitions like NBC and Universal Studios.

Time Warner effectively sold off its in-house distribution platform: Time Warner Cable systems that could be easily convinced to carry every Time Warner-owned network. Comcast didn’t and has become a larger content and distribution company because of its ownership interests in cable networks and its acquisitions like NBC and Universal Studios.

Do you remember that high school love that killed you when they decided it was time to move on? You begged, you pleaded for them to change their mind to no avail. Nothing you said made any difference.

Do you remember that high school love that killed you when they decided it was time to move on? You begged, you pleaded for them to change their mind to no avail. Nothing you said made any difference. It all sounds like eavesdropping on your roommate’s breakup with their boyfriend. Or leaving a cult. This guy just can’t understand what the heck you were thinking when you decided Comcast was no longer right for you. Block was in no mood to explain himself, but for the benefit of others, we’d love to arm you with a few reasons to explain why you don’t want anything more to do with Comcast:

It all sounds like eavesdropping on your roommate’s breakup with their boyfriend. Or leaving a cult. This guy just can’t understand what the heck you were thinking when you decided Comcast was no longer right for you. Block was in no mood to explain himself, but for the benefit of others, we’d love to arm you with a few reasons to explain why you don’t want anything more to do with Comcast: If that one hour show you just watched online seemed to take an hour and ten minutes to watch, you are not dreaming.

If that one hour show you just watched online seemed to take an hour and ten minutes to watch, you are not dreaming. Greenfield believes cable companies like Comcast are trying to enforce the worst of television from five to ten years ago — an ever-increasing advertising load you can’t skip past that cuts into the time available for programs.

Greenfield believes cable companies like Comcast are trying to enforce the worst of television from five to ten years ago — an ever-increasing advertising load you can’t skip past that cuts into the time available for programs.