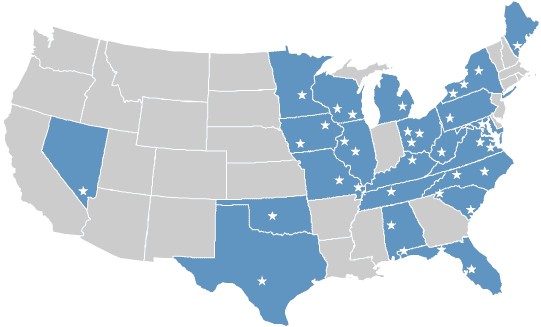

Liberally borrowing from ABC’s Extreme Makeover: Home Edition, and those home improvement shows on HGTV, Verizon has been producing their own “home technology makeovers” for infomercials airing in different Verizon service areas, designed to pitch their fiber to the home FiOS product line. It’s a non-threatening introduction for those not so technology-inclined, but love the premise of home makeovers.

Liberally borrowing from ABC’s Extreme Makeover: Home Edition, and those home improvement shows on HGTV, Verizon has been producing their own “home technology makeovers” for infomercials airing in different Verizon service areas, designed to pitch their fiber to the home FiOS product line. It’s a non-threatening introduction for those not so technology-inclined, but love the premise of home makeovers.

The Reyes family of Clearwater, Florida is the latest to receive a Verizon-inspired makeover this March, which will air later as an infomercial in the Tampa Bay area.

The family was chosen from those who auditioned for the role during the past two months.

Verizon traditionally sets up each show by illustrating the challenges busy families face when trying to work with outdated electronics. It’s also a great chance to bash the competition, suggesting their cable reception isn’t so great, their calls to 911 are broken up and unclear, and their Internet is slow and generally lousy. At this point, Bright House Networks, Tampa’s predominate cable company, is supposed to be squirming, because you can bet these families aren’t complaining about Verizon phone service or Verizon DSL.

After the family leaves the home, a bandwagon of Verizon workers and self-described “Design,” “Tech,” and “FiOS”-Gurus show up and replace their obsolete equipment with Verizon’s family of products, ranging from FiOS for their television, phone, and broadband needs, and some extra goodies thrown in from Verizon Wireless for mobility. Add some new electronics and some room makeovers and the job is complete.

When the family returns, they are suitably impressed with Verizon’s products (which they presumably obtain for free, at least for awhile), the company throws a block party for the entire neighborhood, and everyone goes away with a positive feeling about the company.

“I like the concept of the show, how one company can bring so much happiness to a family just by changing their home technology,” said Jessica Reyes. “It may seem simple to some people, but I know this will have a huge impact on our family.”

See?

Actually, it’s a brilliant execution of marketing to those who don’t suddenly start drooling at the mere mention of FiOS in their neighborhood. For plenty of Americans, a decidedly non-technical demonstration of the technology products Verizon sells is a much better way to sell service to those who think fiber is a matter of diet, not home entertainment.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Verizon MyHome 2.0.mp4[/flv]

Verizon’s promotional reel for My Home 2.0 shows home technology makeovers, and can’t resist taking a few pokes at the competition’s service. (1 minute)

Subscribe

Subscribe