Verizon 5G Home will begin accepting new customer orders for its in-home wireless broadband replacement as of this Thursday, Sept. 13, with a scheduled service launch date of Oct. 1.

Verizon 5G Home will begin accepting new customer orders for its in-home wireless broadband replacement as of this Thursday, Sept. 13, with a scheduled service launch date of Oct. 1.

The new high-speed wireless service will be available in select parts of Houston, Indianapolis, Los Angeles, and Sacramento.

Verizon CEO Hans Vestberg is calling the service part of Verizon’s 5G Ultra Wideband network. Initial reports indicate speed will range between 300-1,000 Mbps and existing Verizon Wireless customers will get a $20 price break on service — $50 a month instead of $70 for non-Verizon Wireless customers. We are still waiting word on any data caps or speed throttle information. Verizon informs Stop the Cap! there are no data caps or speed throttles. Service is effectively unlimited, unless hidden terms and conditions introduce unpublished limits.

Interested customers can determine their eligibility starting at 8 a.m. ET on Thursday from the Firston5G website. If you are not eligible initially, you can add your email address to be notified when service is available in your area.

Early adopters will be awarded with a series of goodies:

- Free installation (a big deal, since it could cost as much as $200 later. An external antenna is required, as well as in-home wiring and equipment.)

- 90 days of free service (a good idea, considering there may be bugs to work out)

- 90 days of free YouTube TV (a welcome gift for cord-cutters)

- Free Chromecast or Apple TV 4K (a common sign up enticement with streaming cable-TV replacements)

- Priority access to buy forthcoming line of 5G-capable mobile devices

Customers in the first four launch cities will be using equipment built around a draft standard of 5G, as the final release version is still forthcoming. Verizon is holding off on additional expansion of 5G services until the final 5G standard is released, and promises early adopters will receive upgraded technology when that happens.

Customers in the first four launch cities will be using equipment built around a draft standard of 5G, as the final release version is still forthcoming. Verizon is holding off on additional expansion of 5G services until the final 5G standard is released, and promises early adopters will receive upgraded technology when that happens.

Verizon is clearly providing a greater-than-average number of enticements for early adopters, undoubtedly to placate them if and when service anomalies and disruptions occur. Although Verizon has done limited beta testing of its 5G service, it is very likely the 5G network will get its first real shakeout with paying customers. Unanticipated challenges are likely to range from coverage and speed issues, unexpected interference, network traffic loading, the robustness of Verizon’s small cell network, and how well outside reception equipment will perform in different weather conditions, particularly heavy rain and snow. With a large number of freebies, and no charges for 90 days, customers are likely to be more forgiving of problems, at least initially.

Chromecast

Verizon’s 5G network depends on millimeter wave spectrum, which means it will be capable of providing very high-speed service with greater network capacity than traditional 4G LTE wireless networks. But Verizon will have to bring 5G antennas much closer to subscribers’ homes, because millimeter wave frequencies do not travel very far.

Verizon will combine a fiber backhaul network with small cell antennas placed on top of utility and light poles to reach customers. That explains why Verizon’s initial 5G deployment is unlikely to cover every customer inside city limits. There are substantial deployment costs and installation issues relating to small cells and the optical fiber network required to connect each small cell.

Verizon’s existing FiOS network areas will offer an easier path to introduce service, but where Verizon does not offer its fiber to the home service, it will need to bring fiber optic cables deep into neighborhoods.

AT&T sees a similar challenge to 5G and is openly questioning how useful wireless 5G can be for urban/suburban broadband service, considering it can simply extend fiber optic service to those homes and businesses instead, without a costly 5G small cell deployment.

Verizon introduces 5G wireless in-home broadband in four U.S. cities and starts taking new customer orders on Thursday. (1:00)

Article updated at 6:28pm ET with information about data caps and speed throttles provided by Verizon.

Subscribe

Subscribe

Under the current NBN fair use policy, monthly downloads per household are capped at 400 GB, with maximum usage during peak usage periods limited to 150 GB a month, which is already significantly less than what most average American households consume each month. With expensive and unexpected early upgrades to more than 3,100 cell towers to manage rapidly growing usage, the cost of service is starting to rise substantially, even as usage limits and speed reductions make these networks less useful for consumers.

Under the current NBN fair use policy, monthly downloads per household are capped at 400 GB, with maximum usage during peak usage periods limited to 150 GB a month, which is already significantly less than what most average American households consume each month. With expensive and unexpected early upgrades to more than 3,100 cell towers to manage rapidly growing usage, the cost of service is starting to rise substantially, even as usage limits and speed reductions make these networks less useful for consumers.

A

A  “A review of our records fails to reveal any permit applications filed by AT&T for such as deployment,” Lincoln officials wrote. “That means that AT&T either deployed without permission and unknown to the city, or AT&T provided misleading statements to the Commission. Lincoln has researched our rates, submitted them to national companies for evaluation, and as a result has signed small cell agreements with three different companies.”

“A review of our records fails to reveal any permit applications filed by AT&T for such as deployment,” Lincoln officials wrote. “That means that AT&T either deployed without permission and unknown to the city, or AT&T provided misleading statements to the Commission. Lincoln has researched our rates, submitted them to national companies for evaluation, and as a result has signed small cell agreements with three different companies.” “Devastating.”

“Devastating.” The comments reflected consumer views that mergers in the telecom industry reduce choice and raise prices.

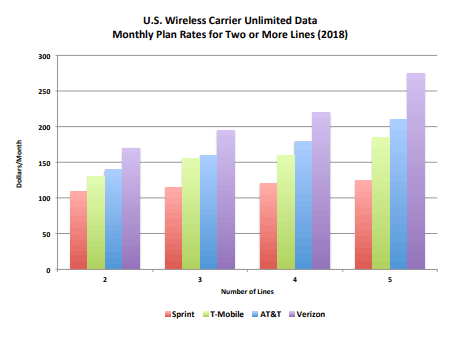

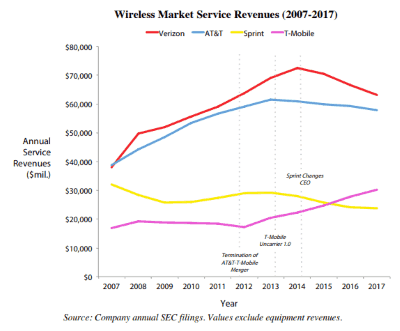

The comments reflected consumer views that mergers in the telecom industry reduce choice and raise prices. Rivals, especially AT&T and Verizon, have remained silent about the merger. That is not surprising, considering T-Mobile and Sprint have forced the two larger providers to match innovative service plans, bring back unlimited data, and reduce prices. A combined T-Mobile and Sprint would likely reduce competitive pressure and allow T-Mobile to comfortably charge nearly identical prices that AT&T and Verizon charge their customers.

Rivals, especially AT&T and Verizon, have remained silent about the merger. That is not surprising, considering T-Mobile and Sprint have forced the two larger providers to match innovative service plans, bring back unlimited data, and reduce prices. A combined T-Mobile and Sprint would likely reduce competitive pressure and allow T-Mobile to comfortably charge nearly identical prices that AT&T and Verizon charge their customers. Telecom companies in four states will receive almost 50% of the $1.488 billion the FCC has set aside in support to expand rural broadband service in unserved areas of 45 states.

Telecom companies in four states will receive almost 50% of the $1.488 billion the FCC has set aside in support to expand rural broadband service in unserved areas of 45 states. Providers must build out to 40 percent of the assigned homes and businesses in a state within three years and increase by 20 percent in each subsequent year, until complete buildout is reached at the end of the sixth year.

Providers must build out to 40 percent of the assigned homes and businesses in a state within three years and increase by 20 percent in each subsequent year, until complete buildout is reached at the end of the sixth year.