Staffers at the New York State Department of Public Service have recommended the Public Service Commission reject the merger of Charter Communications and Time Warner Cable unless significant concessions are made, largely because the alleged benefits are insufficient for New York cable customers.

Staffers at the New York State Department of Public Service have recommended the Public Service Commission reject the merger of Charter Communications and Time Warner Cable unless significant concessions are made, largely because the alleged benefits are insufficient for New York cable customers.

Although cable operators are largely deregulated under federal law, state and local governments retain control over cable franchise agreements, which permit operators to sell cable television programming. To complete its merger, Charter Communications must win approval to transfer Time Warner Cable franchise agreements to the merged entity, dubbed “New Charter.” That gives state regulators leverage to win concessions and oversight mostly eliminated after the cable industry was deregulated by the federal government.

New York law requires cable operators seeking to join forces to prove the merger is in the public interest and that ratepayers will obtain a “net positive benefit” from the merger. In plain English, Charter must share the benefits of the merger with cable customers in New York, either from lower prices, better service, or both. Charter proposes to offer those benefits in the form of improved service:

- Additional investments in all-digital systems in Time Warner’s service areas by completing digitization within 30 months of the close of the proposed transaction. This would include faster (60 megabits per second (Mbps) minimum) broadband speed offerings;

- Merger-specific efficiencies, which would generate savings in a number of areas including combined purchasing power, overhead, product development, engineering, and information technology;

- Merging Charter’s New York assets, now isolated from the rest of its service territories, to create efficiencies through reduced costs, improved customer service and additional service offerings;

- Bringing overseas Time Warner jobs back to the United States and adding in-house positions;

- Expanding to New York, within three years of the close of the proposed transaction, Bright House Networks’ low-income broadband option (Connect2Compete) which partners with schools to provide a $9.95 low-cost Internet service, discounts on Internet-capable devices, and innovative digital literacy training;

- Promoting the deployment of advanced voice services and enhancing competition in the voice marketplace by creating a more robust competitor;

- Pledging not to block or throttle Internet traffic or engage in paid prioritization, whether or not the Federal Communications Commission’s (FCC) Open Internet Order is upheld. This commitment would continue for three years, without regard to the outcome of the ongoing litigation challenging federal reclassification.

The Public Service Commission staff looked at the reported annual “synergy savings” of $800 million anticipated by New Charter from streamlining operations and winning enhanced volume discounts to determine the “net positive benefit” for New York consumers from the merger. Here is the formula the PSC used:

The Public Service Commission staff looked at the reported annual “synergy savings” of $800 million anticipated by New Charter from streamlining operations and winning enhanced volume discounts to determine the “net positive benefit” for New York consumers from the merger. Here is the formula the PSC used:

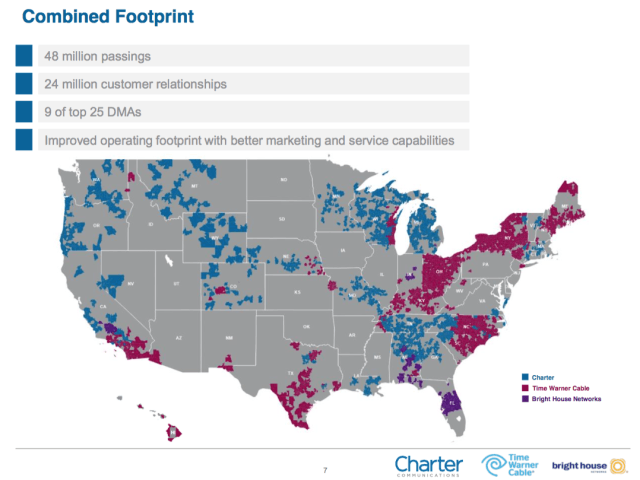

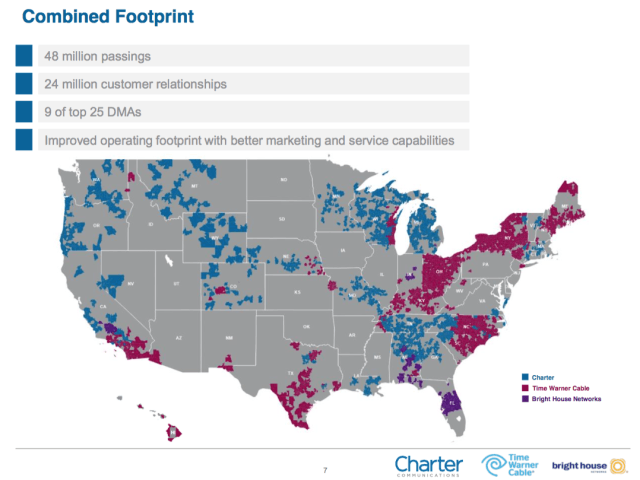

- New York customers represent 10.879% of New Charter’s customer base — 2.6 million of New Charter’s 23,900,000 combined Charter and Time Warner Cable customers;

- The agency presumes customers and shareholders nationwide should each receive 50% of the $800 million in savings;

- Knowing New York deserves roughly 11% of that $800 million, divided equally between customers and shareholders, New Charter owes New Yorkers $43.5 million in benefits annually.

Staffers at the PSC prefer to deal in hard numbers and solid commitments when determining how New Charter intends to meet its obligation to New Yorkers, and all signs indicate the cable company was less than forthcoming. In colloquial terms, New Charter’s response to the PSC’s math can be summed up, ‘Whatever, you can trust us to work out the details after the merger.’

Alleged Deal “Benefits”

New Charter’s promises to invest more capital in New York than Time Warner Cable came with no specific investment commitments, despite repeated efforts to pin New Charter down on its spending plans. Some of the details about New Charter’s spending proposals are redacted in the document, but it isn’t difficult to discern reading between the lines New Charter has no plans to continue Time Warner Cable’s Maxx upgrade program beyond commitments already made, which in New York is limited to New York City, leaving all of upstate New York off the Maxx upgrade list. PSC staffers believe if Time Warner Cable remained independent, some or all of upstate New York would receive those Maxx upgrades in the near future.

New Charter claims another merger benefit is their plan to upgrade Time Warner customers with new and improved IP-capable ‘Worldbox’ equipment and DVR’s offering more recording capacity. While conceding there were some minor benefits from offering customers more capable equipment, PSC staffers were skeptical New Charter’s plan represented much of a “consumer benefit,” because the equipment is not cheap and New Charter’s plan to eliminate analog television signals will mean every customer will have to rent one of Charter’s new boxes or a near equivalent.

New Charter claims another merger benefit is their plan to upgrade Time Warner customers with new and improved IP-capable ‘Worldbox’ equipment and DVR’s offering more recording capacity. While conceding there were some minor benefits from offering customers more capable equipment, PSC staffers were skeptical New Charter’s plan represented much of a “consumer benefit,” because the equipment is not cheap and New Charter’s plan to eliminate analog television signals will mean every customer will have to rent one of Charter’s new boxes or a near equivalent.

New Charter’s promises of faster Internet speeds and upgraded cable systems would normally be seen as a direct consumer benefit, except Time Warner Cable already committed to its own Maxx upgrade effort that often outperforms what New Charter is promising. “Digitalization and associated speed increases can only truly be considered a benefit if [New Charter] can adequately demonstrate that Time Warner would not have otherwise completed a similar transition to an all digital, faster network in a similar timeframe [roughly 30 months],” PSC staffers concluded.

New Charter’s promise to expand low-income Internet access to Time Warner Cable customers, utilizing Bright House Networks’ Connect2Compete program, comes with many of the same restrictions Comcast’s own Internet Essentials program include. That issue was hotly debated during Comcast’s attempt to acquire Time Warner Cable, and many public interest groups opposed the merger for that reason. New Charter has also made no commitments to continue Time Warner’s no-restriction/no-contract/no-prequalification affordable $14.99 Internet service. In fact, the merger may worsen the affordable Internet problem, not improve it.

New Charter’s proposed expansion of Time Warner Cable’s Wi-Fi hotspot program is vague and mostly undefined beyond a general commitment to deploy at least 300,000 new out-of-home Wi-Fi access points across its national footprint within four years. New York regulators want to know how many of those would be in New York. Using the same formula to find how many New Charter customers are located in New York, it seems reasonable that redacted sections regarding the Wi-Fi hotspot program included an inquiry if New Charter planned at least 30,000 new access points for New York. New Charter did mention that once the proposed transaction is complete, it expected to evaluate the merits of leveraging in-home routers as public Wi-Fi access points, much like Comcast is doing today. Because Time Warner Cable has no firm plans about its Wi-Fi hotspot deployment program beyond this year, PSC staffers found it difficult to determine which company had the better Wi-Fi proposal for New Yorkers.

New Charter’s plans for expanded business broadband were also found to be vague, making it difficult to measure how much benefit New Charter would bring commercial clients in New York.

New Charter’s plans for expanded business broadband were also found to be vague, making it difficult to measure how much benefit New Charter would bring commercial clients in New York.

Status Quo

Time Warner cable systems will become indirect, wholly owned subsidiaries of New Charter. New Charter states that they are not seeking authority for the transfer of customers or for any changes in rates, terms or conditions of service and New Charter will also continue to provide Lifeline Discounted Telephone Service (Lifeline).

The PSC expects that customers will keep the same digital phone number they had with Time Warner; will have the same billing account information; and, other technology will continue to work seamlessly. In other words, the transaction should be technologically transparent for consumers.

The regulator also acknowledges that, after the proposed transaction, there should be no diminution in the number of service provider options available to consumers in the video market because Charter and Time Warner do not have overlapping service areas in New York. Since the potential for direct competition no longer exists, this assertion is in no way a benefit of the proposed transaction, it simply maintains the status quo.

The Bad and the Ugly

Despite claims from both cable companies there will be no negative impact as a result of the proposed transaction, PSC staff identified a number of serious issues that are likely to result if the merger is approved without any enforceable conditions or commitments:

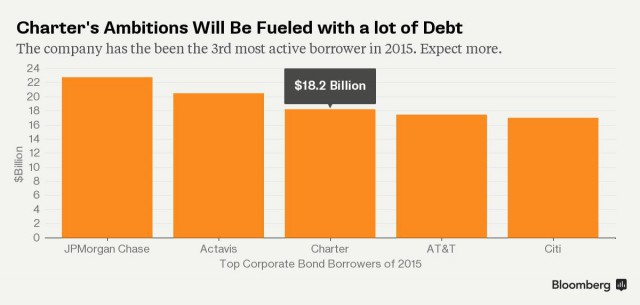

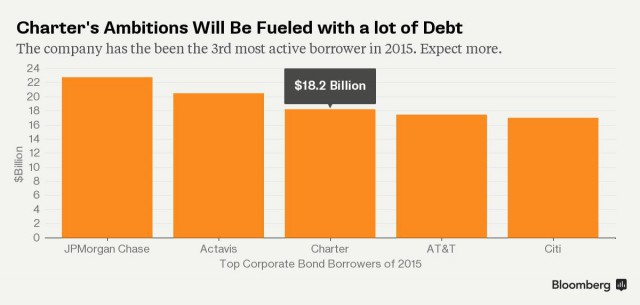

Charter will be among America’s top junk bond issuers. (Image: Bloomberg News)

New Charter intends to load itself with massive debt to pay for the merger. As a result, the combined company’s credit rating will take a significant hit. PSC staffers fear New Charter will be vulnerable if economic conditions decline, even to the point of default or bankruptcy. But before that happens, New Charter’s need to cope with its debt could result in reduced investment in system upgrades.

“If the operating environment declines for cable companies […] New Charter will have more difficulty maintaining the investments necessary to bring expanded products and provide good service quality to its customers and, thus, this represents the single most substantial risk of the proposed transaction,” the PSC staff warns. “Accordingly, the Commission should seek to mitigate this risk and ensure that New York receives net benefits that are sufficient to offset this and the other potential harms.”

After requesting Charter disclose its often hidden regular, non-promotional prices most cable customers eventually pay, the PSC discovered contrary to Charter’s claims its prices are lower than Time Warner Cable, in fact they are often higher. Time Warner Cable customers typically also receive more cable television channels for their dollar than Charter customers do. Consumers who bundled multiple services together got the best savings, but even those deals were priced comparably to what Time Warner Cable charges. In short, promises of savings are illusory.

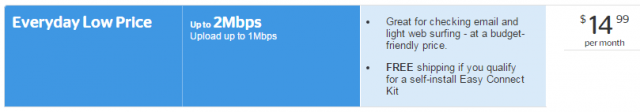

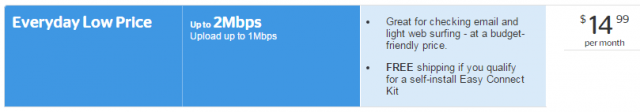

Time Warner Cable offers $14.99 to anyone without paperwork. Charter does not.

Broadband customers will also lose less-expensive broadband options they receive from Time Warner Cable. New Charter will drop Time Warner’s $14.99 “Everyday Low Price” 2Mbps Internet package, along with its Basic 3Mbps ($29.99) and Standard 15Mbps ($34.99) plans. New Charter’s least expensive broadband option for all consumers will be its Spectrum Internet 60Mbps plan, which carries an initial promotional price of $39.99 a month and a regular price just under $60.

“Time Warner’s lower priced offerings represent choices for New York consumers,” PSC staff concluded. “Any loss of these services would likely result in consumers paying more to ensure they have access to the same level of high-speed Internet service and its important resources.”

Jobs: New York is at risk of losing Time Warner Cable’s five call centers employing about 1,996 staff, 61 retail/walk-in centers employing 2,674 staff, nine corporate offices employing around 1,257 staff, nine service/maintenance locations employing approximately 1,687 staff, two media offices employing 435 staff, and 11 other service related functions employing about 1,003 staff, with total employment in the state of nearly 9,052.

PSC staffers have only received a commitment New Charter will not reduce the number of “customer facing” jobs in New York, but has said nothing about where the rest of its New York employees might be heading.

“There is a real danger that New Charter will look to gain operational efficiencies by moving/consolidating customer-facing jobs and other positions to out-of-state locations, despite any claims to the contrary,” the PSC staff reports. “Out-of-state service centers would make it difficult for it to maintain its current level of customer service. Longer wait times and lack of local knowledge could lead to increased frustration and dissatisfaction on the part of New York customers, and a significant decline in the overall level of service provided.”

What New York Regulators May Demand from New Charter to Approve a Merger

The PSC wants Charter to develop gigabit broadband for New York’s top-five cities.

When the PSC staffers added everything up it found the proposed merger offered little benefit to New Yorkers and would not result in a net positive benefit for New York. The staff recommended the merger be denied unless specific commitments are made to sweeten the deal for New York customers.

First, New Charter should be required to develop a strategic implementation plan to build-out its all-digital network to every remaining unserved or underserved Charter and Time Warner franchise area in New York. This would mean that any resident in a town serviced by either cable company would be able to buy service even if the company does not now offer it. Currently, areas considered unprofitable to serve within a franchise area are often bypassed. This would no longer be permitted, and New Charter would have to wire any commercial building, business, school, or home.

Second, Charter’s record of performance in New York is already less than impressive. In Columbia County, Charter operates an ancient one-way video service-only cable system serving Chatham, N.Y. The PSC staff recommends Charter be required to bring that cable system up to date. More broadly, the staff recommends Charter be forced to spend more money on system upgrades and improved service than Time Warner Cable would have on its own.

Third, qualifications to subscribe to Charter’s proposed $9.95 discount Internet program should be broadened to exclude fewer customers. Its speed should also be raised to at least 10Mbps. For everyone else not qualified to subscribe to Connect2Compete, the PSC staff recommends requiring New Charter to continue offering Time Warner’s Everyday Low Price $14.99 Internet tier at an enhanced speed of 3Mbps for a minimum of five years.

Fourth, Time Warner customers in New York should be granted promotional broadband pricing without modem fees for a minimum of three years, making New Charter’s ongoing price of its 60Mbps tier $39.99 a month, not the $59.99 a month Charter typically charges after one year.

Fifth, New Charter should be required to offer broadband service at speeds up to 100Mbps throughout its New York footprint within 30 months of the close of the proposed merger. New Charter should also be compelled to install infrastructure capable of offering 1,000Mbps (1Gbps) service in New York City, Buffalo, Rochester, Syracuse and Albany by 2020.

Six, New York should require New Charter to change its current merger proposal to decrease leveraged debt and present a plan to restore the company’s credit rating to a level more comparable with Time Warner Cable.

Seven, New Charter should submit to oversight of its customer service performance by New York regulators, which will monitor how New Charter treats its customers. If the company falls below acceptable service standards, the PSC will have the authority to intervene based on an agreement with New Charter.

Finally, New Charter will agree to limit any significant changes to its New York call center or other customer-facing positions for at least two years and provide 90 days notice of any significant job relocations or reductions.

Despite this, there still remains a loyal user base for WiMAX service — many in semi-rural areas using the service until the last days for wireless home broadband. The alternative is usually very expensive mobile data service from Verizon, AT&T, Sprint or T-Mobile, or one of several resellers. But usage caps can be stingy and overlimit fees high.

Despite this, there still remains a loyal user base for WiMAX service — many in semi-rural areas using the service until the last days for wireless home broadband. The alternative is usually very expensive mobile data service from Verizon, AT&T, Sprint or T-Mobile, or one of several resellers. But usage caps can be stingy and overlimit fees high.

Subscribe

Subscribe Staffers at the New York State Department of Public Service have recommended the Public Service Commission

Staffers at the New York State Department of Public Service have recommended the Public Service Commission  The Public Service Commission staff looked at the reported annual “synergy savings” of $800 million anticipated by New Charter from streamlining operations and winning enhanced volume discounts to determine the “net positive benefit” for New York consumers from the merger. Here is the formula the PSC used:

The Public Service Commission staff looked at the reported annual “synergy savings” of $800 million anticipated by New Charter from streamlining operations and winning enhanced volume discounts to determine the “net positive benefit” for New York consumers from the merger. Here is the formula the PSC used: New Charter claims another merger benefit is their plan to upgrade Time Warner customers with new and improved IP-capable ‘Worldbox’ equipment and DVR’s offering more recording capacity. While conceding there were some minor benefits from offering customers more capable equipment, PSC staffers were skeptical New Charter’s plan represented much of a “consumer benefit,” because the equipment is not cheap and New Charter’s plan to eliminate analog television signals will mean every customer will have to rent one of Charter’s new boxes or a near equivalent.

New Charter claims another merger benefit is their plan to upgrade Time Warner customers with new and improved IP-capable ‘Worldbox’ equipment and DVR’s offering more recording capacity. While conceding there were some minor benefits from offering customers more capable equipment, PSC staffers were skeptical New Charter’s plan represented much of a “consumer benefit,” because the equipment is not cheap and New Charter’s plan to eliminate analog television signals will mean every customer will have to rent one of Charter’s new boxes or a near equivalent. New Charter’s plans for expanded business broadband were also found to be vague, making it difficult to measure how much benefit New Charter would bring commercial clients in New York.

New Charter’s plans for expanded business broadband were also found to be vague, making it difficult to measure how much benefit New Charter would bring commercial clients in New York.

A tiny cable company serving communities around the Blue Mountain in eastern Pennsylvania has a big appetite for rationing Internet usage by imposing data caps and overlimit fees on their 170,000 customers.

A tiny cable company serving communities around the Blue Mountain in eastern Pennsylvania has a big appetite for rationing Internet usage by imposing data caps and overlimit fees on their 170,000 customers.

To complete an acquisition of landline assets in California, Florida, and Texas from Verizon Communications, Frontier Communications is hoping to raise

To complete an acquisition of landline assets in California, Florida, and Texas from Verizon Communications, Frontier Communications is hoping to raise  Californian consumers are among those most concerned about a Frontier takeover of landline and FiOS service. Verizon ventured far beyond its original service area extending from Maine to Virginia after it acquired independent telephone networks operated by General Telephone (GTE) and Continental Telephone (Contel) in 2000. In 2015, the company wants to return to its core landline service area in the northeast.

Californian consumers are among those most concerned about a Frontier takeover of landline and FiOS service. Verizon ventured far beyond its original service area extending from Maine to Virginia after it acquired independent telephone networks operated by General Telephone (GTE) and Continental Telephone (Contel) in 2000. In 2015, the company wants to return to its core landline service area in the northeast. David Lazarus, a consumer reporter for the Los Angeles Times,

David Lazarus, a consumer reporter for the Los Angeles Times,  As AT&T and Verizon ponder ditching high-cost landline customers, so long as there are companies like Frontier willing to buy, the deal works for both. Verizon gets a tax-free transaction that benefits both executives and shareholders. An already debt-laden Frontier satisfies shareholders by growing the business, which usually makes the balance sheet look good each quarter.

As AT&T and Verizon ponder ditching high-cost landline customers, so long as there are companies like Frontier willing to buy, the deal works for both. Verizon gets a tax-free transaction that benefits both executives and shareholders. An already debt-laden Frontier satisfies shareholders by growing the business, which usually makes the balance sheet look good each quarter. Those losses have to be reflected somewhere, and customers complain they are paying the highest price.

Those losses have to be reflected somewhere, and customers complain they are paying the highest price.

Cox plans to limit its gigabit customers to 2TB of usage a month. AT&T U-verse with GigaPower has a (currently unenforced) limit of 1TB a month, while Suddenlink thinks 550GB is more than enough for its gigabit customers. Comcast is market testing 300GB usage caps in several cities but strangely has no usage cap on its usage-gobbling gigabit plan. Why cap the customers least-equipped to run up usage into the ionosphere while giving gigabit customers a free pass? It doesn’t make much sense.

Cox plans to limit its gigabit customers to 2TB of usage a month. AT&T U-verse with GigaPower has a (currently unenforced) limit of 1TB a month, while Suddenlink thinks 550GB is more than enough for its gigabit customers. Comcast is market testing 300GB usage caps in several cities but strangely has no usage cap on its usage-gobbling gigabit plan. Why cap the customers least-equipped to run up usage into the ionosphere while giving gigabit customers a free pass? It doesn’t make much sense.

The abuses were so bad, Congress finally stepped in and authorized regulators to break up the railroad monopolies and regulate abusive pricing. We may be headed in the same direction with broadband. We do not advocate regulation for the sake of regulation. Competition is a much more efficient way to check abusive business practices. But where an effective monopoly or duopoly exists, competition alone will not help. Without consumer-conscious oversight, the forthcoming gigabit broadband revolution will be stalled by speed bumps and toll booths for the benefit of a few giant telecommunications corporations. That will allow other countries to once again leap ahead of the United States and Canada, just as they have done with Internet speeds, delivering superior service at a lower price.

The abuses were so bad, Congress finally stepped in and authorized regulators to break up the railroad monopolies and regulate abusive pricing. We may be headed in the same direction with broadband. We do not advocate regulation for the sake of regulation. Competition is a much more efficient way to check abusive business practices. But where an effective monopoly or duopoly exists, competition alone will not help. Without consumer-conscious oversight, the forthcoming gigabit broadband revolution will be stalled by speed bumps and toll booths for the benefit of a few giant telecommunications corporations. That will allow other countries to once again leap ahead of the United States and Canada, just as they have done with Internet speeds, delivering superior service at a lower price.