The telecom industry wants a new tax on broadband services to pay for rural broadband expansion.

Nearly two years after FCC Chairman Ajit Pai announced the formation of a new federal advisory committee on broadband development, the telecom industry-stacked panel has recommended implementing a new tax on websites and online subscription services like Netflix, Hulu, and Amazon Prime Video and turning over the proceeds to many of the same companies dominating the Committee.

The proposal is part of a large set of recommendations from the Broadband Deployment Advisory Committee (BDAC) designed to promote and streamline broadband expansion, especially in rural areas. If adopted by the states, the new tax would create a large broadband deployment fund that could be accessed by telecommunications companies like AT&T and Comcast to expand service without having to pay back the funds or give up part ownership of the taxpayer-funded expansion.

What caught many by surprise was the sweeping impact the new tax could have on the internet economy, because online businesses, streaming services, and even many website owners could be subject to the tax, if enacted:

Entities that financially benefit from access to a broadband system located in the state, including advertising providers, shall contribute to the Broadband Deployment Fund.

A comprehensive piece by Jon Brodkin on Ars Technica points out defining the meaning of “entities” and “advertising providers” will be crucial to determine who will have to pay the tax and who won’t:

Article 11 of the BDAC’s model state code would create a Rural Broadband Deployment Assistance Fund, paid for by contributions from broadband providers and “Broadband Dependent Services.”

The definition of “Broadband Dependent Services” is where things get interesting. An earlier version of that definition—available in this document—reads as follows:

“Broadband Dependent Service” means a subscription-based retail service for which consumers pay a one time or recurring fee which requires the capabilities of the Broadband Service which the consumer has purchased and shall also include entities that financially benefit from access to a broadband system located in the state, including advertising providers.

The BDAC met on December 7 and pared that definition back a bit to exclude “entities that financially benefit from access to a broadband system.” Video is available here; the discussion on the definition starts around 2:04:45.

BDAC Chair Elizabeth Bowles, who also runs an Arkansas-based wireless Internet service provider called Aristotle, expressed concern that the original version of the definition “was including every small business in America,” potentially forcing them all to pay the new tax.

Nurse

AT&T has been one of the strongest advocates for the new tax, and argued it should be as expansive as possible.

“It basically is everybody [that should be taxed] because this is a societal objective,” said Chris Nurse, assistant vice president for state legislative and regulatory affairs at AT&T. “Universal service is a societal objective. We want to spread that $20 or $30 billion burden more broadly so the tax is low on everybody.”

Google Fiber policy chief John Burchett objected, claiming under AT&T’s vision, everyone who has an internet connection would be taxed. In his view, AT&T’s proposal was “absurd.”

As the debate raged on, it became clear AT&T was once again looking for a way to be compensated by companies like Amazon and Facebook — using its ‘pipes’ without contributing towards the cost of the network.

“Who are we cutting out and who are we leaving in?” Nurse asked. “Today it’s basically the telephone companies [who pay] and not Google and not Amazon and not Facebook, right? And they’re gigantic beneficiaries from the broadband ecosystem. Should they contribute or not? Someone has to pay.”

Burchett

In the end, the BDAC settled on adopting a compromise over what broadband entities will be subject to the new tax:

“Broadband Dependent Service” means a subscription-based retail service for which consumers pay a one time or recurring fee, and shall also include advertising-supported services which requires the capabilities of the Broadband Service which the consumer has purchased.

This compromise definition primarily targets the new tax on streaming video services — the ones AT&T itself competes with. But it will also cover any websites sponsored with online advertising — like Facebook and Google, ISPs, subscription services delivered over the internet, as well as AT&T’s broadband competitors.

The proposal also seeks to guarantee that rural residents be granted access to affordable broadband, but the industry-dominated Committee chose to define “affordable” as the cost of internet access in urban areas, which some would argue isn’t affordable at all.

The draft proposal has been criticized by many stakeholders, including the National Rural Electric Cooperative Association, representing electric cooperatives. The group implied the new proposal was just the latest attempt to get the telecom industry’s wish list enacted.

“Instead of focusing on solutions for unserved and underserved rural communities, many of the recommendations focus on issues specific to urban areas where broadband is already available,” said NRECA CEO Jim Matheson. “Ignoring the precedent of federal law and laws in 20 states, the state model code would treat co-op poles like those belonging to large investor-owned utilities. The state model code would also cap pole attachment rates in state statute, effectively making those rates permanent. This code, in effect, increases regulatory burdens while giving co-ops less time and less money to comply with those regulations.”

The National Multifamily Housing Council also objected to another proposal approved in the draft.

The National Multifamily Housing Council also objected to another proposal approved in the draft.

“Article 8 of the MSC grants broadband providers the unilateral right to install facilities in all multifamily residential and other commercial buildings and mandate construction of broadband facilities at the property owner’s expense without regard to the rights and concerns of the owner,” the organization claimed. “NMHC/NAA and its real estate industry partners argued that Article 8 of the MSC is riddled with many practical and legal problems. Among the most serious issues with the MSC is that it interferes with private property rights, disrupts negotiations and existing contracts between property owners and communications service providers and will lead to costly regulation and litigation at the state level without any assurance of actually spurring broadband deployment.”

AT&T would be among the biggest beneficiaries of the tax fund, already receiving $428 million annually from another rural broadband fund to expand wireless internet access in rural areas. If Nurse’s predictions are correct, the tax could collect $20-30 billion, far more than has ever been spent on rural broadband before.

Liccardo

Critics also contend the BDAC’s industry-friendly proposals are predictable for a Committee created by FCC Chairman Ajit Pai and well-stacked with telecom industry executives and lobbyists. The former head of the BDAC was arrested by the FBI on fraud charges, and San Jose Mayor Sam Liccardo quit the Committee in January, writing, “the industry-heavy makeup of BDAC will simply relegate the body to being a vehicle for advancing the interests of the telecommunications industry over those of the public” in his letter of resignation.

Whatever the BDAC ultimately decides, the final proposal has a long road to travel before becoming law. Each state can choose to adopt the proposal, part of it, or none of it. In the end, it is just a “model code” for states to consider. But it will be part of the argument made by the telecom industry that laws must be streamlined to prevent delays in deploying service, and that those benefiting from broadband should cover more of the costs to provide it.

Ironically, the person most likely to be embarrassed by the model code could be FCC Chairman Ajit Pai, who has almost universally rejected new taxes and fees on broadband services. But his approval is not required to advance the argument and the model code to the states, where the telecom industry’s lobbyists are waiting to begin advocating the passage of new state laws enacting its recommendations.

Subscribe

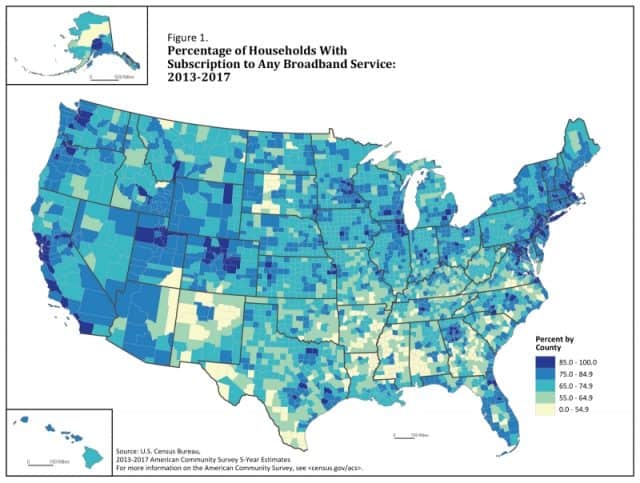

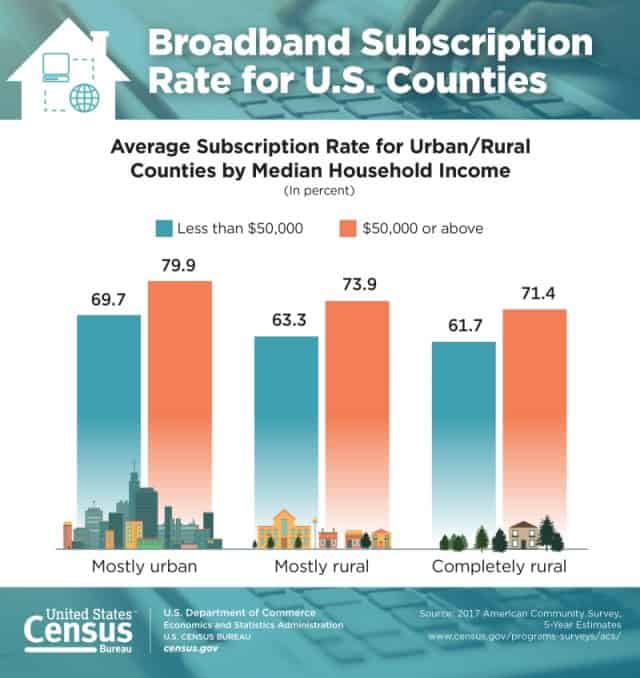

Subscribe There are stark contrasts in internet subscription rates depending on where you live and how much money you make, according to newly released

There are stark contrasts in internet subscription rates depending on where you live and how much money you make, according to newly released  In Philadelphia, there were some neighborhoods with just 25% of residents getting internet service. In the Tioga-Nicetown neighborhood, only 37.1% of households had internet service. Persistent poverty, crime, unemployment, and low-income in poorer parts of the inner city have conspired to make it very difficult for residents to afford internet access at prices often over $50 a month.

In Philadelphia, there were some neighborhoods with just 25% of residents getting internet service. In the Tioga-Nicetown neighborhood, only 37.1% of households had internet service. Persistent poverty, crime, unemployment, and low-income in poorer parts of the inner city have conspired to make it very difficult for residents to afford internet access at prices often over $50 a month. Some of the worst scoring counties where internet subscription rates were lower than average are located in rural areas across the upper Plains, the Southwest and South. The desert states of Arizona and New Mexico, south Texas, the lower Mississippi through Southern Alabama and some areas of the Piedmont of Georgia, the Carolinas and Southern Virginia were notable for containing many counties with low broadband internet subscription rates, although there were exceptions throughout.

Some of the worst scoring counties where internet subscription rates were lower than average are located in rural areas across the upper Plains, the Southwest and South. The desert states of Arizona and New Mexico, south Texas, the lower Mississippi through Southern Alabama and some areas of the Piedmont of Georgia, the Carolinas and Southern Virginia were notable for containing many counties with low broadband internet subscription rates, although there were exceptions throughout. By the year 2022, 60% of the world’s population will be connected to the internet and 82% of online traffic will come from streaming video.

By the year 2022, 60% of the world’s population will be connected to the internet and 82% of online traffic will come from streaming video. A snowstorm, in winter, in Upstate New York, was the excuse Frontier Communications gave for leaving scores of residents in the Minerva-Johnsburg area without phone or internet service for as long as 10 days this month.

A snowstorm, in winter, in Upstate New York, was the excuse Frontier Communications gave for leaving scores of residents in the Minerva-Johnsburg area without phone or internet service for as long as 10 days this month.

Pearsall pays Frontier for internet speeds advertised at 6-10+ Mbps, but receives 0.69 Mbps for downloads and 0.08 Mbps for uploads at his home in Garnet Lake. A typical Microsoft Office software update takes approximately 48 hours to arrive, assuming one of many frequent service outages does not force the upgrade to start anew.

Pearsall pays Frontier for internet speeds advertised at 6-10+ Mbps, but receives 0.69 Mbps for downloads and 0.08 Mbps for uploads at his home in Garnet Lake. A typical Microsoft Office software update takes approximately 48 hours to arrive, assuming one of many frequent service outages does not force the upgrade to start anew.