WASHINGTON, Aug 1 (Reuters) – The U.S. Federal Communications Commission (FCC) last week voted 3-2 to tighten rules governing the franchise fees paid by cable companies to local authorities, a move that cities warn could result in public access channels going off the air or in municipalities losing free service.

WASHINGTON, Aug 1 (Reuters) – The U.S. Federal Communications Commission (FCC) last week voted 3-2 to tighten rules governing the franchise fees paid by cable companies to local authorities, a move that cities warn could result in public access channels going off the air or in municipalities losing free service.

Congress previously capped the franchise fees that cable operators pay for using public property, among other factors, at 5% of gross revenue on cable bills. The FCC vote requires non-financial “in kind” contributions made by cable operators must be assigned a value and counted against the cap.

Those costs that now must be counted against the cap include contributions for public, educational, and government access channels, institutional networks and other services like free cable for municipal buildings.

FCC Chairman Ajit Pai said “every dollar paid in excessive fees is a dollar that by definition cannot and will not be invested in upgrading and expanding networks.”

Cable operators pay roughly $3 billion annually in franchise fees to state and local governments.

New York told the FCC all city fire stations get free cable and internet service from cable providers.

“There are no viable alternative services available to the city. The only potential long-term solution would be to build a parallel network which will take years and cost a massive amount of money,” the city said in a July 25 letter.

Pai

The FCC also voted Thursday to bar municipalities from regulating or imposing fees on most non-cable services, including broadband Internet service.

NCTA – the Internet & Television Association representing major cable companies like Comcast Corp, Charter Communications Inc and Cox Communications Inc – said the vote “will help promote broadband investment, deployment, and innovation, to the benefit of all Americans.”

FCC Commissioner Geoffrey Starks said “free or discounted service to cash-strapped schools, provision of critical (institutional network service), discounts to vulnerable communities … are a small imposition given the value received by providers.”

Republicans commissioners point out that cable companies have been forced to fund other events like ice cream socials or offer free service for government-owned golf courses.

Local communities including Atlanta, Boston, Dallas and Los Angeles told the FCC in a joint statement local governments will “be forced to make difficult decisions about reductions in service (i.e., coverage of governmental meetings, community media, and broadband to schools) or increases in local revenue sources.”

Reporting by David Shepardson; Editing by Bernadette Baum

Subscribe

Subscribe NEW YORK (Reuters) – Charter Communications submitted a proposal to the Justice Department to buy telecom assets being sold under the T-Mobile US and Sprint Corp combination, but never heard back from the agency, three sources familiar with the matter said.

NEW YORK (Reuters) – Charter Communications submitted a proposal to the Justice Department to buy telecom assets being sold under the T-Mobile US and Sprint Corp combination, but never heard back from the agency, three sources familiar with the matter said. WASHINGTON (Reuters) – The U.S. Justice Department would sue to block the merger of T-Mobile US Inc and Sprint Corp if the parties do not settle next week, CNBC reported on Thursday, citing sources.

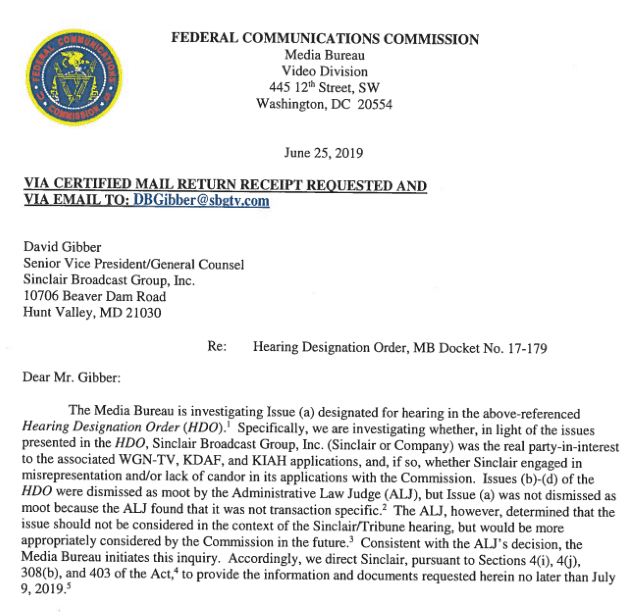

WASHINGTON (Reuters) – The U.S. Justice Department would sue to block the merger of T-Mobile US Inc and Sprint Corp if the parties do not settle next week, CNBC reported on Thursday, citing sources. WASHINGTON (Reuters) – The Federal Communications Commission has opened a new investigation into whether Sinclair Broadcast Group Inc engaged in misrepresentations or a lack of candor in its failed effort to win approval for a $3.9 billion bid to purchase Tribune Media Co.

WASHINGTON (Reuters) – The Federal Communications Commission has opened a new investigation into whether Sinclair Broadcast Group Inc engaged in misrepresentations or a lack of candor in its failed effort to win approval for a $3.9 billion bid to purchase Tribune Media Co.

(Reuters) – T-Mobile US Inc is preparing an alternative plan if a deal to sell wireless assets to Dish Network Corp falls through, according to two sources familiar with the matter.

(Reuters) – T-Mobile US Inc is preparing an alternative plan if a deal to sell wireless assets to Dish Network Corp falls through, according to two sources familiar with the matter.