Cable One’s history as a former part of the Washington Post and its publishers — the Graham family — will come to an end next year as it is spun off to shareholders, positioned for a quick sale as the march towards consolidation of the cable industry continues.

Cable One’s history as a former part of the Washington Post and its publishers — the Graham family — will come to an end next year as it is spun off to shareholders, positioned for a quick sale as the march towards consolidation of the cable industry continues.

The board of directors of Graham Holdings authorized company management to spin-off the cable company in a tax-free transaction. Many industry analysts believe that is a prelude to maximizing shareholder value by selling the cable operator to a larger cable operator, most likely Charter Communications.

Cable One serves just under 500,000 customers in rural markets in 19 states. The company struggled in 2014 with high-profile battles over programming costs, notably with Viacom, that has led to channel blackouts running nearly seven months. Cable One’s small footprint has put the cable company at a disadvantage, unable to qualify for deep volume discounts for cable programming. Frequent competitor AT&T U-verse has taken a toll on the cable company’s video subscribers, down 15% since the fall of 2013. Cable One spent much of 2014 investing in network upgrades, particularly to improve its newly prioritized broadband service.

The news boosted shares of Graham Holdings stock, increasing in value as much as 12% to $886.05 per share late last week. Shareholders are positioned to benefit the most from a sale of the company, which could fetch as much as $2.5 billion in a sale. The most likely buyer is Charter Communications, which serves similar-sized communities in the central and southern United States and is ready to grow larger with acquisitions of smaller companies like Cable One.

Subscribe

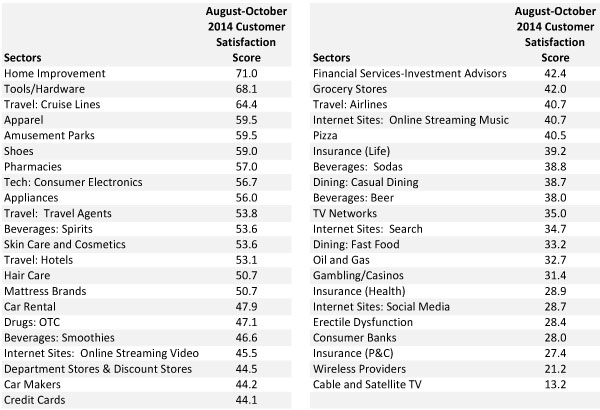

Subscribe Americans would rather deal with unwanted telemarketing calls, fight their insurance company, or pay top dollar for oil and gas because almost anything is better than dealing with the cable company, if it happens to be named Comcast, Time Warner Cable, or Charter.

Americans would rather deal with unwanted telemarketing calls, fight their insurance company, or pay top dollar for oil and gas because almost anything is better than dealing with the cable company, if it happens to be named Comcast, Time Warner Cable, or Charter.

“That to me stands out as a major event over the last few months that has damaged the brand and category perception,” Fraenkel

“That to me stands out as a major event over the last few months that has damaged the brand and category perception,” Fraenkel

Time Warner Cable has

Time Warner Cable has  While Time Warner Cable customers have seen the company’s top premium speed stagnate at 50/5Mbps in many parts of upstate New York, South Carolina, western Ohio, and Maine for several years, TWC Maxx communities will see Standard Service speeds start at 50Mbps and rapidly increase from there. The differences in speed and price paid for broadband in Maxx markets vs. non-Maxx markets is staggering.

While Time Warner Cable customers have seen the company’s top premium speed stagnate at 50/5Mbps in many parts of upstate New York, South Carolina, western Ohio, and Maine for several years, TWC Maxx communities will see Standard Service speeds start at 50Mbps and rapidly increase from there. The differences in speed and price paid for broadband in Maxx markets vs. non-Maxx markets is staggering.