Updated 9/7/2016: Please check our latest coverage on promotional packages for Bright House and Time Warner Cable customers that are being introduced in September 2016 by new parent company Charter Communications. Some of the prices reflected below are now out of date!

Updated 9/7/2016: Please check our latest coverage on promotional packages for Bright House and Time Warner Cable customers that are being introduced in September 2016 by new parent company Charter Communications. Some of the prices reflected below are now out of date!

Charter’s plans for Time Warner Cable and Bright House Networks customers are now potentially clearer thanks to the apparent leak of several informational slides from a presentation given to employees to familiarize them with Charter’s forthcoming service plans.

A reader of DSL Reports in California shared what purports to be informational slides from a company training course. Los Angeles is among the first markets to be offered the new Charter/Spectrum service plans, likely to arrive as early as mid-September.

We’ve condensed the information down into a more readable format to give you an idea (subject to change, of course) about Charter’s pricing and plans. Existing customers may not need to give up their current plans right away, and some customers may not want to. Charter has recognized Time Warner Cable Maxx’s network upgrades in its plans and pricing, which means customers already upgraded for Maxx service will get better value from Charter’s plans than those customers who never made the upgrade list before Time Warner Cable was sold.

Keep in mind Charter will start by offering all “New Charter” customers a “new customer” promotion, priced low the first year and then increasing incrementally in price during the second and third years. Year three pricing will be equivalent to Charter’s regular price, which will be substantially higher than customers on Time Warner Cable customer retention plans have paid. Charter’s service plans offer improved broadband speeds, but at a significantly higher price. Standalone broadband customers in particular will feel an immediate sting. Charter’s entry-level price for most customers is $59.99 for 60Mbps, about $25 more than Time Warner Cable’s promotional rate for Standard 15/1Mbps service, which has been selling for about $35/mo for the first year. Charter will point out that it includes a cable modem for free while Time Warner Cable charged $10 a month, but that offers no solace to customers who have purchased their own equipment.

Please note these plans and prices have not been officially confirmed by Charter. In fact, we would not be surprised to see some pricing changes before the plans are officially available.

TELEVISION

There are big changes in store from Charter. First, the company will end distribution and support for Digital Transport Adapters (DTAs) — the small boxes designed for older analog-only TV sets. Charter expects you to have a traditional set-top box on every cable-equipped TV in the house. Second, it seems Whole House DVR service is being discontinued. Charter prefers the alternative of placing DVR boxes on each set where you want to record and watch TV shows. There is a significant cost for Time Warner Cable to install Whole House DVR service and it involves a technician coming to your home. Charter seems to want to cut truck roll expenses, and traditional DVR boxes are easy for customers to install themselves.

There are big changes in store from Charter. First, the company will end distribution and support for Digital Transport Adapters (DTAs) — the small boxes designed for older analog-only TV sets. Charter expects you to have a traditional set-top box on every cable-equipped TV in the house. Second, it seems Whole House DVR service is being discontinued. Charter prefers the alternative of placing DVR boxes on each set where you want to record and watch TV shows. There is a significant cost for Time Warner Cable to install Whole House DVR service and it involves a technician coming to your home. Charter seems to want to cut truck roll expenses, and traditional DVR boxes are easy for customers to install themselves.

DVR pricing is still confusing for customers. A single DVR box is priced at $4.99 for the equipment + an $11.99 DVR service fee. DVR’s 2-4 cost $4.99 per box + a $19.99 DVR service fee. We are not sure if the $19.99 inclusively covers all DVR boxes in the home or if that is charged for each additional DVR. (Update: STC reader Ricardo reports the $19.99 fee is inclusive, so it is only charged once regardless of how many extra DVRs you have.)

For the first year, traditional set-top boxes for New Charter customers are a bargain at $4.99/mo. Legacy Charter customers pay $2 more, and we predict you will pay more as well after the first year, but the equipment fees are less than what Time Warner Cable charged.

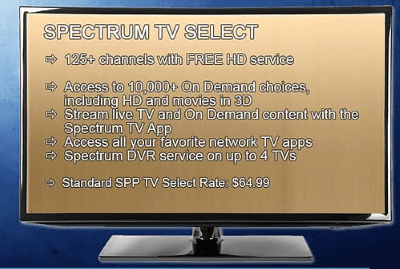

Customers will choose from three plans: Select, Silver, or Gold:

- Select: 125+ channels (HD included), Spectrum App (comparable to TWC TV app), 10,000+ On Demand Library ($64.99)

- Silver: 175+ channels (HD included), Spectrum App, On Demand, HBO, Cinemax, Showtime, NFL Network ($84.99)

- Gold: 200+ channels (HD included), Spectrum App, On Demand, premiums shown above + TMC, Starz, Encore, Epix, NFL Redzone ($104.99)

Charter’s pricing is built to encourage customers to bundle multiple services together, because substantial discounts are provided, especially when combining TV and internet service.

INTERNET

(All presentation slide images courtesy of Tech_Guy 88/DSL Reports)

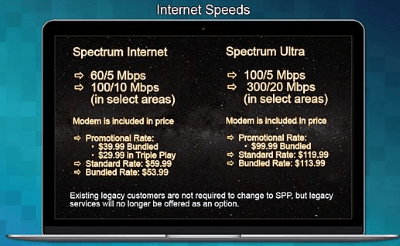

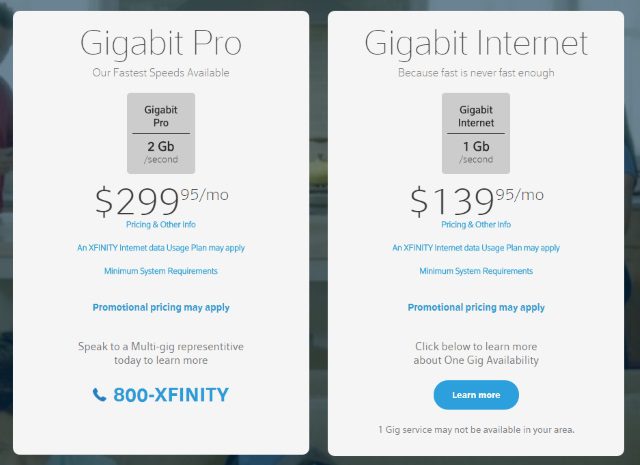

Charter moves to just two tiers of service available to the public (except in New York where TWC’s $14.99 Everyday Low Price Internet continues to be an option for the next two years — although it has been removed from TWC’s website) and standalone broadband pricing is considerably more expensive with Charter than with Time Warner Cable.

Perhaps special promotional offers will bring standalone internet prices closer to the $34.95-39.95 most new customers have gotten for Time Warner’s Standard Service (15/1Mbps) for years. We expect most customers will be more sensitive to price vs. speed and standalone internet at these prices will be a shock. We are not certain if Earthlink will continue to be an alternative option.

Upload speeds in non-Maxx areas are conservative, if these slides are accurate, topping out at just 5Mbps. This still leaves Charter as one of the slower U.S. providers.

In TWC Non-Maxx Areas (maximum TWC speed now 50/5Mbps):

- Spectrum Internet 60/5Mbps: Standalone $59.99/mo or $29.99 as part of a triple play package (first year promo price), $59.99 standalone or $53.99 as part of a bundle (regular price);

- Spectrum Ultra 100/5Mbps: Standalone $119.99/mo or $99.99 as part of bundled package (first year promo price), $119.99 standalone or $113.99 as part of a bundle (regular price).

In TWC Maxx Territories (maximum speed now 300Mbps):

- Spectrum Internet 100/10Mbps: Standalone $59.99/mo or $29.99 as part of a triple play package (first year promo price), $59.99 standalone or $53.99 as part of a bundle (regular price);

- Spectrum Ultra 300/20Mbps: Standalone $119.99/mo or $99.99 as part of bundled package (first year promo price), $119.99 standalone or $113.99 as part of a bundle (regular price)

Spectrum Wi-Fi, for those without their own routers, can be added to any internet plan for a $9.99 setup charge and $5 a month.

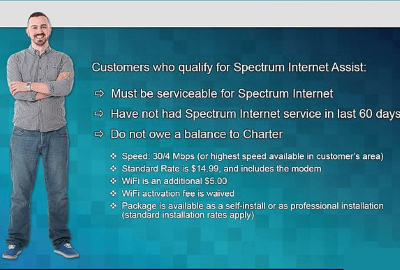

Charter’s discount plan for the income-challenged carries the usual restrictions. The most unconscionable effectively forces current Charter customers to go without internet access for 60 days before they can enroll in Spectrum Internet Assist. They also must not owe any past due balance to Charter.

Charter’s discount plan for the income-challenged carries the usual restrictions. The most unconscionable effectively forces current Charter customers to go without internet access for 60 days before they can enroll in Spectrum Internet Assist. They also must not owe any past due balance to Charter.

Assuming you qualify (eligible for the National School Lunch Program and senior citizens 65 years and older eligible for the federal Supplemental Security Income program), $14.99 will get you up to 30/4Mbps, plus an extra $5 a month if you want Charter to supply a Wi-Fi enabled router. The usual $9.99 activation fee is waived. Self-installation is free. If they have to send a truck to your home, the prevailing standard installation rate will apply. This is the only level of service Charter sells that will not require a credit check.

PHONE

Time Warner’s phone service had been promoted for years at $10 a month as part of a double-play or triple-play bundle. Charter’s triple play bundle pricing seems to show the price for phone service will now be effectively $20 a month.

Charter’s digital phone service has never seemed to be a marketing priority for Charter in its legacy service areas, and will likely be treated as an afterthought going forward. No further information about any service or calling area changes from what Time Warner Cable offered is available yet.

Subscribe

Subscribe After years of financial problems, union problems, and service problems, customers of FairPoint Communications in northern New England report the company has stabilized operations and has been gradually improving service. A hedge fund holding 7.5% of FairPoint agrees, and is now pressuring FairPoint’s board of directors to sell the company, allowing shareholders that bought FairPoint stock when it was nearly worthless to cash out at up to $23 a share.

After years of financial problems, union problems, and service problems, customers of FairPoint Communications in northern New England report the company has stabilized operations and has been gradually improving service. A hedge fund holding 7.5% of FairPoint agrees, and is now pressuring FairPoint’s board of directors to sell the company, allowing shareholders that bought FairPoint stock when it was nearly worthless to cash out at up to $23 a share. “Not as patient as FairPoint’s own customers that spent several years of hell dealing with Verizon’s sale of its landlines in Vermont, New Hampshire, and Maine,” said FairPoint customer Sally Jackman, who lives in Maine. “It looks like the hedge funds want their pound of profits from another sale, exactly what FairPoint customers don’t need right now.”

“Not as patient as FairPoint’s own customers that spent several years of hell dealing with Verizon’s sale of its landlines in Vermont, New Hampshire, and Maine,” said FairPoint customer Sally Jackman, who lives in Maine. “It looks like the hedge funds want their pound of profits from another sale, exactly what FairPoint customers don’t need right now.”

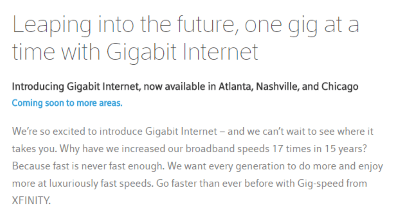

To be a Google Fiber city or not to be a Google Fiber city. It could make a big difference to your wallet if Comcast upgrades broadband speeds in your neighborhood before Google Fiber finally arrives in your “fiberhood.”

To be a Google Fiber city or not to be a Google Fiber city. It could make a big difference to your wallet if Comcast upgrades broadband speeds in your neighborhood before Google Fiber finally arrives in your “fiberhood.”

Hulu’s still-to-be-announced live TV streaming service designed to give subscribers an alternative to bloated and expensive cable-TV packages will lose “real money” if it is priced at around $40.

Hulu’s still-to-be-announced live TV streaming service designed to give subscribers an alternative to bloated and expensive cable-TV packages will lose “real money” if it is priced at around $40.