News that Google is dropping support for YouTube on Amazon-branded set-top boxes, personal assistants, and set-top boxes is being used by anti-Net Neutrality forces to claim those two companies are a much bigger problems for Net Neutrality than cable and phone companies.

News that Google is dropping support for YouTube on Amazon-branded set-top boxes, personal assistants, and set-top boxes is being used by anti-Net Neutrality forces to claim those two companies are a much bigger problems for Net Neutrality than cable and phone companies.

Google will make YouTube unavailable to Amazon device owners on Jan. 1, 2018, with the suggestion the company might change its mind if Amazon agrees to carry Chromecast and Google Home devices on its website and support casting Prime Video.

The last straw may have been Amazon’s decision to drop some of Nest’s newest products last month. Nest is owned by Google.

“Given this lack of reciprocity, we are no longer supporting YouTube on Echo Show and FireTV,” said a Google spokesperson to Multichannel News. “We hope we can reach an agreement to resolve these issues soon.”

“Echo Show and Fire TV now display a standard web view of YouTube.com and point customers directly to YouTube’s existing website,” Amazon responded in a statement. “Google is setting a disappointing precedent by selectively blocking customer access to an open website. We hope to resolve this with Google as soon as possible.”

The dispute was welcomed by anti Net Neutrality forces, who proclaimed consumers were the victims of Amazon.com and Google, not AT&T, Comcast, and other large telecom companies.

#Google and #Amazon are blocking their customers from getting what they want on the Internet the way they want it, yet claim to be #NetNeutrality purists. nothing neutral about Google and Amazon’s behavior here… #HypocrisyMuch https://t.co/pWmQYgAMTy

— Scott Cleland (@SCleland) December 5, 2017

USTelecom, a group sponsored by the nation’s biggest telephone companies, also pounced on the dispute. CEO Jonathan Spalter:

“Broadband ISPs are committed to providing an open internet for their customers, including protections like no content blocking or throttling,” he said. “Seems like some of the biggest internet companies can’t say the same. Ironic, isn’t it?”

(Headline corrected. Thanks to Morgan Wick.)

Subscribe

Subscribe Viacom and Charter Communications today announced a multi-year renewal of a carriage agreement that will bring back Viacom’s cable networks to almost all Spectrum cable television customers.

Viacom and Charter Communications today announced a multi-year renewal of a carriage agreement that will bring back Viacom’s cable networks to almost all Spectrum cable television customers. Charter indicated its agreement allows Spectrum to keep other Viacom-owned networks not mentioned above on its Silver or Gold tiers. The agreement also grants Charter customers access to Viacom networks’ on-demand programming through set-top boxes or mobile apps.

Charter indicated its agreement allows Spectrum to keep other Viacom-owned networks not mentioned above on its Silver or Gold tiers. The agreement also grants Charter customers access to Viacom networks’ on-demand programming through set-top boxes or mobile apps. WASHINGTON (Reuters) – U.S. antitrust regulators believe that AT&T Inc’s proposed acquisition of Time Warner Inc would raise costs for rival entertainment distributors and stifle innovation, a Department of Justice official told Reuters on Thursday.

WASHINGTON (Reuters) – U.S. antitrust regulators believe that AT&T Inc’s proposed acquisition of Time Warner Inc would raise costs for rival entertainment distributors and stifle innovation, a Department of Justice official told Reuters on Thursday.

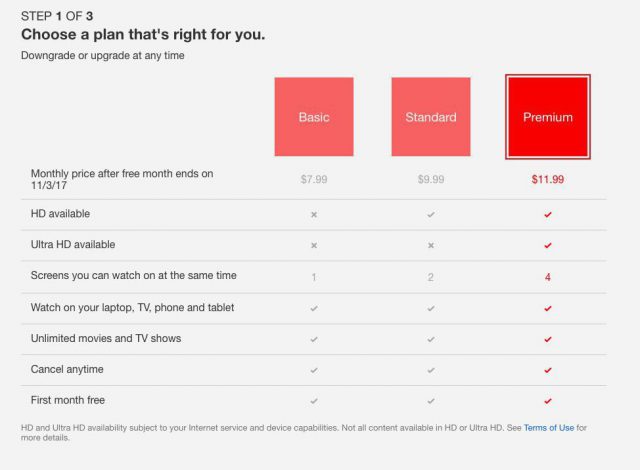

Most Netflix customers in the U.S. will be paying $1-2 more a month to the online streaming service starting in November.

Most Netflix customers in the U.S. will be paying $1-2 more a month to the online streaming service starting in November.