Starting Sept. 1, Chicago residents will be paying 9% more for everything from Netflix to income tax filing as city officials impose a recently reinterpreted entertainment/use tax on almost every online subscription content provider, even those peddling adult entertainment.

Starting Sept. 1, Chicago residents will be paying 9% more for everything from Netflix to income tax filing as city officials impose a recently reinterpreted entertainment/use tax on almost every online subscription content provider, even those peddling adult entertainment.

The Chicago Tribune reports the city’s Finance Department has vastly broadened the reach of Chicago’s amusement and personal property lease transaction taxes to apply the 9% tax to virtually any content that a customer borrows, leases, or subscribes to that is not purchased outright. Buying a CD on Amazon.com would not be subject to the tax but a Spotify subscription allowing you to listen to that same CD as long as your subscription is maintained will be taxed. Buying a digital copy of a movie will not be taxed, but watching it through a subscription service like Apple TV, Amazon, or Netflix will be.

Although some are dubbing it the “Netflix Tax,” it will also apply to cloud storage, paid television programming — including satellite, cable, telephone, and online-delivered content, financial and investment services, and almost anything else accessed online with a paid subscription. Even paying to host a website (or having someone manage it for you) will be subject to the tax.

The expanded tax is part of Mayor Rahm Emanuel’s strategy to deal with Chicago’s huge budget shortfall with fees, fines, and broadening taxes. The city predicts the expanded tax will capture up to $12 million a year from Chicago residents and businesses.

“In an environment in which technologies and emerging industries evolve quickly, the City periodically issues rulings that clarify the application of existing laws to these technologies and industries,” mayoral spokeswoman Elizabeth Langsdorf said in a statement issued Wednesday. “These two rulings are consistent with the City’s current tax laws and are not an expansion of the laws. These ensure that city taxation is uniformly and fairly applied and that businesses are given clear guidance on the applicability of the City’s tax laws to their operations, and they clarify that the amusement tax and personal property lease tax apply to digital services.”

Chicago residents have paid the amusement tax on movie tickets, local concerts and sports events since at least 1998. The city collects 5% on live theatrical, musical, and other live cultural performances held in an auditorium, theater, or other space whose maximum capacity (including balconies) is more than 750 persons. A 9% tax applies on all other events, but no tax is collected on religious, charitable, and not-for-profit organizations holding events for fund-raising purposes as long as they limit them to two events per year.

Chicago residents have paid the amusement tax on movie tickets, local concerts and sports events since at least 1998. The city collects 5% on live theatrical, musical, and other live cultural performances held in an auditorium, theater, or other space whose maximum capacity (including balconies) is more than 750 persons. A 9% tax applies on all other events, but no tax is collected on religious, charitable, and not-for-profit organizations holding events for fund-raising purposes as long as they limit them to two events per year.

A Netflix spokeswoman confirmed that the company will pass the additional cost to subscribers but said no other details were available.

Critics of the tax contend it will be very easy to avoid through the use of payment services like PayPal, which allow customers to specify an out-of-state address — any out-of-state address, valid or not — in the payment details box, allowing residents to avoid the tax. Others are adding the addresses of out-of-state relatives to their credit cards and will use those addresses when placing orders for online content.

“Since they are not mailing you anything, it doesn’t really matter what address you use, as long as it is outside of the city of Chicago,” one anonymous commenter noted.

Wynne

That is exactly what Michael Wynne, a partner and attorney in the Chicago office of the law firm Reed Smith, predicted would happen, noting Chicago is already replete with high taxes and fees and adding more of them would encourage tax dodging. He assumed businesses will also actively avoid the tax, either by moving their offices out of the Chicago city limits or more likely renting a post office box in the suburbs and using it as a billing address.

“Let’s say I sign up for streaming business data in the city but I have offices throughout the country,” Wynne told the newspaper. “I will definitely make sure my billing goes through a different office.”

Wynne believes many Chicago residents may not understand the 9% tax will apply to a lot more than just Netflix. He called the expansion staggering in its breadth in his analysis, excerpted below.

The Unamusing Amusement Tax: It Could Apply to Almost Anything

The Amusement Tax ruling will extend the tax to streaming services for music, movies, games, and the like, as well as satellite TV delivered to a customer located in Chicago. However, the ruling does not impose the Amusement Tax on the same content when it is permanently downloaded by a consumer. The Lease Transaction Tax ruling extends the tax to the online procurement of real estate listings, car prices, stock prices, economic statistics, and “similar information or data that has been compiled, entered and stored on the provider’s computer.” In addition, under the ruling, the Lease Transaction Tax will apply to the online procurement of “word processing, calculations, data processing, tax preparation” and “other applications available to a customer through access to a provider’s computer and its software.” In the ruling, the Department expressly notes that these “examples are sometimes referred to as cloud computing, cloud services, hosted environment, software as a service, platform as a service, or infrastructure as a service.”

The Amusement Tax is imposed on patrons of every amusement within the city. “Amusement” is broadly defined, and it includes “any entertainment or recreational activity offered for public participation or on a membership or other basis,” and “any paid television programming, whether transmitted by wire, cable, fiber optics, laser, microwave, radio, satellite or similar means.”

The Amusement Tax is imposed on patrons of every amusement within the city. “Amusement” is broadly defined, and it includes “any entertainment or recreational activity offered for public participation or on a membership or other basis,” and “any paid television programming, whether transmitted by wire, cable, fiber optics, laser, microwave, radio, satellite or similar means.”

The Amusement Tax ruling specifically taxes charges paid for the privilege of the following amusements delivered to a patron in the city: (1) “watching electronically delivered television shows, movies, or videos”; (2) “listening to electronically delivered music”; and (3) “participating in games, on-line or otherwise.” As a consequence, streaming a movie, listening to streaming music, or playing a game on a smartphone or tablet will now trigger a 9% tax on the subscription charge for those services if those activities are done at a location in Chicago. Furthermore, the ruling addresses “bundled” transactions, by providing that “unless it is clearly proven that at least 50% of the price” is not for the amusement, the entire charge, except for any separately stated non-amusement charges, is subject to the Amusement Tax. That suggests great care must be paid to invoicing services when including any item that might be construed to be an amusement. The ruling does not differentiate between news, current events, sports, movies, music or other types of television programming. As a consequence, an establishment that charges patrons for access to television programming of any sort, plus other goods and services (e.g., a bar that imposes an admission charge for a pay-per-view event that includes food and beverages) may have to navigate the bundling rules.

The Computer Lease Tax Ruling = 9% on Everything You Borrow, Subscribe, Rent, Lease, or Pay-Per-View Online

Rep. Bob Goodlatte (R-Va.) introduced H.R. 235: the Permanent Internet Tax Freedom Act, which passed in the House of Representatives on June 9th and is heading to the Senate.

The ruling provides examples of when the tax applies, such as when performing legal research or similar on-line database searches, to obtain consumer credit reports, or “real estate listings and prices, car prices, stock prices, economic statistics, weather statistics, job listings, resumes, company profiles, consumer profiles, marketing data, and similar information or data that has been compiled, entered and stored on the provider’s computer.” In the ruling, the Department specifically identifies taxable leases of personal property to include “cloud computing, cloud services, hosted environment, software as a service, platform as a service, or infrastructure as a service.” This is quite an expansion for a concept evolved from taxing agreements for time-sharing on mainframe computers, and that has only been judicially tested once, involving legal research in the city on terminals provided by the legal search provider, in days that preceded the creation of the World Wide Web, and the expansion of fiber-optic networks that made possible the Internet networks relied on to deliver many of the services the ruling now targets. See, Meites v. City of Chicago, 184 Ill. App. 3d 887 (1989). The rulings represent a further evolution of the city’s approach under the Lease Transaction Tax to disregard contract terms and recharacterize transactions to fit its tax code definitions; it is doubtful that any consumer or provider of subscription Internet streaming services thinks they are contracting to lease tangible personal property.

Wynne says Chicago officials have expanded the scope of its tax ordinances to their absolute limit, if not further. He also fears Chicago could give other cities and states ideas for new taxes.

“If any state or local governments were wondering how to tax transactions occurring in the Cloud when legislative authority for such taxation is absent, the Department has just sketched a roadmap,” he wrote.

Wynne believes the time to stop these kinds of taxes is now, before they have a chance to spread, or worse, start being collected.

He writes there are strong arguments that Chicago’s creative reinterpretation of its 9% tax is illegal, running afoul of the Federal Telecommunications Act, the Internet Tax Freedom Act, and federal and Illinois constitutional limits on taxation. But while the rulings are likely to be challenged in court, Chicago officials still expect providers to start handing over the 9% tax proceeds beginning this fall. Those that don’t will run into Chicago’s tax penalty buzzsaw – 12% interest on delinquent taxes, a 25% penalty, and a lengthy bureaucratic process (bring your attorney) dealing with the city’s administrative hearings office.

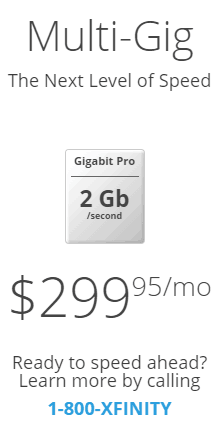

Comcast will challenge cord cutting and entice cord-nevers with an online video package of about a dozen television channels it will sell for $15 a month and likely exempt from its usage cap.

Comcast will challenge cord cutting and entice cord-nevers with an online video package of about a dozen television channels it will sell for $15 a month and likely exempt from its usage cap. Comcast will deliver Stream over the same network it uses for content delivery to game consoles that does not count against Comcast’s trialed usage caps. Watching competitor Sling TV does count against your Comcast usage allowance because it is delivered over the public Internet.

Comcast will deliver Stream over the same network it uses for content delivery to game consoles that does not count against Comcast’s trialed usage caps. Watching competitor Sling TV does count against your Comcast usage allowance because it is delivered over the public Internet.

Subscribe

Subscribe

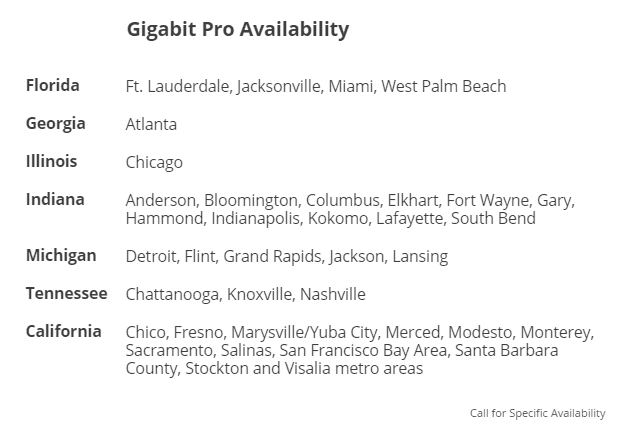

Later this year, the service is also expected to reach further west:

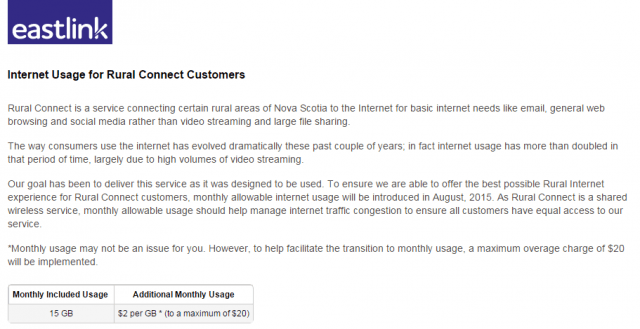

Later this year, the service is also expected to reach further west: A plan to place a 15GB monthly usage cap on Eastlink broadband service in rural Nova Scotia has led to calls to ban data caps, with a NDP Member of the Legislative Assembly of Nova Scotia leading the charge.

A plan to place a 15GB monthly usage cap on Eastlink broadband service in rural Nova Scotia has led to calls to ban data caps, with a NDP Member of the Legislative Assembly of Nova Scotia leading the charge.

Fournier suspects Eastlink has not invested enough to keep up with a growing Internet because the service originally advertised itself as a way to listen to online music and watch video. But he also wonders if the data cap is an attempt to force the government to fund additional upgrades to get Eastlink to back down.

Fournier suspects Eastlink has not invested enough to keep up with a growing Internet because the service originally advertised itself as a way to listen to online music and watch video. But he also wonders if the data cap is an attempt to force the government to fund additional upgrades to get Eastlink to back down. Stop the Cap! will formally participate in New York State’s

Stop the Cap! will formally participate in New York State’s

Starting Sept. 1, Chicago residents will be paying 9% more for everything from Netflix to income tax filing as city officials impose a recently reinterpreted entertainment/use tax on almost every online subscription content provider, even those peddling adult entertainment.

Starting Sept. 1, Chicago residents will be paying 9% more for everything from Netflix to income tax filing as city officials impose a recently reinterpreted entertainment/use tax on almost every online subscription content provider, even those peddling adult entertainment. Chicago residents have paid the amusement tax on movie tickets, local concerts and sports events since at least 1998. The city collects 5% on live theatrical, musical, and other live cultural performances held in an auditorium, theater, or other space whose maximum capacity (including balconies) is more than 750 persons. A 9% tax applies on all other events, but no tax is collected on religious, charitable, and not-for-profit organizations holding events for fund-raising purposes as long as they limit them to two events per year.

Chicago residents have paid the amusement tax on movie tickets, local concerts and sports events since at least 1998. The city collects 5% on live theatrical, musical, and other live cultural performances held in an auditorium, theater, or other space whose maximum capacity (including balconies) is more than 750 persons. A 9% tax applies on all other events, but no tax is collected on religious, charitable, and not-for-profit organizations holding events for fund-raising purposes as long as they limit them to two events per year.

The Amusement Tax is imposed on patrons of every amusement within the city. “Amusement” is broadly defined, and it includes “any entertainment or recreational activity offered for public participation or on a membership or other basis,” and “any paid television programming, whether transmitted by wire, cable, fiber optics, laser, microwave, radio, satellite or similar means.”

The Amusement Tax is imposed on patrons of every amusement within the city. “Amusement” is broadly defined, and it includes “any entertainment or recreational activity offered for public participation or on a membership or other basis,” and “any paid television programming, whether transmitted by wire, cable, fiber optics, laser, microwave, radio, satellite or similar means.”