Former Time Warner Cable and Bright House Networks customers in Florida, Ohio, Michigan, and Wisconsin were glad to see the end of modem rental fees, something promoted as a tangible deal benefit of the merger by new owner Charter Communications. But many of those same customers are now upset to discover that up to $10 modem rental fee has been replaced with a $5 monthly fee for “Wi-Fi service.”

Former Time Warner Cable and Bright House Networks customers in Florida, Ohio, Michigan, and Wisconsin were glad to see the end of modem rental fees, something promoted as a tangible deal benefit of the merger by new owner Charter Communications. But many of those same customers are now upset to discover that up to $10 modem rental fee has been replaced with a $5 monthly fee for “Wi-Fi service.”

LuAnn Summers, a Bright House customer in Tampa, wrote Stop the Cap! in February to complain her new bill from Charter/Spectrum included a $9.99 activation fee and $5 a month for something called “Wi-Fi Service.” The same fees have since appeared on bills for some customers recently switching away from their old Time Warner Cable service plans to new Spectrum pricing and plans.

Rich D’Angelo in Wisconsin recently took Charter up on its offer to switch away from his legacy TWC plan when his promotion expired in January.

“I was able to get a big speed boost and bundle it with Spectrum’s Silver TV package, which includes two of the premium movie channels I was paying TWC $15 each for every month, and my bill was only supposed to go up $10,” D’Angelo tells Stop the Cap! “Instead, it went up $25 and I feel lied to.”

Wi-Fi sticker shock.

D’Angelo retired his old owned Motorola SB6121 modem in favor of a new network gateway supplied free of charge by Charter because his new package didn’t work with his old modem.

“My 6121 modem was a real workhorse and I bought it right after Time Warner started charging modem fees, but it cannot support Spectrum’s fastest speeds in Wisconsin and I didn’t feel like buying a new modem when Spectrum gives them to customers for free,” D’Angelo explained. “This was the device they handed me and I was not offered any other option.”

Champagne Johnson in Columbus, Ohio also took advantage of Spectrum’s new pricing plans thinking she could save her family money and get better internet speeds from the cable operator that advertises it’s a “new day” for Time Warner Cable subscribers.

“New day but the same old lies and deceit,” Johnson writes Stop the Cap! “Do these cable companies only hire thieves? I was told the cable modem was included, but now I am suddenly getting charged for Wi-Fi, which is crazy. I called Spectrum up and they told me there is a charge if I use their modem for my Wi-Fi. I told them I don’t need their Wi-Fi because I have my own router that works fine and they told me it was included inside their modem and I had to pay for something I won’t use.”

Charter assumes if you use Wi-Fi, you want their Wi-Fi Service

We contacted Charter to learn more about this new charge and what customers can do about it.

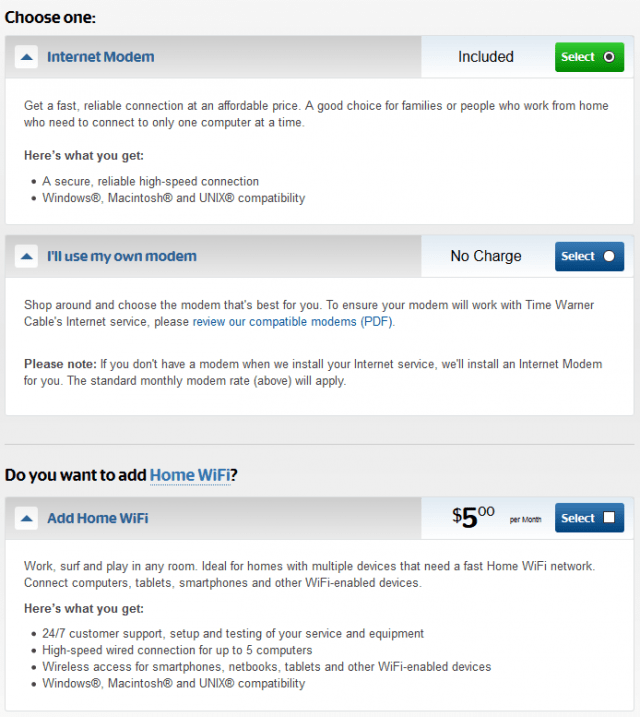

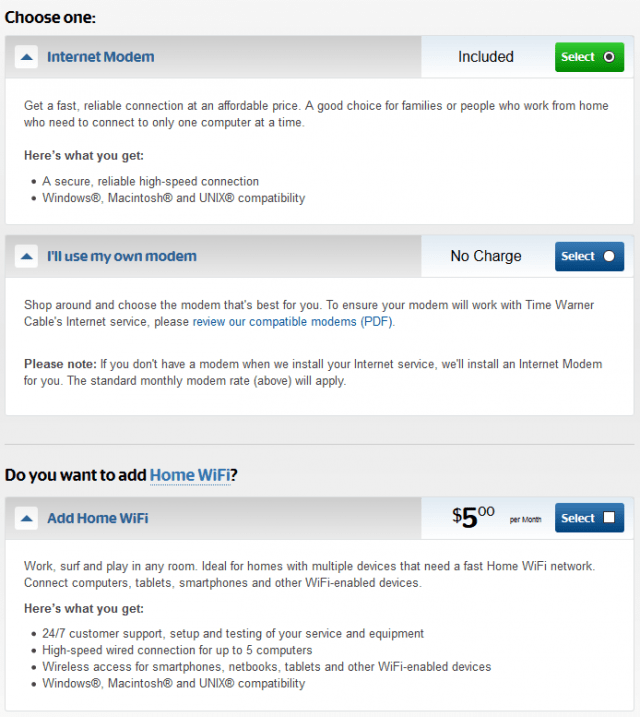

It turns out the Wi-Fi charge and activation fee applies when you use a network gateway device provided by the cable company. We learned the reason so many customers are finding this charge on their bill comes as a result of slightly deceptive sales practices when customers choose a Spectrum internet service plan.

“Do you use Wi-Fi at home?” a Charter representative asked us when we inquired about pricing for a new Spectrum service plan to replace our existing Time Warner Cable plan. When we answered yes, the representative said they would send our “free equipment” and noted we would no longer pay a modem rental charge (despite the fact we had owned our own modem at Stop the Cap! HQ for years). “You can either pick it up in a cable store or we can ship it direct to you in a self-install kit.” That equipment was a “network gateway,” which bundles a cable modem and router into a single device.

Our readers confirm that Charter representatives did not ask them if they have an existing in-home router, which probably already provides Wi-Fi access in the home. Nor do they disclose that accepting a network gateway, which was also interchangeably referred to as “a modem” means they are agreeing to pay a $9.99 activation fee and $5/mo ongoing fee for “Wi-Fi service.”

Our readers confirm that Charter representatives did not ask them if they have an existing in-home router, which probably already provides Wi-Fi access in the home. Nor do they disclose that accepting a network gateway, which was also interchangeably referred to as “a modem” means they are agreeing to pay a $9.99 activation fee and $5/mo ongoing fee for “Wi-Fi service.”

We called three times this afternoon as were given identical information, and no disclosure of any Wi-Fi fees.

On the fourth call, we specifically asked about Wi-Fi fees and the representative told us they did not know the answer and left us on hold for 10 minutes before finally disclosing that Charter does charge both fees. When we asked how to avoid them, we were first told we could not waive the fee if we used Wi-Fi in the home, but a supervisor later clarified that it only applied to their gateway and we could specifically request a “basic modem” or have Wi-Fi disabled on a network gateway, and neither charge would apply.

“How are we supposed to know and understand that in advance?” Johnson asked us.

“Considering more than 90% of Time Warner Cable customers were paying $10 a month for a modem without ever realizing or understanding they could buy their own and avoid that charge, how many Spectrum customers are proficient enough to tell Spectrum they want their network gateway set to bridge mode or want a traditional cable modem without router functionality? It’s clear Charter is going to make $5 a month from a whole lot of customers, and it should be disclosed up front. It even got me and I am a network engineer.”

Summers learned about the controversy of the Wi-Fi charge after googling the fee and discovered a Tampa Bay Times story about the fee.

Spectrum spokesman Joe Durkin told the newspaper the fee should not apply to customers Charter inherited from Bright House who already had internet service. He said Spectrum is reviewing cases the Times has brought to its attention to see if the charges were appropriate.

But that isn’t always the case for customers placing orders on Charter’s website or contacting customer service by phone. In both cases, Charter implied if you want to use Wi-Fi at home, you owe them an extra $5 a month:

Charter’s website suggests that you have to pay $5 a month if you intend to use Wi-Fi at home.

Getting the charges off your bill

Luckily, Charter is readily agreeing to customer requests to remove the charge(s) from customer bills and will supply equipment with Wi-Fi disabled (or not present when using a traditional cable modem). You may need to exchange equipment, however. If either charge appears on your bill, call and complain. While we no longer recommend customers invest in their own cable modems as long as Charter is providing them without a rental fee, we do suggest customers buy their own router and avoid ongoing fees for Wi-Fi service.

Also be aware that if you are still on a legacy Time Warner Cable internet plan, Charter will keep collecting that $10 monthly modem fee until you abandon your Time Warner plan for a Spectrum internet plan. You can still avoid the rental fee by buying your own modem. Charter’s list of supported modems is here.

WASHINGTON (Reuters) – The U.S. Federal Communications Commission voted on Thursday to effectively deregulate the $45 billion business data services market in a win for companies like AT&T Inc, CenturyLink Inc and Verizon Communications Inc that will likely lead to price hikes for many small businesses.

WASHINGTON (Reuters) – The U.S. Federal Communications Commission voted on Thursday to effectively deregulate the $45 billion business data services market in a win for companies like AT&T Inc, CenturyLink Inc and Verizon Communications Inc that will likely lead to price hikes for many small businesses.

Subscribe

Subscribe

“Our work suggests that cable companies have room to take up broadband pricing significantly and we believe regulators should not oppose the re-pricing (it is good for competition & investment).”

“Our work suggests that cable companies have room to take up broadband pricing significantly and we believe regulators should not oppose the re-pricing (it is good for competition & investment).”