AT&T and Comcast have successfully delayed Google Fiber’s expansion around the country long enough to finish upgrades that can nearly match the upstart’s speedy internet service.

AT&T and Comcast have successfully delayed Google Fiber’s expansion around the country long enough to finish upgrades that can nearly match the upstart’s speedy internet service.

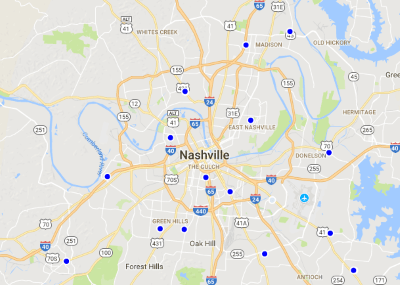

Nearly four years after Google Fiber announced it would offer gigabit speed in Nashville, most residents still have no idea when they will be able to have the service installed. Although officially announced in January 2015, Google has only managed to connect 52 apartment buildings and a limited number of single family homes in parts of Charlotte Park, Edgehill, Sylvan Heights, Sylvan Park, East and North Nashville, and Burton Hills. In all, less than 30% of the homes originally promised service actually have it, forcing Google to seek an extension from the Tennessee Public Utilities Board, which was granted last week.

Google’s problems originate within itself and its competitors. The company’s contractors have been criticized for damaging existing wiring, tearing up streets and yards, piercing water pipes causing significant water damage, and inappropriate microtrenching, which caused some of its fiber infrastructure in Nashville to be torn out of the ground by road repair crews.

But the biggest impediment keeping Google from moving faster is its two competitors — AT&T and Comcast, successfully collaborating to stall Google, giving the phone and cable company plenty of time to improve services to better compete. Both companies have also aggressively protected their customers from being poached by offering rock bottom-priced retention plans that some claim are only available in Google Fiber-ready areas.

“It’s still complicated,” Nashville Google Fiber Manager Martha Ivester told the Tennessean newspaper. “Building this fiber optic network throughout the whole city is a long process, and we never expected it wouldn’t be a long process. Obviously, we have had our challenges here.”

WZTV Nashville reports East Nashville residents were upset over road work related to Google Fiber that lasted for months, severely restricting residential parking. (2:37)

Google Fiber Huts – Nashville, Tenn.

Google’s ability to expand has been restrained for years, despite an informal alliance with city officials, primarily over pole attachment issues. Much of middle Tennessee is challenged by a difficult-to-penetrate layer of limestone close to the surface, making underground utility service difficult and expensive. Google’s negotiations with Nashville Electric Service (NES), which owns 80% of the utility poles in Nashville and AT&T, which owns the remaining 20%, have been long and contentious at times. To bring Google Fiber to a neighborhood, existing wires on utility poles have to be moved closer together to make room for Google Fiber. In real terms, that has taken several months, as AT&T and Comcast independently move at their own pace to relocate their respective lines.

An effort to use independent contractors to move all lines in unison — known as “One Touch Make Ready,” was fiercely opposed by AT&T and Comcast, claiming it would violate contracts with existing workers and could pose safety issues, despite the fact both companies use independent contractors themselves to manage wiring. Both companies successfully challenged One Touch Make Ready in court. A federal judge ruled that only the FCC could regulate poles owned by AT&T, while another judge ruled the city had no authority to order the municipally owned electric company to comply with One Touch Make Ready.

In August, the FCC issued an order allowing One Touch Make Ready to apply to AT&T’s poles, but NES still refuses to change its policy of relocating service lines one line at a time. The electric utility did not explain its reasons. AT&T also recently eased its position on One Touch Make Ready, but with NES still stonewalling, Google Fiber’s delays are likely to continue.

AT&T Fiber is being embraced by some customers tired of waiting for Google Fiber.

In the interim, both AT&T and Comcast have upgraded their respective systems. AT&T Fiber offers a fiber-to-the-home connection available in some areas while Comcast offers near-gigabit download speeds over its existing Hybrid Fiber-Coax (HFC) network. The upgrades have taken the wind out of Google Fiber for some tired of waiting.

Google has recently tried to speed progress using underground “shallow trenching” for installation, which buries cable as little as four inches deep. The company has amassed more than 24,000 permits to lay fiber under roads and yards in Nashville, which may speed some deployment, but for some it is too little, too late.

“It has been more than a year since we expected Google Fiber to serve us and they won’t tell us when they will get here, so I gave up and signed a two-year contract for AT&T Fiber service instead,” said Drew Miller. “Google Fiber just isn’t as exciting as it was when it was announced because other providers have similar service now and I get a better deal bundling it with my AT&T cellphone service.”

Attitudes like that obviously concern Google, as have reports that customers in Google Fiber-ready neighborhoods are getting very aggressively priced retention offers if they stay with their current provider.

“Comcast cut my bill from close to $200 to around $125 if I did not switch,” said Stop the Cap! reader Olivia. “I also got double internet speed. I don’t need a gigabit, so I stayed with Comcast. If I get close to their usage limit I will switch to Google then.”

Olivia notes her mother had exactly the same services from Comcast, but Comcast would not offer her the same promotion because she lived in an area not yet wired for Google Fiber.

With upgrades and aggressive customer retentions, the longer Google takes to string fiber, the fewer customers are likely to switch for what was originally “game-changing” internet speeds and service.

WTVF Nashville shows off Google’s microtrenching, burying fiber optic cables just a few inches underground. (2:36)

Pricing Comparisons

Google Fiber

- Fiber 100: $50 a month, internet speeds up to 100 Mbps

- Fiber 1000: $70 a month, internet speeds up to 1,000 Mbps, downloads and uploads

- Fiber 100 + TV: $140 a month, internet speeds up to 100 Mbps, 155+ channels, premium channels (HBO, Showtime) available

- Fiber 1000 + TV: $160 a month, internet speeds up to 1,000 Mbps, 155+ channels, premium channels (HBO, Showtime) available

AT&T

- Internet-only: $50 a month for first 12 months, then $60 thereafter. $99 installation fee. Unlimited data costs an extra $30 a month. Early termination fee: $180 (pro-rated). Speeds range from 10 to 100 Mbps

- Direct TV + Internet: $75/mo first 12 months, then $121. Customers pay a $35 activation fee and $30 a month for unlimited data. 155 channels. Speeds vary. 24 month contract required.

- Internet 1000: $90 a month during first 12 months, then $100/mo thereafter. Bundled discount can reduce cost of package to $80-90. Up to 960 Mbps downloads. Early termination fee: $180 (pro-rated).

Comcast

- Performance Starter: $20 a month, increases to $50 after two-year promotion. Up to 25 Mbps.

- Blast!: $45 a month, increases to $80 a month after two-year promotion. 150 Mbps.

- Gigabit (DOCSIS 3.1): $70 a month, increased to $140 after two-year promotion. 940/35 Mbps.

WSMV Nashville reports Google’s microtrenching has been problematic as road crews unintentionally dig up Google’s optical fiber cables mistakenly buried just two inches underground. (2:44)

Verizon is continuing efforts to gradually retire its copper-wire facilities in parts of six states, replacing existing copper wiring with a fiber to the home network.

Verizon is continuing efforts to gradually retire its copper-wire facilities in parts of six states, replacing existing copper wiring with a fiber to the home network.

Subscribe

Subscribe AT&T and Comcast have successfully delayed Google Fiber’s expansion around the country long enough to finish upgrades that can nearly match the upstart’s speedy internet service.

AT&T and Comcast have successfully delayed Google Fiber’s expansion around the country long enough to finish upgrades that can nearly match the upstart’s speedy internet service.

“Devastating.”

“Devastating.” The comments reflected consumer views that mergers in the telecom industry reduce choice and raise prices.

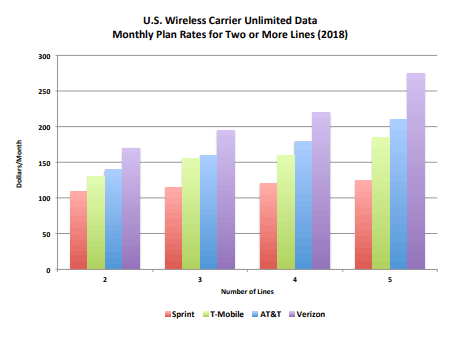

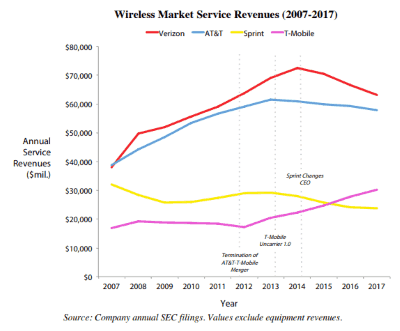

The comments reflected consumer views that mergers in the telecom industry reduce choice and raise prices. Rivals, especially AT&T and Verizon, have remained silent about the merger. That is not surprising, considering T-Mobile and Sprint have forced the two larger providers to match innovative service plans, bring back unlimited data, and reduce prices. A combined T-Mobile and Sprint would likely reduce competitive pressure and allow T-Mobile to comfortably charge nearly identical prices that AT&T and Verizon charge their customers.

Rivals, especially AT&T and Verizon, have remained silent about the merger. That is not surprising, considering T-Mobile and Sprint have forced the two larger providers to match innovative service plans, bring back unlimited data, and reduce prices. A combined T-Mobile and Sprint would likely reduce competitive pressure and allow T-Mobile to comfortably charge nearly identical prices that AT&T and Verizon charge their customers. Telecom companies in four states will receive almost 50% of the $1.488 billion the FCC has set aside in support to expand rural broadband service in unserved areas of 45 states.

Telecom companies in four states will receive almost 50% of the $1.488 billion the FCC has set aside in support to expand rural broadband service in unserved areas of 45 states. Providers must build out to 40 percent of the assigned homes and businesses in a state within three years and increase by 20 percent in each subsequent year, until complete buildout is reached at the end of the sixth year.

Providers must build out to 40 percent of the assigned homes and businesses in a state within three years and increase by 20 percent in each subsequent year, until complete buildout is reached at the end of the sixth year. Spectrum customers in western New York are reporting overdraft charges and missing funds from their checking accounts that trace back to double-charging by Charter Communications for cable service.

Spectrum customers in western New York are reporting overdraft charges and missing funds from their checking accounts that trace back to double-charging by Charter Communications for cable service. This can become a problem for customers who keep a low balance in their checking account and expect those funds to be immediately available to pay bills or make a cash withdrawal. Because of the extended hold, customers could unintentionally overdraw their checking account, leading to overdraft fees or an automatic draw from a line of credit, if one is attached to your checking account. La Voie had enough money in her account to avoid an overdraft, but she was concerned about those who don’t.

This can become a problem for customers who keep a low balance in their checking account and expect those funds to be immediately available to pay bills or make a cash withdrawal. Because of the extended hold, customers could unintentionally overdraw their checking account, leading to overdraft fees or an automatic draw from a line of credit, if one is attached to your checking account. La Voie had enough money in her account to avoid an overdraft, but she was concerned about those who don’t.