Verizon and Samsung on Monday confirmed long-held industry expectations they would seek to steal a march on Apple by launching U.S. 5G smartphones in the first half of 2019.

The two companies said in a statement they would unveil a prototype, using Qualcomm modem chips, at the chipmaker’s annual Snapdragon Technology Summit in Maui, Hawaii this week.

While Verizon is leading the charge to trial 5G in some cities next year, industry analysts say the higher-speed networks are unlikely to be widely available until the middle of the next decade.

Apple is engaged in a legal battle with Qualcomm that has led it to stop using its modem chips, and the Cupertino, California company is widely expected instead to use Intel modems, which will not be ready for production until late 2019.

Citing sources familiar with the matter, Bloomberg reported on Monday that Apple would wait until at least 2020 to release its first 5G iPhones.

The delay could make it easier for Samsung and Verizon to win customers who are eager to connect to 5G networks, which will provide a leap forward in mobile data speeds, up to 50 or 100 times faster than current 4G networks.

Qualcomm has also partnered with other smartphone makers who have committed to 5G phones for next year.

U.S. wireless carrier Sprint is also working with LG Electronics USA to launch a 5G smartphone in the U.S. in the first half of 2019.

Verizon launched its first commercial 5G service in October when its 5G Home offering went live in Houston, Indianapolis, Los Angeles and Sacramento.

Verizon Chief Financial Officer Matthew Ellis said last month that the company plans to target a broader audience for its 5G home broadband product following the adoption of global standards for the technology.

(Reuters) Reporting by Sayanti Chakraborty in Bengaluru; Editing by Shounak Dasgupta

Subscribe

Subscribe Canadian Netflix subscribers will pay up to $3 more a month in the coming weeks for streaming video as the company raises prices to produce more original Canadian content.

Canadian Netflix subscribers will pay up to $3 more a month in the coming weeks for streaming video as the company raises prices to produce more original Canadian content.

Forty companies, including hedge funds, phone companies, and wireless carriers have collectively bid $336,265,480 so far for about 2,500 28 GHz licenses (out of 3,072 available) that will be a part of the buildout of 5G millimeter wave wireless service.

Forty companies, including hedge funds, phone companies, and wireless carriers have collectively bid $336,265,480 so far for about 2,500 28 GHz licenses (out of 3,072 available) that will be a part of the buildout of 5G millimeter wave wireless service. California: Kern

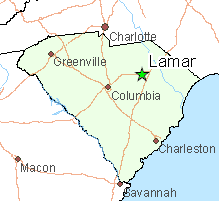

California: Kern Population growth in South Carolina has opened up new opportunities for Charter Communications to extend cable service into areas that were formerly too unprofitable to serve. On Tuesday, the company announced a $1 million construction project to bring Spectrum cable broadband service to the town of Lamar in Darlington County.

Population growth in South Carolina has opened up new opportunities for Charter Communications to extend cable service into areas that were formerly too unprofitable to serve. On Tuesday, the company announced a $1 million construction project to bring Spectrum cable broadband service to the town of Lamar in Darlington County. “Internet is obviously a necessity, it’s not a luxury anymore,” said Ben Breazeale, senior director of government affairs for Charter Communications. “Rural communities all over our country are struggling to try to retain young people and internet is a must. Access to our communications systems is a must for our youth.”

“Internet is obviously a necessity, it’s not a luxury anymore,” said Ben Breazeale, senior director of government affairs for Charter Communications. “Rural communities all over our country are struggling to try to retain young people and internet is a must. Access to our communications systems is a must for our youth.” By the year 2022, 60% of the world’s population will be connected to the internet and 82% of online traffic will come from streaming video.

By the year 2022, 60% of the world’s population will be connected to the internet and 82% of online traffic will come from streaming video.