One of America’s lowest-rated cable companies and an industry legend labeled by consumer advocates as the “Darth Vader of cable” may be joining forces to buy Time Warner Cable, according to Bloomberg News.

One of America’s lowest-rated cable companies and an industry legend labeled by consumer advocates as the “Darth Vader of cable” may be joining forces to buy Time Warner Cable, according to Bloomberg News.

The blockbuster buyout would leap Charter Cable from fourth largest cable operator to second place, although still behind Comcast in terms of revenue and number of subscribers.

The spectacular return of Malone to the top echelon of the American cable industry was the talk of the industry’s Cable Show, ongoing this week in Washington, D.C. Those attending are reportedly buzzing Malone’s imminent return is likely to spark a massive consolidation of the U.S. cable industry to as few as three major cable operators serving more than 95 percent of the American cable marketplace.

Malone

Driving momentum to merge, in Malone’s view, is increasing cable video programming costs, which are cutting into profits. Having a fewer number of cable operators could hand the industry more leverage over broadcasters and unaffiliated cable programmers, but could also cut costs through marketplace efficiencies and volume discounts.

“If you’re John Malone, you’re thinking: we’ve got to get bigger,” Jim Boyle, managing director of SQAD and formerly a cable equity analyst for more than 19 years, said in a telephone interview with Bloomberg News. “The bigger Charter can get, the more economies of scale discounts it can get,” he said. “If everyone else is playing checkers, Malone is playing three-dimensional chess.”

For many on Wall Street, the only thing left to do is plan the funeral for the country’s second largest cable company.

“If you’re going to do a transformational deal, your choices are Time Warner Cable, Time Warner Cable and Time Warner Cable,” Craig Moffett, a veteran industry observer told Bloomberg. “You can roll up all the little guys if you want to, but even if you did, you haven’t built something that’s truly large-scale.”

“Time Warner Cable is gone,” Chris Marangi, a money manager at Gamco Investors Inc., said. “I think Charter will buy them eventually, whether it’s Liberty facilitating that or Charter doing it directly or the two companies doing it in partnership.”

Industry observers predict Malone will signal his dream deal by initially launching smaller mergers and acquisitions before attempting a buyout of a cable company considerably larger than Charter itself.

The first target: perennially bottom rated Mediacom, where any buyer is likely to be hailed as a rescuer by beleaguered subscribers who have regularly dismissed the cable operator as incompetent. Next, the Washington Post’s Cable ONE, which may already be plumping itself up as at attractive takeover target through investment in improving its network infrastructure.

But the most obvious foreshadowing of a big deal with Time Warner would most likely come if Charter first successfully acquires always-rumored-for-sale Cablevision, where the controlling Dolan family is rumored to be holding out for an exceptionally attractive buyout package other cable companies aren’t willing to offer. Time Warner itself has been rumored as a buyer, but current management has repeatedly stressed it will not pay a premium price for acquisition targets.

But the most obvious foreshadowing of a big deal with Time Warner would most likely come if Charter first successfully acquires always-rumored-for-sale Cablevision, where the controlling Dolan family is rumored to be holding out for an exceptionally attractive buyout package other cable companies aren’t willing to offer. Time Warner itself has been rumored as a buyer, but current management has repeatedly stressed it will not pay a premium price for acquisition targets.

Malone may not be able to help himself. His long history in the cable industry includes a voracious appetite for merger and acquisition deals. For more than two decades, Malone led Tele-Communications, Inc. (TCI). When he arrived in 1972, TCI was a rural Texas and western states cable operation with 100,000 subscribers. By 1981, through mergers and acquisitions, he built TCI into America’s largest cable operator. In 1998, AT&T bought out TCI Cable. The phone company later exited the cable business and sold most of the operation to present owner Comcast.

The level of consolidation proposed by Malone is unheard of in the United States, but is familiar in Canada where two major cable operators — Rogers and Shaw — control the majority of cable subscriptions. Third largest Vidéotron leads in Québec and Cogeco serves pockets of Ontario and Québec bypassed by Rogers and Vidéotron, respectively.

![]() “This partnership with Mediacom marks a significant milestone in the continued expansion of our dealer program,” said Comporium SMA Dealer Program general manager Dan Lehman. “We are excited that consumers in Mediacom’s markets will have the opportunity to experience the iControl OpenHome platform that has made the connected home a reality, enabling broadband service providers to offer the next generation of home management, security and connectivity to their customers.”

“This partnership with Mediacom marks a significant milestone in the continued expansion of our dealer program,” said Comporium SMA Dealer Program general manager Dan Lehman. “We are excited that consumers in Mediacom’s markets will have the opportunity to experience the iControl OpenHome platform that has made the connected home a reality, enabling broadband service providers to offer the next generation of home management, security and connectivity to their customers.”

Subscribe

Subscribe

One of America’s lowest-rated cable companies and an industry legend labeled by consumer advocates as the “Darth Vader of cable” may be joining forces to buy Time Warner Cable, according to Bloomberg News.

One of America’s lowest-rated cable companies and an industry legend labeled by consumer advocates as the “Darth Vader of cable” may be joining forces to buy Time Warner Cable, according to Bloomberg News.

But the most obvious foreshadowing of a big deal with Time Warner would most likely come if Charter first successfully acquires always-rumored-for-sale Cablevision, where the controlling Dolan family is rumored to be holding out for an exceptionally attractive buyout package other cable companies aren’t willing to offer. Time Warner itself has been rumored as a buyer, but current management has repeatedly stressed it will not pay a premium price for acquisition targets.

But the most obvious foreshadowing of a big deal with Time Warner would most likely come if Charter first successfully acquires always-rumored-for-sale Cablevision, where the controlling Dolan family is rumored to be holding out for an exceptionally attractive buyout package other cable companies aren’t willing to offer. Time Warner itself has been rumored as a buyer, but current management has repeatedly stressed it will not pay a premium price for acquisition targets.

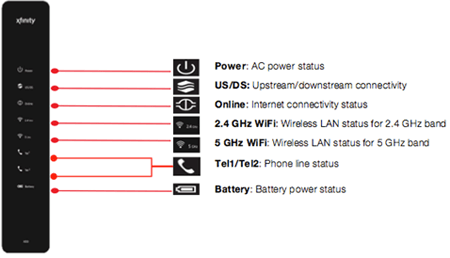

Nagel says the service was designed to address both concerns, noting a 50Mbps Blast customer will still have full access to 50Mbps service, regardless of how many wireless visitors are connected to the customer’s gateway.

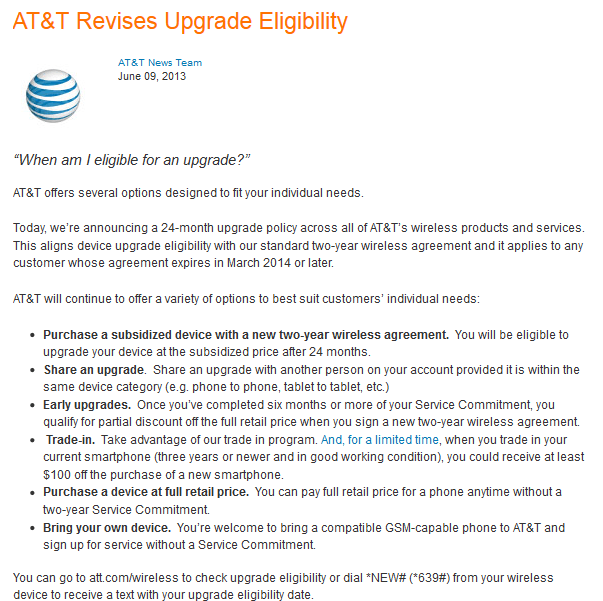

Nagel says the service was designed to address both concerns, noting a 50Mbps Blast customer will still have full access to 50Mbps service, regardless of how many wireless visitors are connected to the customer’s gateway. AT&T has once again followed Verizon Wireless’ lead by ending early upgrades for contract customers, making it impossible to upgrade a handset with a full device subsidy until 24 months have passed.

AT&T has once again followed Verizon Wireless’ lead by ending early upgrades for contract customers, making it impossible to upgrade a handset with a full device subsidy until 24 months have passed.