In Search Of… Savings

The cable industry’s week-long feeding frenzy over consolidating Time Warner Cable out of existence comes with the theory that growing larger guarantees cheaper programming costs from volume discounts and influence. But hang on, says Wall Street analyst firm Sanford C. Bernstein.

This week, senior analyst Todd Juenger released a report, “Will Cable Consolidation Slow Down Affiliate Fee Growth? We Say ‘No,’” that questions the theory the bigger the company, the more leverage available to keep costs down.

Juenger says that few customers are in love with their local cable company, and programmers know it. If another brawl erupts between CBS and a cable operator, the presumption of leverage to quickly resolve the dispute is more hope than reality because customers will readily abandon one provider for another to get what they want.

“Consumers are much more loyal to their favorite TV networks than they are to their distributor,” Juenger says. “Every time a distributor has tried to fight back by dropping the content from one of these [big programming] companies, it has ended badly for the distributor because consumers will switch distributors, not TV networks.”

Programming carriage wars will continue to hurt cable companies as long as there is a satellite or telco-TV competitor ready to sign up disgruntled customers. If a suite of Viacom-owned networks are dropped during a cable fee dispute, the cable operator will save around $2.75 a month per subscriber. But if that subscriber decides to change providers, operators lose as much as $40 in marketing costs paid to attract that subscriber in the first place.

Juenger believes the only way combining cable operators will save on programming fees is when smaller cable operators like Charter get the benefit of big discounts on programming offered to larger, high volume providers like Time Warner Cable.

Juenger adds bringing Comcast in as a buyer gets complicated because if Comcast tries to drop networks, programmers might have leverage by appealing to the federal government with claims Comcast is violating its agreement with the federal government to avoid abuse of market power to strangle competitors.

Subscribe

Subscribe It’s happy days at Comcast’s marketing and public relations department. How does a cable company pocket an extra $1.50 a month from 21.6 million cable TV customers without facing the wrath of the masses? Blame it on greedy broadcasters and quietly bank up to $32.4 million a month in new revenue.

It’s happy days at Comcast’s marketing and public relations department. How does a cable company pocket an extra $1.50 a month from 21.6 million cable TV customers without facing the wrath of the masses? Blame it on greedy broadcasters and quietly bank up to $32.4 million a month in new revenue. Comcast isn’t promising this $1.50 fee covers the total cost of licensing local stations for cable carriage, and they have no plans for similar surcharges for cable networks that have also been known to ask for a lot at contract renewal time. Customers may not realize that in some cases, the local NBC station just so happens to be owned by Comcast-NBC, offering easy opportunities to boost the asking price without too much trouble from co-workers at Comcast Cable.

Comcast isn’t promising this $1.50 fee covers the total cost of licensing local stations for cable carriage, and they have no plans for similar surcharges for cable networks that have also been known to ask for a lot at contract renewal time. Customers may not realize that in some cases, the local NBC station just so happens to be owned by Comcast-NBC, offering easy opportunities to boost the asking price without too much trouble from co-workers at Comcast Cable. Can you drop by your local supermarket and walk out with a year of free home broadband service? In the United Kingdom, Tesco shoppers can.

Can you drop by your local supermarket and walk out with a year of free home broadband service? In the United Kingdom, Tesco shoppers can.

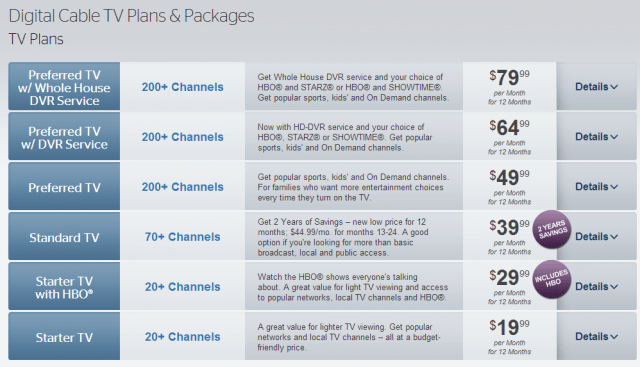

Local ABC, CBS, NBC, FOX, PBS, and CW stations;

Local ABC, CBS, NBC, FOX, PBS, and CW stations;