Windstream will bring its fiber to the neighborhood service Kinetic TV to around 50,000 homes in 13 suburban and exurban communities surrounding Charlotte, N.C., to stay competitive with Time Warner Cable/Charter and a publicly owned cable system serving Mooresville.

Windstream will bring its fiber to the neighborhood service Kinetic TV to around 50,000 homes in 13 suburban and exurban communities surrounding Charlotte, N.C., to stay competitive with Time Warner Cable/Charter and a publicly owned cable system serving Mooresville.

The independent phone company submitted a formal application for a cable television franchise with North Carolina’s Department of the Secretary of State to begin offering television service in Albemarle, Badin, China Grove, Concord, Harrisburg, Hemby Bridge, Indian Trail, Kannapolis, Matthews, Mooresville, Mt. Pleasant, New London and Oakboro.

Windstream claims Kinetic TV leverages “a 100 percent fiber-backed network,” which leaves customers with the impression they are getting fiber optic delivery of television, broadband, and phone service. In fact, for many communities Windstream is constructing a network similar to AT&T U-verse. The phone company brings fiber optic cables into each neighborhood, but relies on existing copper wire infrastructure connecting individual homes to a nearby fiber optic-connected neighborhood hub. The upgrade allows Windstream to expand broadband capacity to support concurrent use of television, phone and internet access. For many Windstream customers complaining about the poor performance of Windstream’s DSL service, that offers a significant improvement. But Windstream does provide even better upgrades in some communities. In April 2016, Windstream launched gigabit speed internet service for seven North Carolina towns: China Grove, Concord, Davidson, Harrisburg, Kannapolis, Lewisville and Matthews. By applying for a statewide video franchise agreement in North Carolina, Windstream will be able to sell cable television service along with gigabit broadband speed.

Kinetic TV is now an exceptionally good deal for new customers.

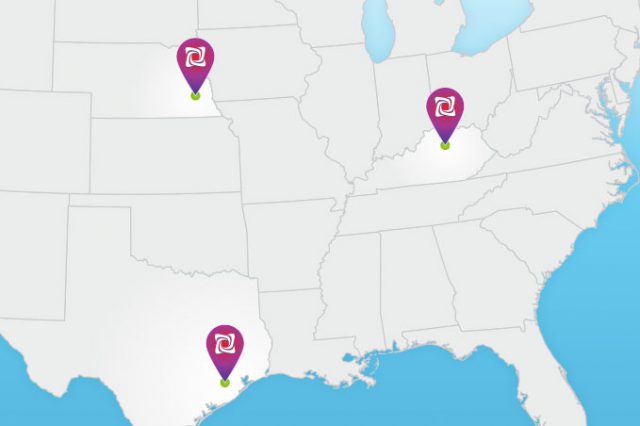

Kinetic TV is already available in Lincoln, Neb., Lexington, Ky., and Sugar Land, Tex.

Windstream aggressively prices its most deluxe double play package of 50Mbps broadband and 270+ channels and Whole House DVR service at a one-year introductory price of $89.99 a month with a one-year service commitment. Customers can upgrade to a triple play package with the same 12 month commitment that includes a phone line with unlimited long distance calling for just $2 more — $91.99 a month. New double/triple-play customers also receive a one-time bill credit of $250, which will generally cover the first two months of service. This promotion is by far the best value for money. Unfortunately, after the promotion expires your price increases by $72.99 to $162.98 a month.

Kinetic TV operates with wireless set-top boxes that can be moved to different televisions as needed. The DVR can handle recording four channels at the same time and Windstream promises no lag while channel changing. The usual $80 installation fee is waived when new customers sign up under a promotional offer. Anyone can register to be notified about Windstream’s promotional offers on the company’s website and will likely receive an invitation as Kinetic TV becomes available in your area.

Earlier this year, Windstream debuted Kinetic TV in Sugar Land, Tex., joining the communities of Lexington, Ky. and Lincoln, Neb. The 13 small cities and communities in North Carolina will be Windstream’s fourth service area for Kinetic TV.

Kinetic TV’s Whole House DVR

The service has received generally positive reviews from those not expecting to place a lot of demand on the service. The fastest internet package tops out for most at 50Mbps and some customers report their actual speeds are sometimes slightly lower. Windstream currently offers Kinetic customers unlimited, uncapped data plans. If you cancel service before the end of your contract, the penalty as stated in Windstream’s terms and conditions is among the steepest we have ever seen: 100% of the charges you would have paid had you kept the service through the rest of your contract.

There is other fine print:

- Kinetic TV cannot support more than four Standard Definition video streams (television sets in use concurrently). HD channels for recording or viewing are limited to between one and four, depending on the capacity of your connection. If you exceed it, the remaining video streams or recordings will be in Standard Definition.

- Kinetic TV will not allow pay per view or video on demand charges to exceed $200 in a calendar month.

- Prices above include one Kinetic TV receiver. Each additional box is billed at $7 a month, and may be limited in quantity. A Windstream gateway, also required for service, is assessed a separate monthly charge.

- Your internet speeds may be affected by how many televisions are concurrently in use in your home.

- Windstream collects information about programming watched, recorded, or accessed. Currently, they use this information to make general programming recommendations to all customers and/or specific recommendations to you based on your personal viewing habits.

(Windstream pricing information gathered by entering a residential street address in Sugar Land, Tex., Zip Code 77478.)

Subscribe

Subscribe California’s Public Utilities Commission (CPUC) couldn’t get cozier with AT&T if they moved regulators into the phone company’s plush executive suites.

California’s Public Utilities Commission (CPUC) couldn’t get cozier with AT&T if they moved regulators into the phone company’s plush executive suites.

There are big changes in store from Charter. First, the company will end distribution and support for Digital Transport Adapters (DTAs) — the small boxes designed for older analog-only TV sets. Charter expects you to have a traditional set-top box on every cable-equipped TV in the house. Second, it seems Whole House DVR service is being discontinued. Charter prefers the alternative of placing DVR boxes on each set where you want to record and watch TV shows. There is a significant cost for Time Warner Cable to install Whole House DVR service and it involves a technician coming to your home. Charter seems to want to cut truck roll expenses, and traditional DVR boxes are easy for customers to install themselves.

There are big changes in store from Charter. First, the company will end distribution and support for Digital Transport Adapters (DTAs) — the small boxes designed for older analog-only TV sets. Charter expects you to have a traditional set-top box on every cable-equipped TV in the house. Second, it seems Whole House DVR service is being discontinued. Charter prefers the alternative of placing DVR boxes on each set where you want to record and watch TV shows. There is a significant cost for Time Warner Cable to install Whole House DVR service and it involves a technician coming to your home. Charter seems to want to cut truck roll expenses, and traditional DVR boxes are easy for customers to install themselves.

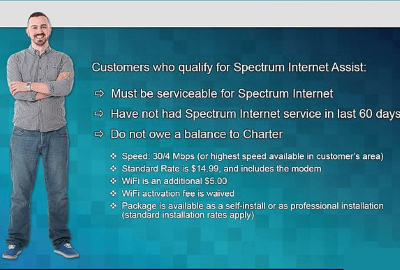

Charter’s discount plan for the income-challenged carries the usual restrictions. The most unconscionable effectively forces current Charter customers to go without internet access for 60 days before they can enroll in Spectrum Internet Assist. They also must not owe any past due balance to Charter.

Charter’s discount plan for the income-challenged carries the usual restrictions. The most unconscionable effectively forces current Charter customers to go without internet access for 60 days before they can enroll in Spectrum Internet Assist. They also must not owe any past due balance to Charter. After years of financial problems, union problems, and service problems, customers of FairPoint Communications in northern New England report the company has stabilized operations and has been gradually improving service. A hedge fund holding 7.5% of FairPoint agrees, and is now pressuring FairPoint’s board of directors to sell the company, allowing shareholders that bought FairPoint stock when it was nearly worthless to cash out at up to $23 a share.

After years of financial problems, union problems, and service problems, customers of FairPoint Communications in northern New England report the company has stabilized operations and has been gradually improving service. A hedge fund holding 7.5% of FairPoint agrees, and is now pressuring FairPoint’s board of directors to sell the company, allowing shareholders that bought FairPoint stock when it was nearly worthless to cash out at up to $23 a share. “Not as patient as FairPoint’s own customers that spent several years of hell dealing with Verizon’s sale of its landlines in Vermont, New Hampshire, and Maine,” said FairPoint customer Sally Jackman, who lives in Maine. “It looks like the hedge funds want their pound of profits from another sale, exactly what FairPoint customers don’t need right now.”

“Not as patient as FairPoint’s own customers that spent several years of hell dealing with Verizon’s sale of its landlines in Vermont, New Hampshire, and Maine,” said FairPoint customer Sally Jackman, who lives in Maine. “It looks like the hedge funds want their pound of profits from another sale, exactly what FairPoint customers don’t need right now.”

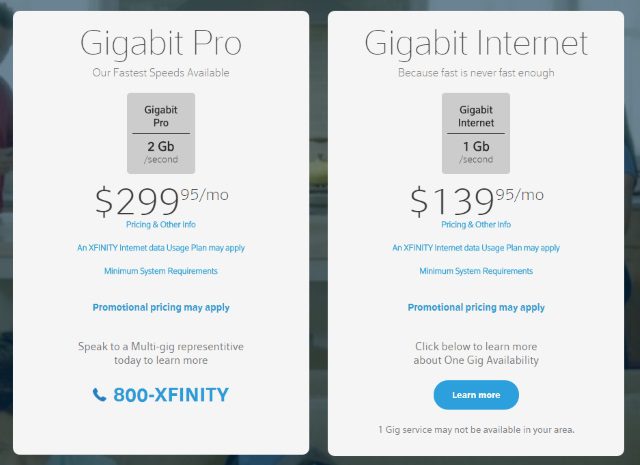

To be a Google Fiber city or not to be a Google Fiber city. It could make a big difference to your wallet if Comcast upgrades broadband speeds in your neighborhood before Google Fiber finally arrives in your “fiberhood.”

To be a Google Fiber city or not to be a Google Fiber city. It could make a big difference to your wallet if Comcast upgrades broadband speeds in your neighborhood before Google Fiber finally arrives in your “fiberhood.”