The Walt Disney Co., is warning AT&T U-verse, TV Now, and DirecTV customers that a blackout of Disney-owned ABC stations, ESPN, Freeform, and the Disney Channel is imminent because AT&T has not yet agreed on renewal terms.

The Walt Disney Co., is warning AT&T U-verse, TV Now, and DirecTV customers that a blackout of Disney-owned ABC stations, ESPN, Freeform, and the Disney Channel is imminent because AT&T has not yet agreed on renewal terms.

If an agreement is not signed before the end of the month, AT&T video customers across the country are looking at a third major programming blackout this year.

“The Disney owned networks and stations have agreements in place with all of the major video providers in DirecTV and AT&T video territories, including Comcast, Verizon FiOS, Cox, Optimum, Frontier and others, and we have a strong track record of successfully reaching multi-year agreements with these and other TV providers,” the company said in a statement. “Unfortunately, so far AT&T has refused to reach a fair, market-based agreement with us, despite the fact that the terms we are seeking are in line with recent marketplace deals we have reached with other distributors.”

The last contract renewal DirecTV signed with Disney was in late 2014. It is likely AT&T’s acquisition of DirecTV allowed the company to combine its U-verse and streaming agreements with the much larger contract with the satellite TV company, with AT&T’s combined carriage agreement likely to expire on Sept. 30, 2019.

The last contract renewal DirecTV signed with Disney was in late 2014. It is likely AT&T’s acquisition of DirecTV allowed the company to combine its U-verse and streaming agreements with the much larger contract with the satellite TV company, with AT&T’s combined carriage agreement likely to expire on Sept. 30, 2019.

AT&T has spent much of 2019 playing hardball with programmers, willing to let their contracts expire and blackout affected stations and networks. Earlier this year, customers lost access to local TV stations owned by CBS, Nexstar, and a handful of local stations under contract with Sinclair Broadcasting. Customers also lost access to the Altitude Sports and Entertainment Network, a regional sports channel, at the end of August. In some cases, it took several weeks to reach a negotiated settlement with local station owners.

It seems likely Walt Disney will find a similar level of intransigence with AT&T’s negotiating team. AT&T is already preparing its customers for a potential protracted fight and blackout.

“We’re disappointed to see The Walt Disney Co. put their viewers into the middle of negotiations. We are on the side of consumer choice and value and want to keep Disney channels and owned-and-operated local ABC stations in eight cities in our customers’ lineups,” AT&T said in a statement. “We hope to avoid any interruption to the services some of our customers care about. Our goal is always to deliver the content our customers want at a value that also makes sense to them. We’ll continue to fight for that here and appreciate their patience while we work this matter out.”

Any blackout would impact Disney-owned and operated ABC affiliates, including:

- WABC-TV 7 New York

- KABC-TV 7 Los Angeles

- WTVD-TV 11 Raleigh-Durham, N.C.

- KGO-TV 7 San Francisco

- KTRK-TV 13 Houston

- KFSN-TV 30 Fresno, Calif.

- WLS-TV 7 Chicago

- WPVI-TV 6 Philadelphia

Subscribe

Subscribe

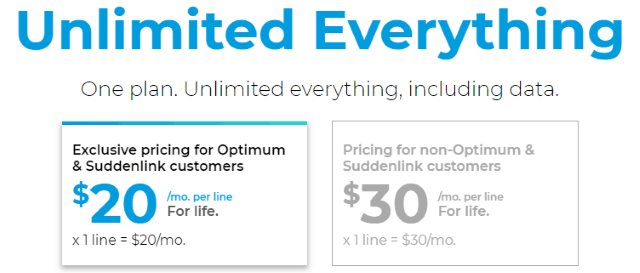

Altice

Altice

Charter Communications has set the stage for a Wall Street-pleasing boost in average revenue per user (ARPU) with a major broadband rate hike planned for this fall.

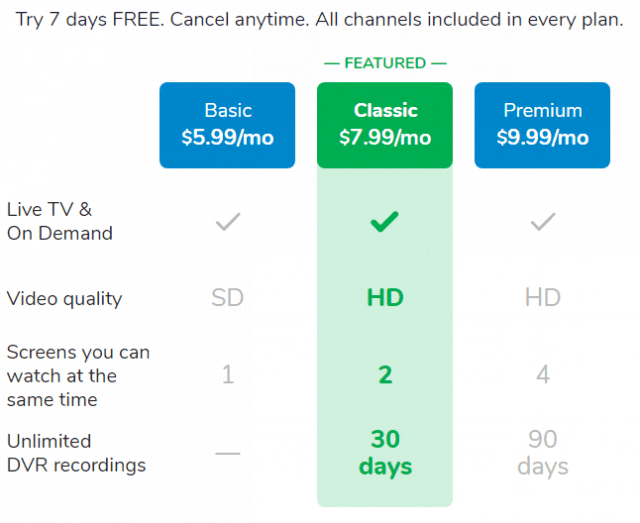

Charter Communications has set the stage for a Wall Street-pleasing boost in average revenue per user (ARPU) with a major broadband rate hike planned for this fall. Those looking for a bare bones basic streaming package of family-friendly TV channels may be happy to learn of

Those looking for a bare bones basic streaming package of family-friendly TV channels may be happy to learn of