After years of financial problems, union problems, and service problems, customers of FairPoint Communications in northern New England report the company has stabilized operations and has been gradually improving service. A hedge fund holding 7.5% of FairPoint agrees, and is now pressuring FairPoint’s board of directors to sell the company, allowing shareholders that bought FairPoint stock when it was nearly worthless to cash out at up to $23 a share.

After years of financial problems, union problems, and service problems, customers of FairPoint Communications in northern New England report the company has stabilized operations and has been gradually improving service. A hedge fund holding 7.5% of FairPoint agrees, and is now pressuring FairPoint’s board of directors to sell the company, allowing shareholders that bought FairPoint stock when it was nearly worthless to cash out at up to $23 a share.

That almost guarantees shareholders a huge profit while likely saddling whoever buys FairPoint with the same kind of sale-related debt that bankrupted FairPoint in 2009.

Maglan Capital’s David Tawil and Steven Azarbad communicated their displeasure to FairPoint CEO Paul Sunu in a letter earlier this summer that complains “shareholders have been extremely patient with the company’s operational turnaround and have suffered because the board has not been vigilant in protecting shareholder value.”

“Not as patient as FairPoint’s own customers that spent several years of hell dealing with Verizon’s sale of its landlines in Vermont, New Hampshire, and Maine,” said FairPoint customer Sally Jackman, who lives in Maine. “It looks like the hedge funds want their pound of profits from another sale, exactly what FairPoint customers don’t need right now.”

“Not as patient as FairPoint’s own customers that spent several years of hell dealing with Verizon’s sale of its landlines in Vermont, New Hampshire, and Maine,” said FairPoint customer Sally Jackman, who lives in Maine. “It looks like the hedge funds want their pound of profits from another sale, exactly what FairPoint customers don’t need right now.”

Jackman endured three weeks of outages after FairPoint took over Verizon’s deteriorating landline networks in northern New England. The nearest cable company – Time Warner Cable, is almost 50 miles away, leaving Jackman with FairPoint DSL or no broadband service at all.

“Wall Street doesn’t care, they just want the money,” Jackman added. “They probably assume Frontier will pay a premium for FairPoint and then we can go through the kind of problems customers in Texas and Florida dealt with for over a month.”

The hedge fund managers argue that FairPoint “has made enormous strides” and notes “revenue is stabilizing and growth is coming.”

Maglan is well positioned to cash out with an enormous gain, having been an investor in FairPoint since the phone company declared Chapter 11 bankruptcy almost six years ago. The fund held shares when their price dipped below $4. Now, assuming FairPoint will put shareholders first “in ways that other wireline telecom companies do,” investors like Maglan hope to see a sale at a share price of $23, a 75% premium.

“With the company’s labor challenges behind it and with it $700 million of long-term debt removed from FairPoint’s balance-sheet, the time has come for the company to be sold or to be merged into a peer,” the hedge fund managers write.

Tawil (L) and Azarbad (R)

Maglan recommends the company be sold to Communications Sales & Leasing, a tax-sheltered Real Estate Investment Trust spun off from Windstream with no current experience running a residential service provider. CS&L primarily provides commercial fiber services for corporations, institutions, and cell phone towers. Shareholders would benefit and CS&L would benefit from diversification, argues Maglan. But the hedge fund has nothing to say about the sale’s impact on FairPoint customers.

Maglan also demanded that while FairPoint explored a sale of the company, it must turn its investments away from its network and operations and start “generating value for shareholders immediately.” Maglan wants FairPoint to turn spending towards a $40 million share repurchase program (to benefit shareholders with a boost in the stock price) and initiate a recurring shareholder dividend payout. To accomplish this, FairPoint will have to designate much of its $23 million of cash on hand and a hefty part of the $52 million of free cash flow anticipated in 2016 directly to shareholders. The company may even need to tap into its revolving credit line if financial results are worse than expected.

Tawil and Azarbad characterize their plan as “well within the range of comfort.”

“It is high-time that the company and the board turn its attention directly to shareholders and, specifically, unlocking shareholder value,” the hedge fund managers add. “We have been a very patient group.”

But perhaps not as patient as they thought. This week, Maglan demanded that FairPoint remove four of its board members — Dennis Austin, Michael Mahoney, David Treadwell and Wayne Wilson, demanding they “immediately tender their resignations” and warned Maglan would push for a special meeting if no action was taken. The reason? Tawil and Azarbad said they did not think the four were “critical to the board in any way.”

“Wall Street has been about as useful as cancer for those of us trying to communicate with the outside world up here,” Jackman said. “I hope all three states get copies of these temper tantrums, because if FairPoint does sell, maybe this time they won’t approve the deal. After all, even the Titanic only sank once.”

Subscribe

Subscribe

A Los Angeles man has reached the boiling point after two years of telemarketing calls from Charter Communications that turn out to be the result of a wrong number.

A Los Angeles man has reached the boiling point after two years of telemarketing calls from Charter Communications that turn out to be the result of a wrong number. 2013: “I have never been more harassed by spam telemarketing/calling in my life than from Charter Communications and they already have my business! It’s

2013: “I have never been more harassed by spam telemarketing/calling in my life than from Charter Communications and they already have my business! It’s

Further expansion of Google Fiber

Further expansion of Google Fiber

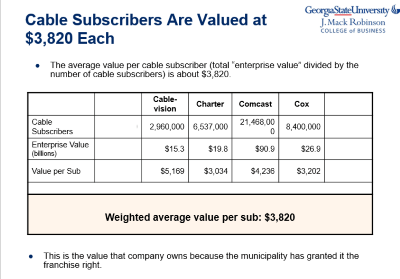

But like all publicly traded companies, Google must answer to Wall Street and their investors and some are not happy with what they see from Google Fiber. Craig Moffett from Wall Street research firm MoffettNathanson has rarely been a fan of any broadband provider other than cable operators and Google Fiber is no different.

But like all publicly traded companies, Google must answer to Wall Street and their investors and some are not happy with what they see from Google Fiber. Craig Moffett from Wall Street research firm MoffettNathanson has rarely been a fan of any broadband provider other than cable operators and Google Fiber is no different.