The city of Salisbury on Monday “soft-launched” its fiber to the home service Fibrant to the community of 27,000. Fibrant joins Wilson’s GreenLight system in giving residents a real choice between Time Warner Cable and phone companies like AT&T, Windstream and CenturyLink.

The city of Salisbury on Monday “soft-launched” its fiber to the home service Fibrant to the community of 27,000. Fibrant joins Wilson’s GreenLight system in giving residents a real choice between Time Warner Cable and phone companies like AT&T, Windstream and CenturyLink.

But the launch did not come without controversy.

The system has drawn some complaints from beta testers about set top DVR boxes that are not working as expected, video channels that are not ready for launch, a porn channel controversy, and some negative anonymous comments that suspiciously draw from the well of telecom talking points complaining about Fibrant’s business model.

Yet Fibrant’s eager group of more than 100 beta testers may quickly become the service’s first paying customers, delighted with the exceptionally faster broadband speeds finally available in the community.

Salisbury, North Carolina

Indeed, some of the biggest complaints are that Fibrant didn’t arrive sooner and the speeds are not fast enough. The city-owned service is still fighting its way to wire fiber optic cable on utility poles where its competitors have engaged in foot-dragging to move their existing cables to make room for Fibrant. The company’s waiting list for sign-ups now numbers well into the hundreds.

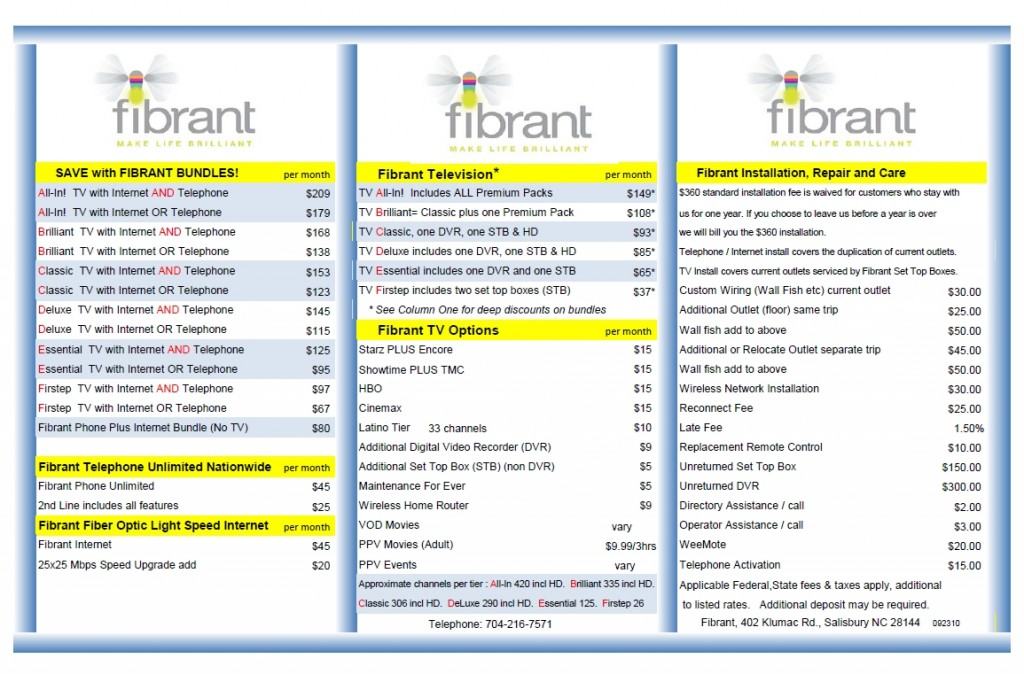

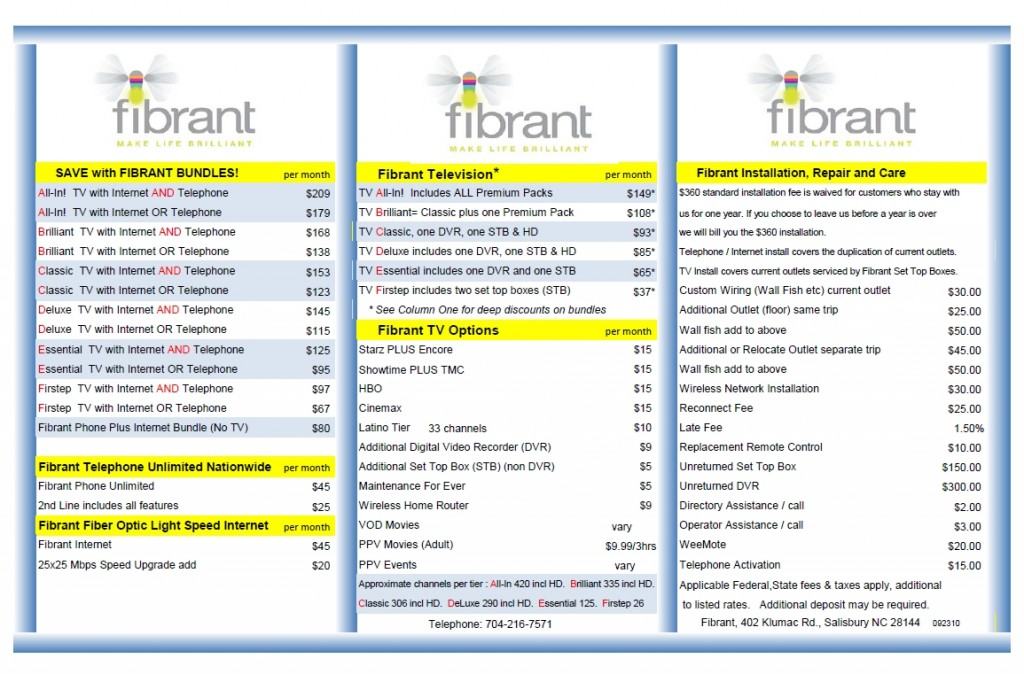

Local media has been buzzing about Fibrant’s published pricing, which undercuts Time Warner Cable’s regular prices but not its promotional deals. The cable company recently launched a national promotion marketing broadband, cable, and telephone service for $99 for the first year. That’s about $45 cheaper than a comparable “deluxe” package from Fibrant.

Fibrant marketing director Len Clark told the Salisbury Post they cannot compete with those special deals.

“We can’t afford it,” he said.

But many municipal providers have turned these promotions upside down and told their potential customers their pricing does not come with tricks, traps, or temporary discounts that expire exposing customers to much higher prices down the road.

EPB, the utility provider in Chattanooga, has been successful with everyday pricing that beats Comcast and delivers far better service — faster broadband speeds, better picture quality, and no annoying Internet Overcharging schemes.

Clark hopes Salisbury residents will take notice that their temporarily higher prices include better quality service and faster broadband.

Also important: the money earned by Fibrant stays in Salisbury and could eventually help defray city expenses.

The Post explains the differences between the cable company and Fibrant:

The $99 special includes Road Runner High Speed Online with a download speed of 7 megabits per second and upload speed of .384 Mbps. For a limited time, subscribers can upgrade for free to Road Runner Turbo, boosting their Internet speed to 10 Mbps for downloads and .512 Mbps for uploads.

Fibrant’s standard Internet speed of 15 Mbps for both downloads and uploads is twice as fast as Road Runner High Speed Online and 50 percent faster than Road Runner Turbo. Fibrant customers can go faster — 25 Mbps up and down — for an additional $20 per month.

Both Time Warner’s $99 special and Fibrant’s comparable package offer about 150 TV channels. High definition is free for Time Warner subscribers, while Fibrant customers must pay more.

Time Warner’s package does not include a digital video recorder. Fibrant’s does.

However, people who sign up for the $99 Time Warner special this month get Showtime for free, Dan Ballister, director of communications for Time Warner Cable Charlotte said. Next month, it could be a free DVR, he said.

Time Warner’s phone service offered in the $99 deal has about a dozen features, including the popular caller ID that appears on the TV screen. Fibrant’s phone service offers 17 calling features.

Some area consumers and businesses expressed concern about Fibrant’s broadband speeds topping out at just 25Mbps, which is slow in comparison to many other fiber to the home providers. They are also concerned the company did not more aggressively price services at launch.

Some area consumers and businesses expressed concern about Fibrant’s broadband speeds topping out at just 25Mbps, which is slow in comparison to many other fiber to the home providers. They are also concerned the company did not more aggressively price services at launch.

Many municipal providers have learned from the mistakes of others who have tried to engage in all-out pricing wars with large cable companies. Most cable companies can cross-subsidize rates to ridiculously low, predatory prices to win such pricing wars, making them untenable for municipal providers with bonds to pay back. But at the same time, municipal providers are in serious danger or obliterating the marketing benefits fiber brings by not showcasing fiber’s capabilities and giving customers the motivation to throw their current provider overboard. We urge Fibrant officials to consider reducing the price or increasing the speed of Fibrant’s 25Mbps service, which appears too expensive and slow priced at $65 a month. It needs to be at least $10 less a month to make it an attractive alternative to Time Warner’s inevitable future speed upgrades in the area to 10/1 standard service and 15/2 for “turbo” service, commonly found wherever fiber competes. Remember, Time Warner also markets “Speedboost” to consumers as though those temporary speeds are delivered consistently.

As EPB quickly learned, the “wow” factor can drive sign-ups, and they doubled their broadband speeds to get more bang for the buck. Fibrant needs to remember the valuable marketing lesson of driving customers towards “sweet spot” premium tier pricing customers feel they got for a steal. If 15Mbps service is $45 a month, how many would spring for 20 or 25Mbps for just $5-10 more? Time Warner learned this selling their “turbo” speed package. And most importantly of all, Fibrant risks harming their own argument fiber optics brings new businesses and jobs when their current price schedule shows speeds topping out at just 25Mbps. Admittedly those are residential service offerings, but we encourage them to deliver faster speeds, especially to businesses.

Fibrant's Price List (click to enlarge)

Fibrant even hides the names of its adult channels

The controversy about Fibrant carrying porn pay per view channels also popped up in the local media and drew complaints from conservative residents upset with their local government accommodating such programming.

Fibrant handily dealt with the controversy, noting tax dollars do not pay for Fibrant, it needs to compete with cable and satellite providers who offer such content, and Fibrant has gone beyond the competition in masking even the names of the channels to those who do not want such pay per view programming in their homes.

Time Warner Cable readily provides not only the names of the adult channels they carry, but also includes program titles that leave absolutely nothing to the imagination. And who can forget Time Warner accidentally promoted its adult content on a free on-demand children’s channel earlier this year.

Fibrant officials also said the right thing telling residents they absolutely do not want to be in the business of telling people what they can and cannot watch. It’s a personal decision, and the provider will go out of its way to make sure customers who do not want such material coming into their homes need not see a single bit of evidence it’s there.

That goes a long way to ameliorating a politically sensitive issue.

[flv width=”640″ height=”500″]http://www.phillipdampier.com/video/WBTV Charlotte Fibrant Porn Controversy 10-12-10.flv[/flv]

WBTV-TV covered the controversy of Salisbury’s Fibrant service carrying adult pay per view programming. (3 minutes)

A vocal minority of comments left on the Post‘s website have also attacked the service with a considerable amount of false information. Some are upset with a $360 installation fee that actually will only be charged to a customer leaving within the first year of service. Others invented monthly fees that don’t exist, and one actually wrote:

“The field is already crowded enough with Windstream, Time Warner, AT&T and a slew of decent wireless ops. The existing internet providers offer far better deals. Fibrant which was supposed to have high speed fiber optic, really doesn’t. Fibrant’s download speeds are not as fast as Time Warner and higher end Windstream. Fibrant doesn’t seem to want to compete pricewise or service wise–so why bother?”

Of course, Fibrant’s matched upstream and downstream speeds leave Windstream’s DSL gone with the wind. Time Warner Cable currently delivers standard speeds half that of Fibrant’s lowest speed service (and as you can see in the video below doesn’t even actually deliver that), and AT&T’s U-verse maxes out under the best conditions at real world speeds below what Fibrant can deliver. Anyone who has used wireless broadband knows speed is the first thing sacrificed. Unlimited, unthrottled wireless broadband is second. Fibrant needs some social networking to put out these kinds of BS brushfires before they become accepted memes. Stop the Cap! helped, at least for today.

Meanwhile, Time Warner Cable officials used Fibrant’s launch to, once again, draw false connections between local government funds paying for a cable system that duplicates existing services.

Back to the Post:

Time Warner is still surprised by “municipal overbuilds,” or city-owned fiber optic networks like Fibrant in Salisbury and Greenlight in Wilson, Ballister said.

“It’s just interesting that during these economic times, when city and county budgets are being cut back, that they would want to spend millions of dollars providing services that are already out there,” Ballister said.

Salisbury borrowed $33 million to launch Fibrant.

Cities have an unfair advantage in offering communication services, Ballister said.

“We’re all for competition, as long as people are on a level playing field,” he said.

Cities pay no property or income taxes. They can operate the utility at a loss and cross-subsidize from other areas of government, Ballister said.

“They can level taxes on citizens to recover their operating costs,” he said.

Fibrant is expected to operate at a loss for three years and have a positive cash flow by year four. It will take longer to make a profit, Clark said.

Eventually, Fibrant is supposed to generate revenue for the city.

Cities in the fiber optic business also can hike the fees their competitors must pay to get access to their subscribers, Ballister said.

“They are the gatekeepers to rights of way and pole attachments,” he said.

The company has no specific examples of fee hikes to hurt Time Warner, but “these are valid concerns that exist right now,” Ballister said.

It’s ironic Ballister complains about utility pole fees considering Fibrant is currently a victim of Time Warner’s slow progress making space on those poles to accommodate the city’s fiber optics. No vendetta by city officials is apparent, as they patiently wait for the cable company to handle its responsibilities.

Ballister should not be surprised the city of Salisbury did for itself what Time Warner Cable refused to do in the community. Just like in Wilson, Salisbury city officials pleaded with the cable company to deliver improved service in the community but it fell on deaf ears. Many sections of the city center cannot access reliable broadband from the cable company to this day. But most of them can now get service from Fibrant. Cable companies like Time Warner have spent millions of subscriber dollars trying to legislatively ban networks like Fibrant, fearful of the competition they can bring.

Salisbury Assistant City Manager Doug Paris notes the enormous amount of money poured into North Carolina’s state legislature trying to ban projects year after year. That Time Warner money could have made a real difference for residents and small businesses in Salisbury and other parts of North Carolina if used to improve service, not fight competition.

Kirk Knapp of Tastebuds Coffee and Tea doesn’t care what Time Warner does with the money at this point, so long as he can finally be liberated from them. He told the Post he feels “held hostage by Time Warner.”

“Time Warner has the worst customer service I have ever dealt with,” Knapp said in an e-mail to the Post.

“Fibrant may have these same kind of issues, however I can actually go to the source to deal personally with someone who is vested in the community, not spend two hours on the phone and never solve the problem as I do with TWC,” he said.

“Even if pricing is higher, I would make the change. Price is important, but quality and service is tantamount.”

[flv width=”640″ height=”500″]http://www.phillipdampier.com/video/Fibrant Intro 11-2-10.flv[/flv]

Folks from the Walser Technology Group, Inc. in Salisbury gave an informal introduction of Fibrant on its YouTube channel, including a very revealing speed test comparing broadband service from Fibrant with Time Warner Cable. (7 minutes)

Charlotte, N.C. Time Warner Cable customers can thank city officials in nearby Salisbury for finally provoking Time Warner Cable into boosting speeds for residents across the region. Just as community-owned Fibrant was opening its doors for business promoting its new fiber to the home service, the area’s dominant cable company managed to steal some of their thunder.

Charlotte, N.C. Time Warner Cable customers can thank city officials in nearby Salisbury for finally provoking Time Warner Cable into boosting speeds for residents across the region. Just as community-owned Fibrant was opening its doors for business promoting its new fiber to the home service, the area’s dominant cable company managed to steal some of their thunder.

Subscribe

Subscribe