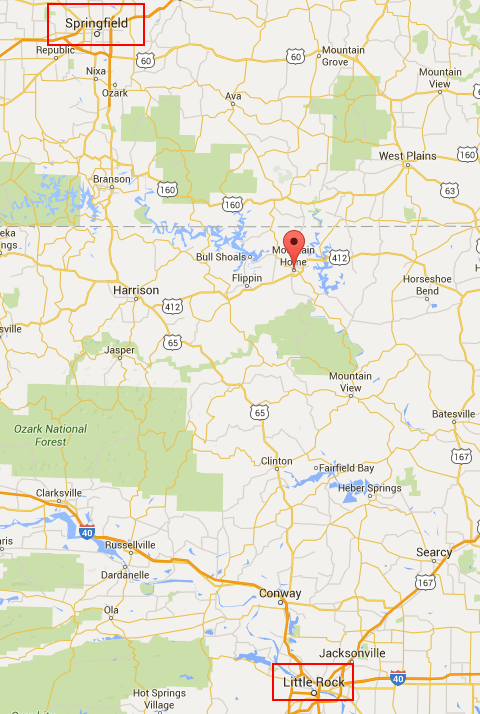

Time Warner Cable subscribers in Otsego County, N.Y. have been able to watch WBNG-TV, the CBS affiliate in Binghamton, since there has been a cable company called Time Warner Cable. But as of yesterday, that is no longer the case. In Baxter County, Ark., Suddenlink customers suddenly lost KARK (NBC) and KTHV (CBS), two stations from Little Rock, after the cable company decided it would henceforth only carry KYTV (NBC) and KOLR (CBS) instead. Part of the problem for subscribers is those two stations are located in Springfield, Missouri, a different state.

Time Warner Cable subscribers in Otsego County, N.Y. have been able to watch WBNG-TV, the CBS affiliate in Binghamton, since there has been a cable company called Time Warner Cable. But as of yesterday, that is no longer the case. In Baxter County, Ark., Suddenlink customers suddenly lost KARK (NBC) and KTHV (CBS), two stations from Little Rock, after the cable company decided it would henceforth only carry KYTV (NBC) and KOLR (CBS) instead. Part of the problem for subscribers is those two stations are located in Springfield, Missouri, a different state.

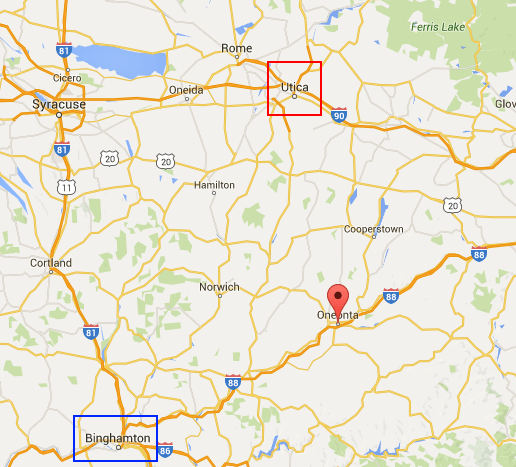

Time Warner Cable wasted no time yanking WBNG off the lineup of their Oneonta and Cooperstown cable systems. WBNG received a letter informing them of the decision on June 16. Two weeks later, the channel was replaced with WKTV from Utica, which is a secondary affiliate of CBS (WKTV has been an NBC affiliate for decades, but through the use of digital subchannels, WKTV has managed to lock down affiliations with CBS, NBC, CW, and Me-TV). Time Warner argues Otsego County is in the Utica television market, such as it is, so there is no reason to spend more to put Binghamton stations on the lineup as well.

Oneonta, N.Y. is located between Binghamton and Utica.

Another cable company with cost-cutting fever is Altice-owned Suddenlink, which stopped carrying the two Little Rock-based broadcast stations in northern Arkansas on June 7, leaving KATV (ABC) as the only central Arkansas-based news outlet on the cable provider’s Mountain Home-area system.

Another cable company with cost-cutting fever is Altice-owned Suddenlink, which stopped carrying the two Little Rock-based broadcast stations in northern Arkansas on June 7, leaving KATV (ABC) as the only central Arkansas-based news outlet on the cable provider’s Mountain Home-area system.

The decision to drop the two Little Rock channels was made at the corporate level, local employees told The Baxter Bulletin, and the Mountain Home office had no input in that decision and were not allowed to talk about it.

The mayor of Mountain Home sure is, however.

“We’ve had a lot of people calling in, coming by the office,” Mayor Joe Dillard told the newspaper. “Several have been in a couple times. I do not understand why we got two of our main channels in the state taken away.”

An authorized Suddenlink spokesperson finally admitted it was about the money.

“In recent years, local broadcast station owners have begun asking for increasingly larger amounts of money in exchange for allowing us to renew contracts to carry their stations,” said Gene Regan, senior director of corporate communications for Suddenlink. “To help keep down the costs of providing services to our customers, we have made the decision to drop out-of-market stations that duplicate network affiliations with other existing in-market stations.”

That policy has been gradually implemented in a growing number of Suddenlink-served communities, which are often exurban or rural towns located between two larger metropolitan areas. These are the areas most likely to receive multiple network affiliates from different nearby cities.

Suddenlink has standing orders from Altice to look for savings wherever possible, but none of those savings are returned to subscribers. The loss of the stations has not reduced anyone’s cable bill and Suddenlink recently moved TBS and INSP — a Christian cable network — to a more costly Expanded Basic tier. In place of the two networks dropped from the Basic package are home shopping networks that actually make Suddenlink money – Evine Live and Jewelry TV.

Suddenlink has standing orders from Altice to look for savings wherever possible, but none of those savings are returned to subscribers. The loss of the stations has not reduced anyone’s cable bill and Suddenlink recently moved TBS and INSP — a Christian cable network — to a more costly Expanded Basic tier. In place of the two networks dropped from the Basic package are home shopping networks that actually make Suddenlink money – Evine Live and Jewelry TV.

“I’m disappointed,” Anna Hudson of Bull Shoals told the newspaper. “I have friends in Little Rock, in Batesville. I like to know what’s going on in Arkansas, not in Missouri. It doesn’t help when the Legislature is in session, that will not be covered by the Springfield stations.”

Subscribe

Subscribe Premium movie channels Starz and Encore

Premium movie channels Starz and Encore

“Size-wise, they’re the Godzilla of telecommunications,” said Steve Oden, director of member services at the tiny electric co-op. “And we’re just a lowly electric co-op here in Middle Tennessee.”

“Size-wise, they’re the Godzilla of telecommunications,” said Steve Oden, director of member services at the tiny electric co-op. “And we’re just a lowly electric co-op here in Middle Tennessee.” First credit cards were tied to your credit score, then auto insurance, and now how much you pay for cable television and what kind of support you receive from customer service may also depend on your creditworthiness, at least at Cable One.

First credit cards were tied to your credit score, then auto insurance, and now how much you pay for cable television and what kind of support you receive from customer service may also depend on your creditworthiness, at least at Cable One. Cable One has even stopped direct marketing its cable service, even though it was winning nine percent of new customer sign-ups. The customers Cable One attracted were so low quality, Might claims the company didn’t make a penny from the marketing effort.

Cable One has even stopped direct marketing its cable service, even though it was winning nine percent of new customer sign-ups. The customers Cable One attracted were so low quality, Might claims the company didn’t make a penny from the marketing effort.

Despite vociferous denials to New York regulators that Altice’s unique way of cost-cutting expenses in Europe would mean the same in the United States, a Suddenlink employee in the Appalachians found herself visiting a nearby Kroger supermarket recently to pick up some “forever” postage stamps after the office’s postage meter machine stopped working.

Despite vociferous denials to New York regulators that Altice’s unique way of cost-cutting expenses in Europe would mean the same in the United States, a Suddenlink employee in the Appalachians found herself visiting a nearby Kroger supermarket recently to pick up some “forever” postage stamps after the office’s postage meter machine stopped working. When Altice took over Cablevision, employees were stunned when top executives dined in the staff canteen on their first day after the deal closed. That was never the style of former CEO James Dolan and other executives who avoided hobnobbing with anyone too far from the executive suites. Dolan himself often used a helicopter to travel back and forth from the office, occasionally with bodyguards.

When Altice took over Cablevision, employees were stunned when top executives dined in the staff canteen on their first day after the deal closed. That was never the style of former CEO James Dolan and other executives who avoided hobnobbing with anyone too far from the executive suites. Dolan himself often used a helicopter to travel back and forth from the office, occasionally with bodyguards. With a commitment to slash $900 million in expenses out of Cablevision alone during 2016, that’s a lot of discipline. Employees are echoing their French counterparts at Altice’s SFR-Numericable when they call life at Suddenlink and Cablevision “a culture of fear,” watching workers exiting each week without being replaced. Much the same happened in Europe, despite commitments not to engage in job-cutting. In both cases, Altice claims the slow but steady trickle of employee departures are “normal churn,” not layoffs.

With a commitment to slash $900 million in expenses out of Cablevision alone during 2016, that’s a lot of discipline. Employees are echoing their French counterparts at Altice’s SFR-Numericable when they call life at Suddenlink and Cablevision “a culture of fear,” watching workers exiting each week without being replaced. Much the same happened in Europe, despite commitments not to engage in job-cutting. In both cases, Altice claims the slow but steady trickle of employee departures are “normal churn,” not layoffs.