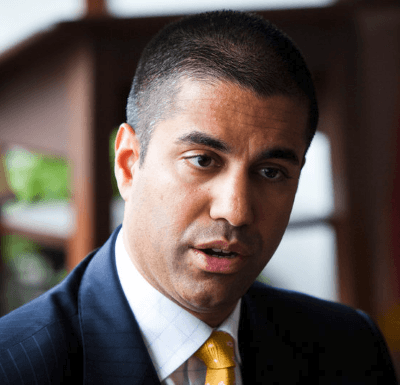

Pai

Federal Communications Commission Chairman Ajit Pai will meet with Wall Street analysts at a Wells Fargo investors conference on Thursday closed to the public and news media.

Pai is expected to focus most of his remarks on the topics of 5G wireless networks and forthcoming spectrum auctions, but will also likely praise the Trump Administration’s overall deregulatory policies and achievements Pai feels point to the regulator’s recent successes. In attendance will be top executives from T-Mobile, Verizon, AT&T, and the powerful D.C. law firm Wilkinson Barker Knauer, LLP that specializes in serving telecommunications industry clients. That firm will present a regulatory discussion entitled, “Will Washington Topple Tech and Telecom.”

A review of past investor conferences shows it is rare for a chairman of the FCC to appear at such private events, usually attended by professional analysts working for Wall Street investment firms and top executives from the businesses analysts cover for their investor clients. The propriety of public officials attending closed door events with the industries they regulate is controversial, particularly because topics discussed during informal meetings are not always disclosed to the public through “ex parte” notices filed with the Commission. But Pai has proven to be an industry-friendly chairman and formerly served as counsel for Verizon Communications.

A transcript of Pai’s formal remarks at the event will be published on the FCC’s website within a few days of his speech, and it likely Pai will speak on issues already a part of the agency’s public record. Normally the opportunity to strengthen personal ties between regulators like Pai and the regulated and a chance to meet Pai to exchange views is worth gold to many investors, but this specific event will be conducted entirely “virtually” online.

Defenders claim such meetings allow the FCC to become better informed about Wall Street investor concerns not discussed by corporate executives worried about any negative impact on their stock price. They also contend there is no opportunity for Pai to engage in “ex parte” discussions because the event is entirely webcast online. But critics note regulators that appear at such industry events rarely attend Question and Answer events open to the public. Critics view that as further evidence of the kinds of cozy D.C. relationships between the government and special interests many ‘good government’ groups decry as a conflict of interest.

Subscribe

Subscribe Despite repeatedly promising the public and regulators that a merger of T-Mobile and Sprint would create thousands of new jobs, this week hundreds of Sprint employees are learning their old jobs are gone.

Despite repeatedly promising the public and regulators that a merger of T-Mobile and Sprint would create thousands of new jobs, this week hundreds of Sprint employees are learning their old jobs are gone. Cricket Wireless and AT&T

Cricket Wireless and AT&T

(Reuters) – The Federal Communications Commission (FCC) will probe an extensive T-Mobile network outage that impacted customers across the United States, the head of the U.S. telecommunications regulatory agency said on Monday.

(Reuters) – The Federal Communications Commission (FCC) will probe an extensive T-Mobile network outage that impacted customers across the United States, the head of the U.S. telecommunications regulatory agency said on Monday.

Residents of Hawaii, New Mexico, North and South Dakota, Ohio, Texas and Wisconsin will get a slight reprieve on their internet bill starting July 1, as taxes on internet access will end in the few remaining states that have been taxing service since 1998.

Residents of Hawaii, New Mexico, North and South Dakota, Ohio, Texas and Wisconsin will get a slight reprieve on their internet bill starting July 1, as taxes on internet access will end in the few remaining states that have been taxing service since 1998.