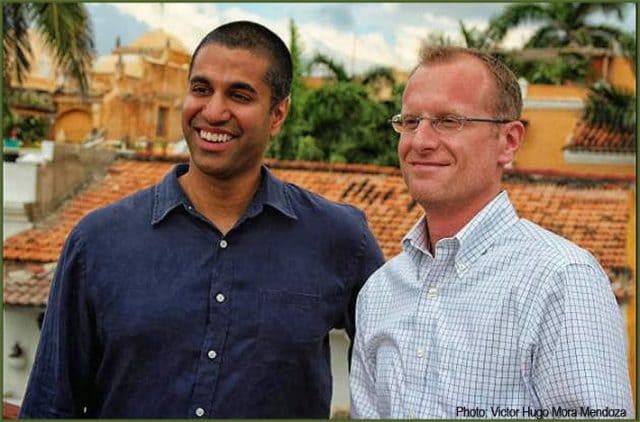

FCC Chairman Ajit Pai (left) with FCC general counsel and Republican FCC nominee Brendan Carr (right). (Image: Victor Hugo Mora Mendoza)

Federal Communications Commission Republican nominee Brendan Carr forgot to mention in sworn testimony before the U.S. Senate that his work at a D.C. law firm included representing AT&T, Verizon, and the wireless industry’s top lobbying trade association.

Carr, who today works as general counsel to the FCC under current chairman Ajit Pai, was nominated by Pai to serve as the third Republican FCC commissioner.

“Brendan’s expertise on wireless policy and public safety will be a tremendous asset to the Commission,” Pai said in a statement.

Mignon Clyburn is currently the sole Democratic Party commissioner, likely to be rejoined eventually by Democrat Jessica Rosenworcel if her re-nomination to the FCC is approved by the Senate.

At a confirmation hearing, Carr testified he “accepted a job at a law firm where [he] could gain broad experience working on various telecommunications issues” before taking a clerkship which “helped spark [his] interest in public service,” according to BroadbandBreakfast. What Carr did not mention is that work took place at D.C. powerhouse law firm Wiley Rein, where Carr represented the interests of AT&T, Verizon Communications (also a former client of Chairman Pai), and the industry-funded U.S. Telecom and CTIA trade associations which represent phone and wireless companies respectively.

The revelation isn’t expected to create a problem for Carr’s confirmation among Republicans, and Democrats don’t seem likely to create any obstacles for Carr either, perhaps because of a largess of campaign contributions from some of the same cable and phone companies that are likely to share Carr’s positions on issues expected to come before the Commission. Carr is widely expected to support Chairman Pai’s efforts to kill Net Neutrality policies at the FCC.

Senate Commerce Committee Ranking Member Bill Nelson (D-Fla) told BroadbandBreakfast the issue won’t cause any delay in his upcoming confirmation vote. Nelson’s third largest contributor over the last five years was Comcast, which contributed close to $70,000 last year to Nelson’s campaign with a panoply of Comcast lobbyists and their families also donating significant sums. Verizon was Nelson’s 16th largest contributor with more than $37,000 in donations to his campaign last year and many thousands more from Verizon’s lobbyists.

Subscribe

Subscribe