After the inspector general of the Federal Communications Commission opened an investigation into FCC Chairman Ajit Pai’s close relationship with executives at Sinclair Broadcasting, Pai stopped returning Sinclair’s phone calls and refused any further meetings with America’s largest local TV station owner, at least until last Tuesday when Pai called Sinclair’s general counsel to say its multi-billion dollar merger with Tribune Media was in trouble.

After the inspector general of the Federal Communications Commission opened an investigation into FCC Chairman Ajit Pai’s close relationship with executives at Sinclair Broadcasting, Pai stopped returning Sinclair’s phone calls and refused any further meetings with America’s largest local TV station owner, at least until last Tuesday when Pai called Sinclair’s general counsel to say its multi-billion dollar merger with Tribune Media was in trouble.

The revelation Pai effectively froze out Sinclair while under investigation came in an ex parte communication disclosed by FCC Commissioner Jessica Rosenworcel’s office late last week.

“I realize that you appear to have been unwilling to discuss this matter for the past several months (and for that reason our counsel and Tribune’s have been reaching out everyone at the FCC but you),” Sinclair general counsel Barry Faber wrote in an email to Ajit Pai the morning after the phone call.

Based on the email, it is clear Mr. Pai personally called Mr. Faber on Tuesday evening to report the FCC planned to refer Sinclair’s buyout of multiple Tribune Media TV stations, including WGN in Chicago, to an independent administrative law judge who would pursue a hearing — a procedure that usually signals the death of a proposed merger or acquisition. The courtesy call was one last consideration to Sinclair by Mr. Pai, giving executives an early warning that would allow them to quietly withdraw the deal as a face-saving measure before the FCC publicly pulled the rug out the next day. The call came as an apparent shock to executives at Sinclair and Tribune, who had repeatedly expressed confidence the transaction would meet approval from the Republican majority at the FCC — one led by Pai, who personally proposed several rule changes that made the Sinclair transaction possible.

Faber told Pai in response the two companies could not agree to withdraw the deal “in the brief period of time provided to us.” Instead, Faber begged Pai to give the companies more time to reassure the FCC and then offered to withdraw the controversial sweetheart sales of TV stations in Chicago, Dallas, and Houston a short time later. The buyers all had long-standing, close ties to the family that founded Sinclair and were suspected of buying the stations to become Sinclair’s silent partners. Pai refused Faber’s request and went public the next morning with the proposal to refer the matter to an administrative hearing. As of today, the deal is still headed for a hearing, but few expect it will survive long enough to begin the process. But the repercussions are likely to last far longer than that.

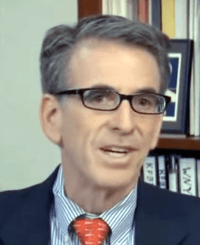

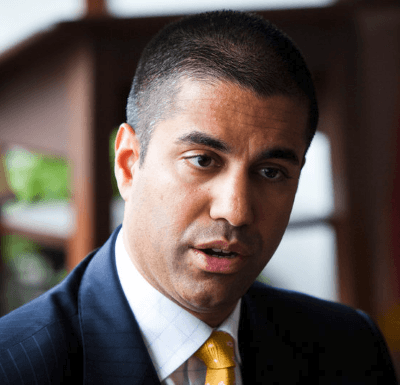

Faber

While talking to Faber, it is clear Pai also raised the issue of Sinclair’s possible deception in its merger application and its lack of candor about its plan to divest stations in those three cities.

“I understand that if Sinclair has not been completely truthful and forthcoming with regard to these proposed sales, abandoning them would not eliminate such unacceptable behavior. I point out, however, that as we discussed yesterday no evidence exists that Sinclair has mislead the FCC or been anything other than completely candid with respect to our relationships with the proposed buyers and the terms of the transaction,” Faber wrote. “To designate our transaction for hearing based on the possibility that there may be more to the deals than meets the eyes based on the pricing and other terms that have been disclosed, would be extraordinary and unprecedented.”

Deal critics claim Sinclair’s bold effort to barely disguise the sweetheart deals with well-known business associates of Sinclair’s chairman David Smith was extraordinary and unprecedented as well. Several Wall Street and K Street analysts have expressed concern Sinclair was being exceptionally brazen with the FCC, proposing to spin-off stations to known Sinclair associates at fire sale prices, with contract clauses allowing Sinclair to program the stations ‘for the owner’ and also have the right to buy the stations back at their original fire sale price, assuming deregulation of station ownership caps continued moving forward. Sinclair is no stranger to political controversy, generating a full-scale advertiser boycott and Wall Street blowback over mandatory political programming aired on its stations during the 2004 U.S. presidential election. Recently Sinclair’s mandatory editorials and news stories have received even more scrutiny in the media, and have generated a lot of negative press for the Baltimore-based TV station owner.

Pai

Some on Wall Street are reportedly growing tired of Sinclair management’s political agendas getting in the way of potential profits, and this latest high-profile incident is likely to further strengthen that perception. Pai’s announcement that the merger deal smacked of a “lack of candor” and “misrepresentation,” raise questions about the Sinclair’s honesty and character, something that could threaten its ability to keep or renew its stations’ licenses. Long standing FCC rules state a license can be revoked if an owner lies to the Commission or engages in unethical or criminal behavior.

The FCC rarely forgets about egregious bad conduct. In the 1960s, RKO General, a division of General Tire and Rubber Company, falsely testified to the FCC that its television stations, including KHJ Los Angeles, WNAC Boston, and WOR New York did not engage in “reciprocal trade practices” — forcing General Tire’s vendors to buy advertising time on RKO stations if they wanted their contracts with the tire company renewed. In 1969, the FCC had enough evidence to prove RKO officials had lied to the Commission and were brazenly violating FCC rules. In 1975, RKO was once again hauled before the FCC and questioned about allegations General Tire was bribing foreign officials, had a secret slush fund to finance campaign contributions, and misappropriated revenue from overseas operations to cook its books.

Five years later in 1980, the FCC stunned the broadcasting industry by canceling the license of RKO’s Boston station — WNAC, declaring RKO “lacked the requisite character” to hold a FCC license because it openly deceived the FCC by withholding evidence, covered up improper dealings, and maintained a “persistent lack of candor” about its business practices and behavior. The FCC also moved to cancel licenses for KHJ in Los Angeles and WOR in New York. RKO held on for a few more years by appealing the FCC’s decision in various courts. It eventually sold most of its TV stations by the mid-1980s. But by then, FCC administrative law judge Ed Kuhlmann documented even more corruption by RKO, calling the company’s conduct the worst case of dishonesty in FCC history. RKO systematically misled advertisers about station ratings, fraudulently billed clients, destroyed audit reports demanded by the FCC, and filed several false financial statements with the FCC. Kuhlmann wanted RKO out of the broadcasting business for good, ordering RKO to surrender licenses for the two remaining TV stations it still owned in 1987, as well as 12 radio stations.

Sinclair’s critics are likely to invoke RKO General in challenging Sinclair license renewals in the future, noting a similar lack of candor and misrepresentation.

With the Sinclair-Tribune merger deal now swirling in the bowl, shareholders may be the ultimate judge, jury, and executioner, at least at Tribune Media. Sports Fan Coalition and Public Knowledge took the opportunity to remind Tribune’s board of directors it just blew a $3.9 billion deal by allowing Sinclair to manage the transaction with apparent dishonesty and chutzpah:

The FCC has unanimously determined that Sinclair may have “engaged in misrepresentation and/or lack of candor in its applications with the Commission,” in possible violation of the Communications Act and FCC rules. Thus, because Sinclair failed to satisfy its commitments under the merger agreement, Tribune can and should invoke its termination right under the merger agreement. Such termination would not trigger the liquidated damages provisions of the merger agreement.

[…] “Either take immediate action to terminate your agreements for the sale of your company to Sinclair Broadcast Group, or resign as directors of Tribune Media.”

Subscribe

Subscribe

I agree this should never have gone through. That is too much power in one broadcasters hands. But yes theres a but, The only reason Pai is doing this is to try to save his ass cause he’s knows he is under investigation. Soon all of this will be proved and hopefully Pai will have to spend some time in jail for all of his wrongdoing and kissing ass to the ISP,phone,cable and soon broadcasters. Hopefully him and his menter Trump can be in the same cell and then both their sex lives could be great,Butt Buddies from then on.… Read more »