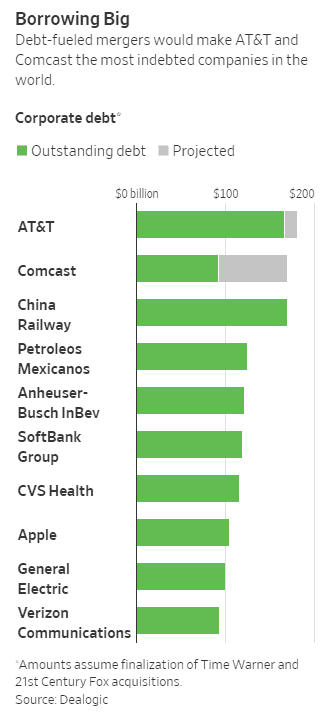

If Comcast’s $65 billion all-cash offer for 21st Century Fox is accepted, America’s largest cable operator will also be among the world’s largest corporate debtors, owing $170 billion in all.

If Comcast’s $65 billion all-cash offer for 21st Century Fox is accepted, America’s largest cable operator will also be among the world’s largest corporate debtors, owing $170 billion in all.

Comcast will borrow as much as $85 billion to cover the acquisition of Fox, plus an additional $27.5 billion to cover the buyout of the United Kingdom’s satellite operator Sky.

Excluding banks, Comcast will be the world’s second most-buried-in-debt corporation, outdone only by AT&T, according to Moody’s.

Comcast’s all-cash offer to snatch Fox away from its corporate arch-enemy Disney, also bidding for Fox, is remarkable for a company with only $6 billion of cash on hand. Comcast will have to borrow most of the money for the buyout, in addition to covering Fox’s existing $20 billion in debt. The result will be a 1980s style leveraged buyout that is likely to result in a significant downgrade of Comcast’s credit rating. Moody’s has already warned the company of exactly that.

Some Wall Street analysts see the transaction as particularly unusual for Comcast, a company that has avoided massive debt. Some suspect the generous cash offer for Fox is being driven by personal animosity between Comcast CEO Brian Roberts and Disney CEO Robert Iger, originating more than a decade earlier when Comcast attempted a hostile takeover of Disney, and failed.

Many investors are clearly worried about the growing debt levels of several large telecommunications companies, which remind some of two spectacular corporate failures at the end of the dot.com boom, when MCI-Worldcom and Global Crossing were both brought down by accounting scandals and bankruptcy in an effort to hide their debts.

There are fears that a decade of unprecedented low-interest rates, business-friendly regulatory policies, and a stabilized economy have allowed companies to grow complacent about the risks of debts from blockbuster mergers that are now bigger and more expensive than ever. Companies may be overconfident that their huge, debt-financed deals can be managed with low interest loans and frequent refinancing and bond sales to until debts can be paid down. But some analysts warn that if there is a downturn in the economy, easy credit will be hard to get, and interest rates will be significantly higher. Because highly leveraged companies are bigger credit risks, bondholders will likely demand a better deal for themselves.

The Wall Street Journal reports global corporate debt (excluding financial institutions) now stands at $11 trillion, and those companies are now 30% more leveraged than they were just before the start of the financial crisis of 2007. Wall Street expects several additional merger deals in the telecommunications and media sectors this year, which will likely raise debt levels even higher.

The unprecedented level of debt has not escaped the notice of the Federal Reserve. Asked whether the United States is in a “credit bubble,” Fed chief Jerome Powell said last week that officials are “watching” elevated levels of corporate leverage.

AT&T and Comcast officials told the Journal any fears are unwarranted; they are different from most companies because their respective debts are expected to be repaid quickly with higher levels of cash generated by their businesses. AT&T claims it could apply the $8-10 billion of its anticipated free cash flow from the merger with Time Warner to reduce debts, although that could threaten shareholder perks like dividend payouts and share buybacks, as well as customer-focused network upgrades.

AT&T and Comcast officials told the Journal any fears are unwarranted; they are different from most companies because their respective debts are expected to be repaid quickly with higher levels of cash generated by their businesses. AT&T claims it could apply the $8-10 billion of its anticipated free cash flow from the merger with Time Warner to reduce debts, although that could threaten shareholder perks like dividend payouts and share buybacks, as well as customer-focused network upgrades.

Investors that used to treat AT&T and Comcast stock as a safe haven are not anymore.

“We are getting a lot of calls,” Allyn Arden, a telecom and cable analyst at S&P Global Ratings, told the Journal after both S&P and Moody’s cut their respective ratings on AT&T bonds last week to a level just two notches above the junk-debt category.

AT&T CEO Randall Stephenson downplayed the concerns of Wall Street over the additional debt.

“This thing delivers quickly,” he told CNBC. “Within four years, we’ll be back to our normal levels of debt.”

Where will AT&T and Comcast get the money to pay down their debts? Captive customers could be one source. Both AT&T and Comcast are planning to continue raising rates, particularly on internet customers, providing a lucrative shot of extra revenue. By gaining control of deep content libraries, both Comcast and AT&T will be able to hike licensing fees on that content as well.

Subscribe

Subscribe

I can believe in AT&T’s plan, but not Comcast. For better or worse, AT&T is going “all in” on video and is unlike other major providers in that it has a national footprint for TV with DirectTV and WatchTV not to mention FTTx, wireless, etc. AT&T can therefore offer exclusive content in a way that Comcast can’t. For instance, years ago Time Warner spent too much for the broadcast rights to the Los Angeles Dodgers. Other cable companies could not afford to pay for this mistake so it turned out that if you could watch the Dodgers or not depended… Read more »