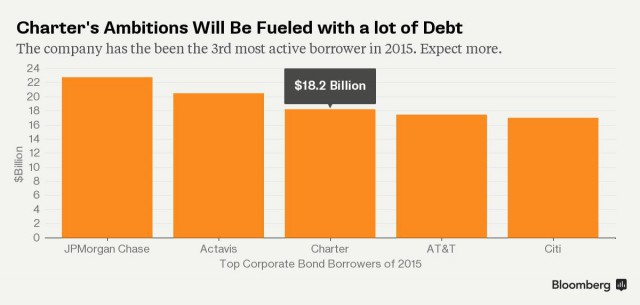

Charter will be among America’s top junk bond issuers. (Image: Bloomberg News)

The attempted $55 billion acquisition of Time Warner Cable will saddle buyer Charter Communications with so much debt, it will make the cable operator one of the nation’s largest junk bond borrowers.

Bloomberg News reports investors are concerned about the size and scope of the financing packages Charter is working on to acquire the much-larger Time Warner Cable. Total debt financing this year has already reached $18.2 billion and one of Charter’s holding companies is signaling plans to add another $10.5 billion in unsecured debt. Bloomberg reports the total value of Charter’s combined debt from existing operations and its acquisition of Time Warner Cable and Bright House Networks may reach as high as $66 billion.

Ironically, Time Warner Cable CEO Robert Marcus used Charter’s penchant for heavily debt-financed acquisitions as one of the reasons he opposed Charter’s first attempted takeover of Time Warner in January 2014.

The New York Times suggested Marcus seemed to be looking out for shareholders when he called the offer “grossly inadequate” and demanded more cash and special protections, known as “collars,” to protect stockholders against any swings in the value of Charter stock used to cover part of the deal.

The Marcus-led opposition campaign against Charter gave Comcast just the time it needed to mount a competing bid — all in Comcast stock, then worth around $159 a share. Comcast also offered Marcus an $80 million golden parachute if the deal succeeded.

The Marcus-led opposition campaign against Charter gave Comcast just the time it needed to mount a competing bid — all in Comcast stock, then worth around $159 a share. Comcast also offered Marcus an $80 million golden parachute if the deal succeeded.

Marcus’ concerns for shareholders suddenly seemed less robust. Gone was any demand for cash to go with an all-stock deal — Comcast stock was good enough for him. Most blockbuster mergers of this size and complexity also contain provisions for a breakup fee payable by the buyer if a deal falls apart. Marcus never asked for one, a decision the newspaper called “foolish,” considering regulators eventually killed the deal, leaving Time Warner Cable with nothing except bills from their lobbyists and lawyers.

After the Comcast deal failed to impress regulators, Charter returned to bid for Time Warner Cable once again. This time, Charter offered nearly $196 a share — nine times earnings before interest, taxes, depreciation, and amortization. (They offered about seven times earnings in 2014.) Marcus will now get the $100 a share in cash he wanted from Charter the first time, but shareholders are realizing that cash will be a lower proportion of the overall higher amount of the second offer.

Marcus has also said little about the enormous amount of borrowing Charter will undertake to seal its deal with Time Warner Cable. Nor has he said much about a revisited and newly revised golden parachute package offered to him by Charter, expected to be worth north of $100 million.

Marcus

But others did notice Charter raised $15.5 billion selling bonds on July 9, many winning the lowest possible investment grade rating from independent ratings services. Standard & Poor’s and Fitch Ratings bottom-rated part of Charter’s debt offering and Moody’s classified that portion as Ba1 — junk grade.

Charter traveled down a similar road six years ago, overwhelmed with more than $21 billion in debt to cover its aggressive acquisitions. Charter declared bankruptcy in 2009. The cable company has survived this time, so far, because of the Federal Reserve’s low-interest rates and very low corporate borrowing costs.

“Charter is walking on a razor’s edge,” warned Chris Ucko, a New York-based analyst at CreditSights.

Not so fast, responds Charter.

“The combined company will” reduce debt quickly, Francois Claude, a spokesman for Stamford, Conn.-based Charter said in a statement to Bloomberg News.

One likely source of funds to help pay down that debt will come from customers as the company seeks to drive higher-cost products and services into subscriber homes. Some of that revenue may come from selling higher speed broadband, a service customers are unlikely to cancel and may find difficult to get from telephone companies that have not kept up with the speed race. If cord cutting continues, and online video competition increases, that could result in customers dropping cable television packages at a growing rate, negatively impacting Charter’s revenue.

Time Warner Cable’s bondholders are already counting their losses. Their “investment grade” securities have already lost 9.3 percent of their value this year, compared with 0.58% losses in the broader high-grade debt market, according to Bank of America/Merrill Lynch. If increased competition does arrive or the FCC continues its pro-consumer advocacy policies, there is a big risk Charter’s revenue expectations may never materialize.

Subscribe

Subscribe

This smells of a backdoor method for Comcast to be in control of almost all cable service in the US.

What I see may happen is, Charter buys Time Warner, they can’t afford their extremely high debt and files bankruptcy. Comcast flys in and buys Charter for pennies on the dollar.

Who is stupid enough to buy debt from Charter 11 (haha, see that’s a pun on Chapter 11 bankruptcy)? Wouldn’t a smarter move be just to buy Charter outright and then claim all the supposed earnings from Charter’s latest hare-brained scheme? Yes, it would, so it leads back to the question: who is stupid enough to buy the debt? Discover the answer, and you will uncover the frightening truth about how our economy is no more free-market than China’s. Hell, it’s probably less so. Sigh, the timer has fewer and fewer ticks left.