Without dramatic changes in wireless pricing and more careful usage, owning a smartphone will cost an average of $119 a month per phone by the year 2019.

Without dramatic changes in wireless pricing and more careful usage, owning a smartphone will cost an average of $119 a month per phone by the year 2019.

Ever since the largest players in the wireless industry decided to monetize wireless data usage by ending unlimited use data plans, the average monthly phone bills of smartphone users have been on the increase. In 2013, the average cell phone bill was $76 a month, according to Bureau of Labor statistics. That’s up 50% from the $51 a month customers paid in 2007, the first year the iconic Apple iPhone was offered for sale.

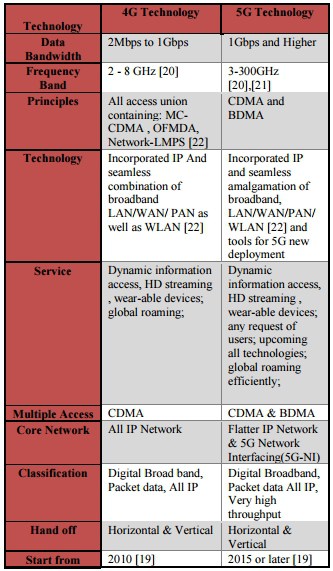

Although wireless companies claim their current 4G (largely LTE) networks are robust enough to sustain the growing demand for wireless data until more spectrum becomes available, the transition to next generation 5G technology will dramatically increase the efficiency of wireless data transmission, delivering up to 40 times the speed of existing 4G networks. But if providers are not willing to slash prices on 5G data plans, average usage and customers’ phone bills are likely to soar to new all-time highs, costing a family of four smartphone owners an average of $476 a month.

A study by Wafa Elmannai and Khaled Elleithy at the Department of Computer Science and Engineering at the University of Bridgeport found wireless carriers have given up on monetizing voice and texting services, including unlimited minutes and text messages as part of most basic service plans. The real money is made from wireless data plans which traditionally cost customers between $10.79-16.72 per gigabyte, depending on the carrier and whatever fees, surcharges and required add-ons are necessary to get the service.

Wireless carriers defend their pricing, claiming they have cut prices on certain data plans while granting some customers extra gigabytes of usage at no extra cost. Some evidence shows that carriers have indeed reduced the asking price of delivering a megabyte of data by 50 percent annually. But their costs to deliver that data have dropped even faster, particularly as networks shift traffic away from older 3G networks to 4G technology, which is vastly more efficient than its predecessor.

Wireless carriers defend their pricing, claiming they have cut prices on certain data plans while granting some customers extra gigabytes of usage at no extra cost. Some evidence shows that carriers have indeed reduced the asking price of delivering a megabyte of data by 50 percent annually. But their costs to deliver that data have dropped even faster, particularly as networks shift traffic away from older 3G networks to 4G technology, which is vastly more efficient than its predecessor.

The end of unlimited data plans by AT&T and Verizon Wireless was key to shifting the industry towards monetizing data usage. The more a customer consumes, the more revenue a carrier earns. But as web pages and applications become more complex and bandwidth intensive, customers will naturally consume more and more data each month, forcing regular usage plan upgrades to avoid confronting overlimit fees. Unless providers pass along more of their savings on traffic costs to consumers, bills will rise.

At current usage estimates from Cisco, the average customer will consume at least 57% more wireless data by 2019 than they do today. To sustain that usage, wireless providers are bidding for additional spectrum rights and are working towards upgrading to next generation 5G technology. But some carriers, including AT&T and Verizon, are also investing in new applications for their networks that include in-car telematics, home security and automation, and online video. Using some of these technologies guarantees an even greater amount of data usage, particularly for online video. Unless customers are careful about their usage and avoid high-bandwidth applications, they are in for a much bigger bill in the future, much to the delight of wireless providers.

While most analysts expect wireless companies will choose to give customers a larger data allowance instead of resorting to fire sale pricing, Elmannai and Elleithy expect that will not be enough to keep cell phone bills stable.

“We will need to reduce the bit rate to (1/1000th) of today’s level in order to receive x1000 of data capacity [at the] same cost [we see today],” the authors conclude. That would mean a low end 1GB data plan on a 4G network would cost just $0.03. Larger allowance plans would cost less than one cent per gigabyte.

The authors of the study expect carriers to price 5G data plans more or less the same as 4G plans, but will probably boost usage allowances to deliver a perception of greater value. But as web applications continue to gravitate towards higher data usage, bills will continue to rise, assuring providers of growing returns even with modest to moderate levels of competition.

At the moment, despite some evidence of price competition, some carriers are still raising prices. Verizon increased the price of its 10GB plan by $20 to $100 a month and T-Mobile raised the price of its unlimited data plan by $10 a month last year.

Subscribe

Subscribe

Carriers have no interest in 5G, in the sense of 1000x more bandwidth. The business model of telecoms is to charge a constant price while advances in technology lower their costs dramatically. From time to time, this breaks down, as it did around 2000 with the fiber glut and mass broadband, but usually they hold the line. To get telecoms to provide 1000x more bandwidth they are going to want to get paid 1000x as much but there isn’t much more in the economy. They might be satisfied with 10x or 100x but really 4G as it is the “best… Read more »