The prevalence of unlimited wireless data plans may have been an important factor in the American consumer’s move away from Research in Motion’s (RIM) former superstar BlackBerry, according to a company official.

Responding to questions about its falling market share in the U.S., Patrick Spence, the managing director of regional marketing at RIM pointed to unlimited usage plans as one potential way the competition got a leg up on their devices.

“In the United States, they’ve had flat rate data pricing for a long time, which has meant users haven’t had to worry about how they are using their smartphones,” Spence said.

He noted Americans love for wireless data has forced carriers to launch 4G upgrades in advance of other markets where 3G remains the fastest available standard.

The Guardian’s Charles Arthur gave RIM’s Patrick Spence a challenging series of questions about RIM’s ongoing loss of market share, and why the company is forcing BlackBerry owners to cope through two major platform upgrades in the coming months. (11 minutes)

You must remain on this page to hear the clip, or you can download the clip and listen later.

Spence said the dynamics of unlimited data have inspired a change in the types of devices used in the United States, namely not necessarily those carrying the BlackBerry brand.

As carriers end unlimited data, Spence predicts users will likely change their behavior in concert with new data plan limits as low as 200MB per month.

Where data limits prevail, BlackBerry devices seem to do better. Spence touted the fact BlackBerry phones have now achieved number one status in Africa and countries in the Middle East like Saudi Arabia, displacing troubled Nokia.

Spence warned tech reporters not to extrapolate American marketplace trends as foreshadowing developments in the rest of the world. One reason for that, according to Spence, has been the unlimited data plan, now being replaced with usage based billing or usage-capped plans.

BlackBerry phones have had a difficult time competing with the iconic Apple iPhone, as well as Android-based smartphones on offer from virtually every wireless carrier. BlackBerry devices, once deemed the most advanced phones in the market, have lost quite a bit of luster in the last four years, particularly after the arrival of iPhone.

BlackBerry phones have had a difficult time competing with the iconic Apple iPhone, as well as Android-based smartphones on offer from virtually every wireless carrier. BlackBerry devices, once deemed the most advanced phones in the market, have lost quite a bit of luster in the last four years, particularly after the arrival of iPhone.

As a result, RIM has been engaged in serious cost-cutting, announcing job cuts of some 2,000 employees recently. The company hopes to spring back with a series of platform upgrades and new phones, dubbed “superphones” by RIM, to regain market share.

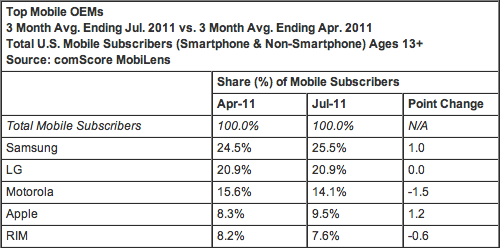

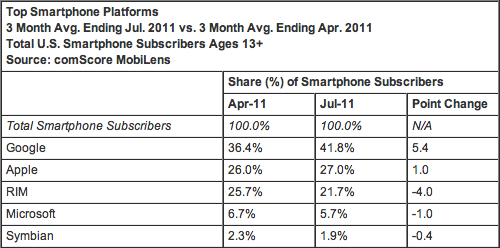

It cannot come soon enough, as RIM lost another four percent of market share in just the past four months. comScore suggests RIM phones now have just 21.7 percent of the smartphone market. Only Microsoft and Nokia are doing worse. Most of the BlackBerry fan base are moving to Android-based smartphones instead as their contracts come up for renewal, particularly those made by Samsung. The Korean manufacturer now manufactures one of every four smartphones Americans own.

As of July 2011, RIM has 7.6 percent of the market share in the United States.

BlackBerry phones have fewer challenges overseas, and the devices remain very popular among younger users in the United Kingdom, parts of western Europe, Africa, and the Middle East. That has been a mixed blessing for RIM in England, where the phone has been implicated as the device of choice for looters during riots earlier this month.

BlackBerry phones have fewer challenges overseas, and the devices remain very popular among younger users in the United Kingdom, parts of western Europe, Africa, and the Middle East. That has been a mixed blessing for RIM in England, where the phone has been implicated as the device of choice for looters during riots earlier this month.

Subscribe

Subscribe