The impact of the last minute stampede by Verizon Wireless customers (new or otherwise) to lock in the company’s unlimited data plans before they were retired last week has reached Wall Street, but the ripples extend far beyond Verizon Wireless itself.

The impact of the last minute stampede by Verizon Wireless customers (new or otherwise) to lock in the company’s unlimited data plans before they were retired last week has reached Wall Street, but the ripples extend far beyond Verizon Wireless itself.

Macquarie USA analyst Kevin Smithen this morning downgraded AT&T stock to “neutral,” expressing concern about AT&T’s slowed growth in wireless revenues.

“We see increased headwinds to wireless revenue growth, limited improvement in enterprise and a lack of clarity on the status of the [pending acquisition of T-Mobile],” he writes. “We view projected organic revenue growth of 0.5% in 2012 as uninspiring. At current levels, we believe absolute and relative risk-reward to roughly balanced given these issues.”

Customers concerned about Internet Overcharging schemes being implemented by Verizon Wireless began fleeing other providers to “lock in” unlimited data service with Verizon before it was nigh. One big victim of that was AT&T.

“We were waiting for the next iPhone to finally jump to Verizon, even if it meant paying a termination fee to AT&T, just to escape the dreadful service,” says Shai Lee, who was among several dozen readers contacting Stop the Cap! for assistance securing unlimited data plans with Big Red. “When Verizon announced $30 for 2GB, there was no way we were going to be locked into paying that, so we jumped early.”

“We were waiting for the next iPhone to finally jump to Verizon, even if it meant paying a termination fee to AT&T, just to escape the dreadful service,” says Shai Lee, who was among several dozen readers contacting Stop the Cap! for assistance securing unlimited data plans with Big Red. “When Verizon announced $30 for 2GB, there was no way we were going to be locked into paying that, so we jumped early.”

Many followed.

Smithen believes customers are also fleeing other carriers, especially T-Mobile, which he believes will lose two million customers before AT&T closes the deal or faces ultimate rejection for its merger by Washington regulators.

Some analysts believe T-Mobile customers are leaving over a combination of the company’s inherent weakness as a provider-now-in-limbo while others dread the reality of being ultimately stuck with AT&T.

Some analysts believe T-Mobile customers are leaving over a combination of the company’s inherent weakness as a provider-now-in-limbo while others dread the reality of being ultimately stuck with AT&T.

“It’s like fleeing a country before the invading army reaches your town,” shares Samuel, a T-Mobile customer leaving for Verizon. “I won’t live under AT&T’s regime.”

Smithen sees even greater challenges for AT&T with the arrival of iPhone 5, which will either cost the company to subsidize or start another wave of AT&T emigration.

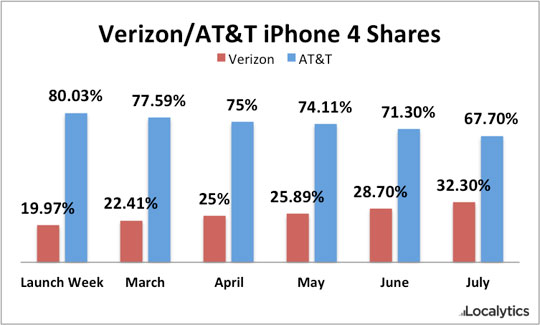

Verizon has already managed to secure 32 percent of the U.S. iPhone 4 market, according to a study by the mobile analytics company Localytics. Since rumors about Verizon imminently ending unlimited data plans began in May of this year, Localytics has tracked a spike in Verizon iPhone purchases, one explained by existing customers upgrading to smartphones, and new customers arriving from other carriers.

For AT&T, customers on contract with smartphones are not adding additional services and those with data plans are trying to stay within plan limits, robbing AT&T of extra revenue.

Smithen says with this track record, average revenue per customer is “stalling.”

Subscribe

Subscribe