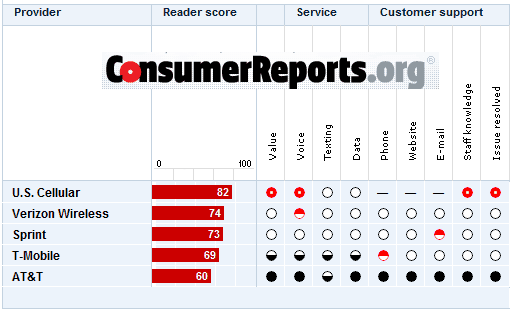

Consumer Reports underlines the point: America's worst cell phone company promises America better things by merging with America's second-worst cell phone company. Is this a good deal for America or just for AT&T and T-Mobile?

This morning’s announced deal of a merger between AT&T and T-Mobile is what antitrust rules were made to prevent. This bold merger would not have even been attempted had the two companies believed they could not get it past supine regulators and members of Congress who receive substantial contributions from AT&T.

Ordinary consumers can see right through AT&T’s business plans, so why can’t our regulators and policymakers? In a word, money.

The FCC’s own National Broadband Plan delivers clear warnings that the growing concentration in the wireless industry will hamper better broadband in the United States, not enhance it. Reduced consumer choice and competition takes the pressure off carriers to innovate, expand, and keep wireless costs under control.

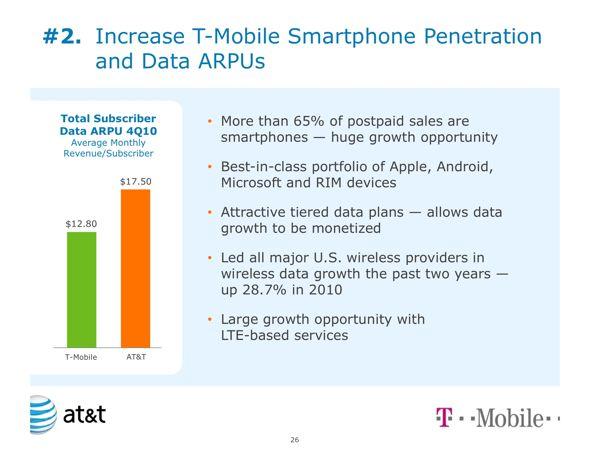

Reducing the number of players on the field delivers countless benefits to carriers and their shareholders. But for consumers, there is nothing but a few promised spoonfuls of sugar to help the industry’s agenda go down — with vague promises of better rural service, faster wireless data, and new handsets.

In a truly-competitive marketplace, Washington regulators need not exact promises of better service from mega-sized carriers: the much-vaunted “free market” would deliver them naturally, as competitors invest and innovate to succeed. But that kind of market is increasingly disappearing with every merger.

Nowadays, officials at the FCC and Justice Department are willing to accept deals if they promise some token bone-throwing, at least until the company lobbyists inevitably manage to get those conditions discarded during the next round of deregulation — cutting away rules that “tie the hands” of companies picking your pockets.

Money makes the impossible very possible, and AT&T intends to spend plenty to earn plenty more down the road. Let’s review how the game will be played, and what you can do to stop it.

The “Free Market” Crowd Sells Out

Randolph May is willing to sell robust competition down the river if it means he can get 4G network access faster.

When the chorus of capitalism capitulates on the most important formula for success in a deregulated marketplace — robust competition on a level-playing field, we know there is a problem. Take Randolph May. He works for the free market think tank Free State Foundation. Watch what happens when even the most ardent supporter of ‘letting the marketplace sort things out’ twists and turns around admitting America is facing a future duopoly in wireless:

“In an ‘idealized’ marketplace, the more competitors the better. But the telecom marketplace is not an idealized market. It is one that requires huge ongoing capital investments to build broadband networks that deliver ever more bandwidth for the ever more bandwidth-intensive, innovative services consumers are demanding,” he says. “My preliminary sense is that the benefits from the proposed merger, with the promise of enhanced 4G network capabilities implemented more quickly than otherwise would be the case, outweigh the costs. Even after the merger, the wireless market should remain effectively competitive with the companies that remain.”

That’s a remarkable admission for someone who normally argues that marketplace fundamentals are more important than individual players.

May is willing to sell a robust competitive marketplace down the river in return for 4G — a standard AT&T is hurrying to bring to its customers threatening to depart for better service elsewhere. With this deal, disgruntled customers will have one fewer choice to turn to for service.

Make no mistake: a free, unregulated wireless marketplace requires more than two national carriers and a much-smaller third (Sprint) to deliver real competition.

The Dollar-A-Holler Phoney Baloney Astroturf Groups

AT&T will waste no time trotting out comments from non-profit groups essentially on their payroll who will peddle filings with regulators promoting AT&T’s business agenda in return for substantial sized donation checks to their causes. The usual suspects, which include groups serving minority communities, will tout the “wonderful things” the deal will bring to their constituencies.

Already out this morning is this curious remark picked up by Broadcasting & Cable from Debra Berlyn, who claims to represent consumers as part of a group called the Consumer Awareness Project:

Beryln's consumer group has a few problems: It's not a group, it doesn't represent consumers, and she is an industry consultant.

“Wireless acquisitions over the course of the past decade have not led to price increases for consumers and, in fact, the statistics show that prices have declined during this period. While some consumer voices have focused on the loss of a wireless competitor in relation to AT&T’s recently announced plans to acquire T-Mobile USA, the news for consumers should be seen in another light with a focus on the benefits that this merger can bring to consumers across the U.S.”

Perhaps the first goal of any group trying to make consumers aware of anything is to actually have a website associated with your group. The “Consumer Awareness Project” forgot this important first step, but we eventually found the “group” using a re-purposed web address, “consumerprivacyawareness.org,” and note they have only recently become significantly active on this issue, now peddling AT&T’s agenda with gobbledygook.

When Berlyn isn’t pounding out prose to benefit AT&T, she is making guest appearances in Comcast’s corporate blog or being a favorite source of industry-connected groups like the nation’s largest broadband astroturf effort, Broadband for America.

In fact, after some digging, one learns there are no actual consumers involved with the “Consumer Awareness Project.” The entire affair is actually a project of a Washington, D.C., lobbying-consultancy firm — Consumer Policy Solutions, which counts among its services:

- Federal advocacy: Legislative and regulatory advocacy work before Congress, federal agencies and the administration.

- State and local advocacy: Policy development and implementation and grassroots mobilization.

That is the very definition of interest group “astroturf.” But my favorite section of this company’s website is the promise paying clients will get Berlyn’s experience “in communicating complex language and issues into easily understandable, applicable messages for consumers.”

Such as: AT&T’s merger with T-Mobile is good for consumers, even if it raises prices and reduces competition.

I’m sold.

The Cowardly Lion & A Myopic Justice Department

FCC Chairman Julius Genachowski's cowardly cave-ins set the stage for AT&T's bold merger move, believing they have government oversight under their control.

The first hurdle this deal will need to overcome is among Washington regulators, most of whom are either way over their heads understanding the implications of super-sized mergers like this or are simply terrified of going out on a limb with a multi-billion dollar company that can create headaches for your agency in Congress.

AT&T will sell this deal within a very limited context of the deal itself, and urge regulators to ignore “emotional” issues about the increasingly concentrated wireless marketplace. Verizon did much the same with its acquisition of Alltel — urging regulators to ignore the fact they were removing a player in the market and focus instead on the benefits Verizon’s size and scope could bring to existing Alltel customers. Of course, in many areas Alltel served, customers were free to do that themselves simply by signing up for Verizon service.

Dan Frommer, a senior staff writer at Business Insider, delivers a TripTik outlining AT&T’s roadmap to deal approval:

“AT&T believes its experience with regulatory review has given it a good picture of what’s realistic and what isn’t from an approval standpoint, and believes it can frame the deal in a way that won’t be rejected,” he writes. “AT&T says the Feds are looking at “the facts” — hinting that they aren’t acting based on emotions or politics. Though, no doubt, there will be plenty of jockeying in the press and among lobbyists from those on both sides of the deal.”

But Frommer wades in too deep and drowns his credibility claiming the combination of some of the largest wireless carriers in the country still leave plenty of competitors. Besides Verizon, there is just a single national player of consequence remaining – Sprint. MetroPCS and Cricket deliver service in urban areas in selected cities. US Cellular, Cellular South, and several others deliver service to an even smaller number of communities, entirely dependent on large carriers for roaming coverage.

The Justice Department’s typical solution to antitrust concerns is to force limited concessions like divestiture of assets in particularly concentrated markets. In most cases, companies agree because those assets are often redundant and would be sold anyway, or cover such a limited area as to be inconsequential to the greater deal. Former Alltel customers found themselves traded first to Verizon and then divested away to AT&T.

Most of the customers divested away from T-Mobile’s future with AT&T will likely end up switched to Verizon, hardly a success story for increased competition.

FCC lawyers will likely review this transaction with a narrow scope, too. Instead of contemplating the implications of the inevitable duopoly that could result, the FCC will likely find itself negotiating over individual details of the deal without considering an outright rejection of it.

At the FCC, Julius Genachowski’s performance as a regulator has been nothing short of a disaster, pleasing almost nobody in the process. His “cowardly lion” approach to regulation has delivered rhetoric without substance and a whole lot of broken promises. Genachowski has proven to be unable to stand up to the companies he is tasked with regulating. With two Republican commissioners likely to favor the deal and Michael Copps almost certainly in opposition, it will be up to Julius Genachowski and Mignon Clyburn to vote this deal up or down.

But regulators are also responsive to Congressional pressure and dramatic backlash by consumers, such as what happened just a few years ago when big media companies lobbied to relax media ownership rules. When consumers (and voters) revolt, regulators will change their tune… and fast.

What You Can Do

Consumers can make a difference in what comes next for T-Mobile and AT&T. The first step is to make this an issue with your member of Congress and two senators. Let them know you have profound concerns about another huge wireless merger.

There is simply no tangible benefit that can outweigh the loss of another important competitor in the American wireless marketplace.

AT&T’s bottom-rated service will not become any better acquiring the second-to-last rated service. The company must invest in its network to compete, not simply pick off competitors to save money. The loss of T-Mobile would mean only three national carriers, and it is highly unlikely Sprint would be able to withstand pressures on Wall Street to merge themselves away, probably to Verizon.

Tell your elected officials the AT&T/T-Mobile deal is a consumer nightmare and should not be approved under any circumstances.

[flv width=”360″ height=”290″]http://www.phillipdampier.com/video/Bloomberg Glenchur Says Regulatory Risk Substantial for ATT 3-21-11.mp4[/flv]

The always optimistic Bloomberg News says AT&T’s deal could still get past regulators, but there is a substantial risk as well. Consumers can help make that risk unsustainable by telling the Obama Administration and Congress better broadband does not come from a duopoly, no matter how well-intentioned. (4 minutes)

Subscribe

Subscribe

What’s the point of high-speed rural 4G service when you’re being forced to pay $10 per GB? You’ll blow through your cap in less than a few hours or days and soon end up with bill in the hundreds of dollars.

Customers are better off with a slower more reliable 3G service that at least keeps their usage from racking up massive bills.

The problem here is mostly timing. A few years ago, this would be a forward-looking merger. Data services are all very similar, there’s a large cost to increasing bandwidth in the absence of a new standard protocol. Today, now, wireline fiber-based data services can either build new infrastructure, or wait for 100GbE over fiber to be cheap to deploy. Likewise, cellular services can upgrade to 4G or expand capacity. The problem is that in major markets (like NYC) there’s very little room to expand for GSM providers. There simply isn’t enough spectrum available. Unlike cables, there’s an absolute limit on… Read more »

This merger will go through after a dog and pony show. AT&T is the number one PAC contributor in the nation. Too many favors are owed.