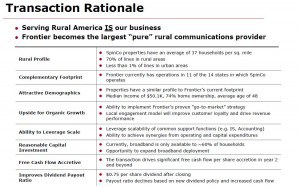

Frontier Communications agreed Wednesday to acquire nearly five million telephone customers being spun off from Verizon, primarily in rural areas, for $5.25 billion in stock. The buyout supercharges Frontier into the nation’s largest rural telephone company. But the deal also puts a spotlight on large providers sacrificing their rural customers to focus on their larger urban markets. About 700,000 of those Verizon customers are now off the list for Verizon FiOS deployment, as they transition into Frontier service territories.

Verizon’s chairman and CEO Ivan Seidenberg characterized the spinoff as part of Verizon’s interest in larger cities where advanced technology deployment makes sense.

“This transaction is part of our multiyear effort to transform our growth profile and asset base to focus on wireless, FiOS fiber-optic services and other broadband development, and global IP,” he said.

Our analysis of this will focus on the broadband implications of the transaction. With this acquisition, Verizon wins by offloading more expensive and difficult-to-serve rural communities, where it is unlikely to deploy large broadband platforms in the future. Frontier wins by becoming the nation’s largest rural telephone and communications services provider, potentially accessing even larger shares of forthcoming broadband stimulus money and other revenue available from the Universal Service Fund to sustain rural telephone service.

But will customers win? Today’s announcement provides additional evidence that broadband service is diverging in urban and rural communities. Large communities are enjoying deployment of advanced broadband platforms, and rural communities are simply not.

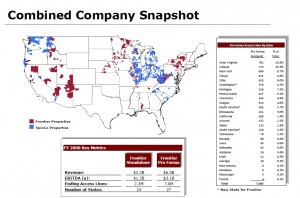

While the vast majority of Americans with wireline phone service are served by one of the three-remaining “regional Bell operating companies,” AT&T, Qwest, or Verizon, there are a handful of large cities and many more rural communities serviced by independent (non-Bell-affiliated) telephone/telecommunications providers. Citizens Communications, which merged with Frontier and adopted its name several years ago, has been building its company footprint through mergers and acquisitions among the remaining independent standalone phone companies. Today’s acquisition brings many more customers from Verizon than Frontier already has, nearly tripling the size of the company and allowing Frontier to leapfrog into first place among independents.

If the transaction passes regulatory review, Frontier Communications will become West Virginia’s primary telephone service provider, assuming control over the majority of the state. It will also become a major player in northern Washington state, northern and central Idaho, and assume control over large sections of suburban and rural communities in Ohio, Indiana, Illinois, Wisconsin and Michigan.

The result? A company that will continue to focus on “frontier America,” with less than 1% of their telephone lines serving urban areas. The average Frontier Communications service area has an average of just 37 households per square mile. Some 70% of their customers are in truly rural communities, many so small, they were previously served by family-0wned phone companies or telephone cooperatives.

Meanwhile, Verizon’s corporate vision continues to be directed towards development of advanced broadband and wireless services for their urban and suburban customers, especially across larger population states (especially in the northeast). Verizon is aggressively deploying fiber optics to these areas, reaching most by the end of 2010. Dumping smaller markets, particularly those isolated from larger communities or simply too rural to make advanced network deployment financially viable makes sense to Verizon. Frontier is only too happy to add these rural communities to its portfolio, particularly when many of the customer demographics are shared by those already served by Frontier.

Frontier’s average customer is 48 years old, most own their own home, and have a median income of around $50,000 per year. That’s a conservative demographic, in the age range most likely to keep their wired telephone service and not be tempted to switch to wireless or a competing service provider (if there even is one). It’s also within the demographic that is unlikely to demand the most advanced broadband delivery platforms and service levels. At this age range on up, the demand for broadband is often limited to web page and e-mail use. In more urban areas where average customer profiles are younger, demand for more advanced services usually tracks more aggressively as the age range drops. Younger people simply place more demands on broadband than most older users do.

One of the benefits Frontier sells to shareholders is their ability to more aggressively deploy broadband services in their service areas. Frontier claims just 20.9% of the Verizon service areas impacted by this deal have broadband service, whereas Frontier’s penetration rate is 25.7%. Neither number is all that impressive, and we suspect in areas where there is competition, the majority of broadband customers are likely taking a cable broadband product. Verizon believes these markets are simply not suitable for them to deploy FiOS or advanced broadband services, which was one of the primary reasons the company has agreed to divest them. Although Frontier believes it can perform better for broadband penetration in these markets, the devil is in the details.

First, one must define “broadband.” Many rural Frontier service areas already enjoy only limited DSL service, at speeds that often achieve well below 3Mbps. It’s better than dial-up, but hardly representative of the level of service available in urban communities and from most cable providers. Second, Frontier has only shown mild interest, and little action, in moving towards a fiber-based network to deliver advanced speeds and services to its customers. If it hasn’t done it in an urban, technology-friendly city like Rochester, its largest service area, it will be a long, long wait for the people in more rural West Virginia.

First, one must define “broadband.” Many rural Frontier service areas already enjoy only limited DSL service, at speeds that often achieve well below 3Mbps. It’s better than dial-up, but hardly representative of the level of service available in urban communities and from most cable providers. Second, Frontier has only shown mild interest, and little action, in moving towards a fiber-based network to deliver advanced speeds and services to its customers. If it hasn’t done it in an urban, technology-friendly city like Rochester, its largest service area, it will be a long, long wait for the people in more rural West Virginia.

Frontier can deliver more creative, locally-targeted promotional campaigns which have shown to be successful in reaching certain groups with their version of a “triple play” package of telephone service, video (through satellite), and broadband DSL. But in markets where cable providers exist, building market share against cable’s more advanced delivery platform can be brutal, requiring major marketing expenses related to promotions and giveaways.

The track record of Frontier has become established. They are assuming a dominant position in serving rural America, but there is no evidence thus far the company plans to keep up with larger urban markets with faster and more reliable broadband service, particularly in areas where fiber to the home is becoming commonplace. The company may be able to leverage Obama Administration broadband stimulus money to help defray upgrade expenses in many of their rural markets, but consumers must be vigilant with Frontier, which has shown a prior interest in capping their broadband service at levels of just 5GB per month. The company has shelved plans to enforce that limit for now, but we remain wary as long as language continues to exist in acceptable use policies and service agreements which try to bind customers to those limits, whether they are enforced or not.

Subscribe

Subscribe

Thanks Phill for fixing the homepage. If only TWC listened and acted as quickly as you!

Wow. If they have that kind of money laying around, then what is taking them so long to upgrade what they have in Rochester ?

Now Verizon can afford to buy out Frontier Rochester. 🙂

We can only hope!

I would love to see FIOS come to my neighborhood. Then I cold really feel as though I could vote caps down with my $$$.

If only TWC put out an poll “Would you dump us if we offered you less internet for more dollars?” and heeded the results instead of waiting the deadly aneurysm of customers.

I hear you. FIOS would indeed be very nice.

This article was posted in DSLReports. Thought you guys who didn’t catch this over at that site might want to read it for some possible Fiber deployments in other markets, thanks to Verizon giving Frontier a couple hundred thousand FiOS customers as part of the sell out. Look at the bottom of the article.

http://www.wtop.com/?nid=111&sid=1674858

While we’re in the minority of the impacted customers, those of us in the SUBURBS of Portland, OR and Seattle, WA have just been screwed. Bye-bye, FiOS, it was great knowing you! And hello, Comcrap :p

Verizon has stated that they will NOT come to Rochester.

They probably did not want to upset this sale, and probably have some kind of non-competition clause.