If you are one of the millions of former Bright House Networks or Time Warner Cable customers now facing a significantly higher cable bill courtesy of Charter Communications, you are not alone. While incessantly promoting itself as “redefining what a cable company can be,” customers from around the country are complaining Spectrum is charging considerably higher prices for fewer channels and discourages customers from upgrading to higher speed internet services with unjustified setup fees amounting to $200.

If you are one of the millions of former Bright House Networks or Time Warner Cable customers now facing a significantly higher cable bill courtesy of Charter Communications, you are not alone. While incessantly promoting itself as “redefining what a cable company can be,” customers from around the country are complaining Spectrum is charging considerably higher prices for fewer channels and discourages customers from upgrading to higher speed internet services with unjustified setup fees amounting to $200.

It’s all a part of a strategy laid out by Charter Communications CEO Thomas Rutledge, who sees a mission in correcting years of Time Warner Cable and Bright House’s “mispricing” of packages just to keep customers from leaving.

Long term Time Warner Cable customers know the drill. Every year, many call and complain about the high price of cable service and ask customer retention specialists for a better deal to stay. As the economy struggled to recover from The Great Recession, former Time Warner Cable CEOs Glenn Britt and Robert Marcus consciously adopted aggressive “customer retention” deals from 2010-2013 to keep customers threatening to cancel service. Some of these packages were cheaper than new customer promotions. The concept of retention pricing is simple: keeping current customers is less costly than attracting new ones. As a result, customers quickly learned all they had to do to pay a lower cable bill is to ask for a lower cable bill.

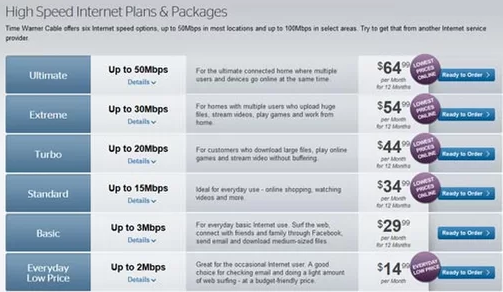

Time Warner Cable developed pricing promotions for virtually everyone. Older, fixed income customers were offered cut-rate cable television service when they called to cancel over the size of the bill. Families under economic distress were offered lower priced bundles that included savings as much as $600 annually. Millennials and cord-cutters were offered a half-dozen internet speed tiers at all price ranges, and were usually later targeted with relentless offers to add cable TV to broadband-only packages at cut-rate prices. Time Warner even targeted those stubbornly holding on to low-priced, low-speed DSL by introducing its $14.99 Everyday Low Price Internet offer, at speeds of just 2/1Mbps. That tier, available to anyone, would later become a de facto low-income internet package for those unable to afford the company’s regular broadband prices.

Charter Communications CEO Thomas Rutledge arrived at Charter after spending years at Cablevision, a company that had already started cracking down on promotions and the customers that depended on them year after year as it fought an ongoing price war with Verizon FiOS. Cablevision eventually adopted a “one promotion per customer” policy, refusing to extend new promotional offers to customers rolling off old ones as they expired. Company officials admitted the policy would cost it customers it deemed undesirable, but would assure investors that prices, and earnings would continue to rise well in excess of inflation. The policy of “rate discipline” was applauded on Wall Street where it was seen as serving the interests of shareholders. The increased churn (customers leaving) rate was forgiven as long as revenue continued to grow.

By 2013, Time Warner Cable was under growing pressure to raise prices. Incoming CEO Rob Marcus told investors that year the company would back off on extending promotions and special offers and would stop trying to save every customer that threatened to cancel. He also announced the company would begin restricting who was authorized to offer customer retention deals. Employees were instructed to forward calls from rate-sensitive customers to new national customer retention call centers, where representatives were trained to get customers to voluntarily cut back their cable package before offering a lower rate.

By 2013, Time Warner Cable was under growing pressure to raise prices. Incoming CEO Rob Marcus told investors that year the company would back off on extending promotions and special offers and would stop trying to save every customer that threatened to cancel. He also announced the company would begin restricting who was authorized to offer customer retention deals. Employees were instructed to forward calls from rate-sensitive customers to new national customer retention call centers, where representatives were trained to get customers to voluntarily cut back their cable package before offering a lower rate.

That summer, Time Warner took a beating as more customers chose competitors or followed through on their threats to cancel.

“As we discussed before, this [new pricing] approach represents a conscious decision to pursue subscribers with higher ARPU, higher profit and lower churn even if that means fewer connects,” Marcus told investors in July 2013, defending the results. “So it’s not a surprise that as in the first quarter of 2013, subscriber net adds were down in the second quarter on a year-over-year basis.”

The more Time Warner Cable tried to hold the line on pricing, the more customers left, especially if the competition had a better deal. In early 2014, Comcast announced its intention to acquire Time Warner Cable, starting a lengthy merger review process and distracting the company as it contemplated getting the deal approved in Washington. To protect the value of the company, Time Warner Cable quietly began offering aggressive promotions once again to hold onto customers. Those promotions largely remained as the deal with Comcast collapsed all the way through its acquisition by Charter Communications, which was completed last summer.

Customers were allowed to keep their existing Bright House and Time Warner Cable packages and promotions, and could even sign up for new ones until the company managed to complete rolling out its Spectrum packages and pricing across its acquired service areas over late 2016 and early 2017. Once Spectrum arrived in an area, new customers had to select a Spectrum plan and if a current Bright House or Time Warner Cable customer switched to a Spectrum plan, they could not return to their old plan.

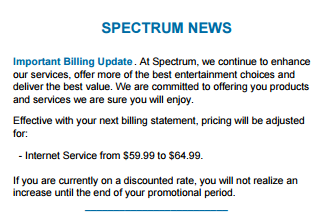

What drives most customers to contemplate switching plans is the bill shock that occurs when an existing promotion or bundled discount expires. Time Warner Cable gradually increased prices on customers coming off of a promotion. Charter hits them all at once with an immediate rate reset to regular prices. The result is a bill increasing $20-50 without warning.

What drives most customers to contemplate switching plans is the bill shock that occurs when an existing promotion or bundled discount expires. Time Warner Cable gradually increased prices on customers coming off of a promotion. Charter hits them all at once with an immediate rate reset to regular prices. The result is a bill increasing $20-50 without warning.

When customers call to complain and attempt to negotiate a better deal, Charter representatives are trained to sell customers regular priced Spectrum plans and bundles. Rutledge calls it sensible and simple pricing. But some customers call it highway robbery, especially when they find out Charter does not consider them to be “new customers” qualified to get the heavily promoted new customer pricing advertised in newspapers and on the website.

Negotiations over pricing with Spectrum’s representatives largely go nowhere. Customers are typically offered “a deal” in the sense Charter’s regular pricing is usually less egregious than Time Warner Cable or Bright House’s “rack rates.” Getting a lower price from Charter as an existing TWC or BH customer typically means cutting back on services.

Charter is likely to continue to lose around 50,000 customers every quarter, if not more, as promotions continue to expire and rates increase dramatically as a result. Rutledge believes once the last Time Warner Cable and Bright House promotions end, the churn rate will settle down. We’re not so sure that is true. Charter’s heavy focus on differentiating its TV package while offering one advertised broadband speed for all is likely to trigger family discussions about cord-cutting over one issue: price. Time Warner Cable customers moving to Charter’s popular Select TV package guarantees losses of several popular cable networks. Getting those channels back will cost at least $12 a month, if not more. That could prompt customers to consider whether cable TV is still worth the price. Time Warner Cable avoided spiking cable TV rates over the last three years precisely to avoid the kind of customer departure stampede Charter is experiencing today. (To be fair, Time Warner Cable did increase its Broadcast TV and Sports Programming surcharges, but Charter also adopted the Broadcast TV surcharge for its own customers.)

Charter does not prominently publish its retail rates on its website, only promotional rates for new customers. To help readers intelligently decide what package is right for you, we’ve obtained Spectrum’s rate card and enlisted 15 regular readers to interact with Charter to get the best deal possible. This special report is the result as customers navigate to maximize savings without spiking your bill.

Option A – The Big Money Saver: Cancel Service and Come Back as a New Customer

If you want the lowest possible price on Charter service, you will have to cancel your current Time Warner Cable or Bright House package, return your equipment, and potentially survive a 30-day waiting period without Charter service before again qualifying as a new customer. This isn’t a problem if your area is well-served by a competing phone company and many customers in those areas bounce between new customer promotions offered by the cable and telephone company year after year. But if your phone company hasn’t seen fit to upgrade and is still trying to sell low-speed DSL, our savvy readers discovered you can bypass the waiting period and get service back within 24-48 hours, as a new customer at the new customer price.

If you want the lowest possible price on Charter service, you will have to cancel your current Time Warner Cable or Bright House package, return your equipment, and potentially survive a 30-day waiting period without Charter service before again qualifying as a new customer. This isn’t a problem if your area is well-served by a competing phone company and many customers in those areas bounce between new customer promotions offered by the cable and telephone company year after year. But if your phone company hasn’t seen fit to upgrade and is still trying to sell low-speed DSL, our savvy readers discovered you can bypass the waiting period and get service back within 24-48 hours, as a new customer at the new customer price.

To manage this, you will need another member of your household willing to put service in their name. Here is how our readers managed it, and following these instructions is important if you want to minimize downtime.

Step 1: Handling your Time Warner Cable/Bright House phone line and email address.

If you have phone service with Time Warner Cable or Bright House and want to keep your phone number, you will need to move it to a new provider. You can pick up a cheap cell phone for under $20 at Walmart or other discount stores and usually port your Time Warner Cable or Bright House phone number to a cheap prepaid cell phone plan you will set up for about a month. Follow all instructions on the cellular provider’s website on how to transfer your number. There is usually no cost for this service. Do NOT cancel your existing cable service until you are notified your phone number was successfully transferred, which can take 24 hours to a week. When you dial your number, it should ring the cell phone. The cable company will automatically cancel your phone service when the number is successfully ported out. If you use TWC’s Phone2Go app, you need to deauthorize all devices on your account from inside the app before canceling service. This will allow you to re-register those devices under your new account.

Also be aware you will lose your rr.com or twc.com email address after canceling service. If you are using either, why? Avoid the hassle by getting an online email address from Gmail (or another provider). This will protect you from future frustrating delays informing your contacts of your latest email address.

Step 2: Return your equipment and cancel service.

Gather your cable box(es), remote(s), cable and/or phone modem and return the equipment to the Charter Cable Store and tell them you are canceling service. When you are asked why you are leaving, explain the rates are too high and you are finished with them. Keep the receipt you are given for returning the equipment until after your final bill arrives to make sure there are no discrepancies.

Step 3: Go home and have a fellow household member sign up as a new customer.

Return home and visit the Spectrum website. You will be entering your home address and will likely be told there is already service at that address. You must return all equipment and cancel service before ordering new service or your order will be canceled.

Proceed by selecting “No, I would like to setup new service for this address.” You will then be shown options to configure your new service. Remember, Charter requires a 30-day waiting period without service before it will consider you a “new customer.” But your spouse, in-home relative, or legal age children can be considered new customers immediately if service is put under their name (if you get pushback for having the same last name, tell them the original account holder has moved out and canceled service and you want to establish service under your own name, or use your maiden name). You can sign up online or use the online chat feature to help expedite your order. If you end up talking to a representative, it will probably be from an offshore call center less likely to hassle you about your qualifications as a new customer. A credit check will be requested. Ask if you can waive that requirement by using a credit card to cover the first month’s payment and skip the inquiry that may land on your credit report.

Building Your New Package

At the time this article was prepared, Charter was heavily promoting an offer of cable TV, broadband, and phone service for $29.99 each for 12 months. Additional cable TV services are available in two packages known as “Silver” and “Gold.” Silver costs an extra $20 a month, Gold effectively costs $40 more when you review the offer carefully. Both bundle premium movie channels with extra basic cable networks you probably used to have with Time Warner Cable or Bright House package. It is important to check what channels are included with each package or you will find some channels missing from your lineup if you switch to Select. If you discover some “must-have” channels are missing, you need not buy premium movie channels as part of the Silver or Gold package if you don’t want them. Charter sells add-ons consisting of bundles of several basic cable channels missing from the Select package for $12 each.

If Charter wanted customers to consider them more honest than their predecessors, they have some work to do.

We found Charter’s promotion to be deceptive because it gives customers the impression they can build lesser packages at the $29.99 price for each component. For example, if you just wanted TV and broadband service, that should cost $59.98 a month for both under the $29.99 each formula, right? Nice try. In fact, that “$29.99 each” price is effectively meaningless because it only applies when choosing a triple-play offer! It would be more honest to advertise a price of $89.97 for Spectrum’s triple-play service. See below to understand what happens when a customer thinks they can save some money by omitting the phone line.

Pick a Package

- Charter/Spectrum’s Select TV package + Internet 60¹Mbps + Nationwide Unlimited Phone Service: $29.99 + $29.99 + $29.99 = $89.97

- Charter/Spectrum’s Select TV package + Internet 60¹Mbps: $59.99 + $29.99 = $89.98 (It costs more without the phone line!)

- Charter/Spectrum’s Standalone Broadband 60¹Mbps (¹-100Mbps in some areas) = $44.99

It gets even worse for double-play customers if they have a DVR box. Charter waives the $9.99 DVR service fee on the first DVR box in the home, but only for triple play customers. If you skip the phone line and have a DVR, your bill will be $9.99 a month higher without the phone line. You will be better off taking the phone line even if you don’t use it!

Choose Optional Upgrades

- Add Silver TV to Select TV package (Adds additional basic channels + HBO, Cinemax, and Showtime) = Add $20/month

- Add Gold TV to Select TV package (Includes all Silver channels/networks, plus even more basic networks and Starz, StarzEncore, Epix, and The Movie Channel) = Add $40/month

- Add Spectrum Voice International (Unlimited toll-free calls to 70 countries) = Add $5/month

- Add Wi-Fi capability = Add $5/month ($9.99 setup fee may apply)

- Add Internet Upgrade = $104.99 for standalone 100Mbps (non-Maxx) or 300Mbps (Maxx) service + $199 setup fee. For a triple-play internet upgrade: Add $40/mo + $199 setup fee

Missing basic cable channels you want back? If you don’t want to pay the extra $20-40 for Silver or Gold, you can upgrade to get back the basic cable channels gone missing without getting any premium movie channels by choosing one or both add-ons:

Silver Digi Tier 1 ($12) for Select adds the following channels²:

Animal Planet, ASPiRE TV, AXS TV HD, Baby First TV, BBC World News, BET Jams, BET Soul, BYUtv, CBS Sports Network, Centric, CMT, Cooking Channel, Disney Junior, Disney XD, DIY Network, El Rey Network, ESPN Deportes, ESPNews, ESPNU, FM, FOX Deportes, FOX Sports 2, Fuse, FXX, fyi, GAC, Golf Channel, GSN, Lifetime Real Women, LMN, LOGO, MLB Network, MTV Classic, MTV Live HD, MTV2, Nat Geo Wild, NBA TV, NBC Universo, NFL Network, Nick Jr., Nick Music, Nicktoons, Ovation, OWN, Reelz, REVOLT, RFD-TV, Smithsonian Channel, Spectrum News (NYC), Sprout, TCM, TeenNick, Tennis Channel, The Impact Network, Travel Channel, TV One, Univisión Deportes, Uplifting Entertainment, Viceland

Gold Digi Tier 2 ($12) for Select adds the following channels²:

American Heroes, BeIN Sports, BeIN Sports Español, BET, Boomerang, BTN, CNBC World, Comedy Central, Crime & Investigation, Destination America, Discovery Family, ESPN Classic, ESPN College Extra, ESPN Goal Line/Buzzer Beater, FamilyNet, FCS Atlantic, FCS Central, FCS Pacific, FOX Soccer Plus, HDNet Movies, Military History, MLB Strike Zone, MTV, NBC Universal HD, NFL RedZone, NHL Network, Nickelodeon, Outdoor Channel, PAC-12 (Various Regionals), Science Channel, Spike, TV Land, TVG, VH1, Willow Plus Cricket

(²- Channel selection may vary in different geographic areas. This list applies to the Northeast U.S./former TWC territory)

Choose Equipment

Charter DVR box.

Next step is selecting equipment, and this is one area where Charter does better for its customers than its predecessors. At the current time, the cost of the HD-DVR box or an HD box is the same for new customers: $4.99/mo each. The DVR service fee, charged regardless of the number of DVR boxes, is usually $9.99 a month. However, a current triple play promotion waives the fee for the first DVR box. If you want more than one DVR, the $9.99 fee will be levied once on your bill regardless of how many extra DVRs you have. Therefore, if you want more than one DVR, you might as well choose DVR units for every TV set in the home because there is no difference in price between a traditional set-top box and the DVR.

- HD-DVR $4.99/mo per box

- HD Box $4.99/mo per box

- DVR Service: $9.99/mo for two or more DVRs (waived if choosing Triple Play package and have only one DVR box)

- Cable Modem: No charge

- Phone Modem: No charge

If you own your own cable modem, you can continue to use it. If you sign up for both phone and internet service, Charter will likely supply you with a device that handles both the phone and broadband service, but can disable the internet side of the modem to favor your own equipment. Charter does not charge rental fees for either a cable or phone modem. If you do not already own a wireless router for Wi-Fi, Charter will lease you a Wi-Fi equipped modem (usually made by Ubee) for $5 a month. A setup fee of $9.99 may also apply.

Completing Your Order

A self-install kit.

To minimize service interruption, choose the option of a “self-install” kit instead of a service call or having equipment mailed to you. Self-install kits are free without a service charge for a technician to visit to hook up the equipment and you can pick up equipment immediately.

At the end of the order, you should be given your account number and an equipment reservation number. Both are extremely important so be certain to write them down. Use online chat if you did not get one or both. Various verification procedures to activate your equipment and apps may require your account number. If you don’t have it, you may have to wait up to two weeks for your first invoice to be generated showing your account number.

Step 4: Time to pick up your equipment.

Take both your account number and reservation number along with legal photo ID to the nearest Charter Cable Store to pick up your new equipment. Some of our readers accomplished this on the same day they canceled service. You might avoid an awkward encounter by returning equipment at one store location and picking up new equipment at another. The store should give you equipment if your ID at least shows the same physical address where service is located. It depends on local store policies whether the account holder must be present or not.

Step 5: Hook everything up and activate service.

Return home and hook up your equipment. There are a few things you should know, however:

- If you ordered home phone service, there is a mandatory 24-48 hour waiting period before TV and phone services will become active. Internet service may be intermittent at times during this waiting period or not work at all.

- You will be required to complete a quick third-party verification call to activate home phone service and understand Charter’s 911 policies.

- Your cable TV equipment will not authorize until the end of any waiting period, but you can use the Spectrum TV website or app to access TV immediately.

- You may be given a temporary phone number if you are transferring your original landline number back to the cable company until the port request is complete.

- There may be a brief delay of several days before you can use TWC’s or BH’s Wi-Fi hotspots.

- Your first bill will usually be generated within a few days of activating service. Charter bills one month in advance. You can access your bill from the MyTWC, Bright House, or Spectrum account apps. Configure autopay as soon as possible to avoid your account going past-due.

Enjoy 12 months of reasonably priced cable service!

Option B – Understanding Charter’s Pricing for Existing Time Warner Cable/Bright House Customers

The best deals always go to new customers while loyal ones pay more.

Charter Communications considers current TWC/BH customers to be current Charter customers as well and do not qualify for new customer discounts or pricing. However, that does not mean you need to give Charter more money than they deserve.

For most customers, the option of keeping a legacy Time Warner Cable or Bright House Networks package will depend almost entirely on price. Charter is honoring existing BH/TWC bundled service promotions, new customer discounts, and retention plans until they expire (usually after one year, but occasionally two years). To avoid customer bill shock, Time Warner Cable used to gradually reset rates back to regular price over an extended period. Charter does not. Once your promotion is over, your bill will spike by $10-50 a month depending on the promotion you used to have. This rate reset is by design. If you do nothing, Charter will pocket revenue from a rate increase it wouldn’t dare try to impose on every customer. If you call to complain, you just saved Charter marketing expenses trying to convince you to contact them to discuss changing plans.

Because only a minority of customers ever paid regular Time Warner Cable pricing, Charter’s own rates may seem lower in comparison. Retail prices at a cable company are about as useful as the manufacturer’s suggested retail price on a piece of clothing. When the MSRP on a shirt is $55 and you pay $19.95, you may think you are getting a bargain. But if nobody was ever charged $55 for that shirt and it routinely sold for $19.95, that is no deal at all.

Our analysis shows Charter’s rates for existing customers are considerably higher for those who used to bounce from one Time Warner Cable promotion to the next and owned their own cable modem. For customers who just pay the bill and never attempt to negotiate a lower price, Charter’s regular pricing is comparable to slightly less that what customers used to pay Bright House and Time Warner Cable, if you don’t mind losing some TV channels.

The biggest winners of Charter’s Spectrum prices and plans are customers who rent a lot of equipment and subscribe to multiple premium movie channels. Charter charges considerably less for cable equipment and has no modem fee at all. Premium movie channels are bundled into Spectrum’s Silver and Gold TV plans, resulting in significant savings for customers who subscribe to multiple networks. DVR equipment and DVR service fees are also lower.

So get out your current cable bill and review these prices from Charter and compare. Charter does still offer some additional bundled discounts not reflected here. You will not get them unless you ask what offers are available to you. Don’t expect any gift card rebates or other big dollar promotions like Time Warner Cable used to offer. Charter is not a big believer in those kinds of marketing efforts, but the company will pay up to $500 towards any early contract termination fees charged if you switch to them from a satellite or telephone company competitor.

Our recommendations:

Our recommendations:

- Do not attempt to negotiate using the new customer promotions Charter is advertising. You will get shot down because you are considered an existing customer. If you are primarily focused on price, strongly consider Option A above, despite the hassle. A representative can only give you the deals they are authorized to offer, and Charter’s management has severely curtailed promotional plans, even if it means losing you as a customer.

- You will pay about $65 a month for a basic TV package that, in our area at least, includes just shy of 200 channels. We found that was more than adequate, although we will miss Comedy Central, Nickelodeon, Turner Classic Movies, and BBC World News which are not a part of Spectrum’s base Select package. Adding another $12-24 a month to get these channels back isn’t worth it.

- Charter still sells the equivalent of Broadcast Basic — a small package of over the air stations and some ancillary channels for around $24 a month. It isn’t advertised and frankly is overpriced for what you get, but it is an option if you just want local TV stations.

- If you want HBO, Cinemax, or Showtime, upgrading to Spectrum Silver is worth it. For $20 a month more, you get all three of those premium movie channels plus a number of basic networks that used to be a part of your TWC or BH lineup.

- Check bundled promotions for existing customers carefully. Ask what is currently on offer. You may still find in certain circumstances the triple-play offer of TV, internet, and phone service is very closely priced to the double-play packages.

- If you have a DVR, ask if there are any promotions that waive the $9.99 DVR service fee for the first DVR box. If you are going to have to pay the DVR service fee, check the rates for HD-DVR boxes vs. a traditional HD-set top box. You may just want to put a DVR on every set in the home if the prices are nearly the same. Charter does not offer Whole House DVR service.

- Always choose to pick up any equipment in the local cable store. You will avoid Charter’s truck roll fee to send a technician to your home. Ask about any shipping fees if you want Charter to mail equipment to you. Those fees may be substantial.

- Customer self-install kits are a good option if your home is pre-wired for cable and you require no rewiring. You can get equipment and connection cables for free almost immediately. Don’t spend money at Best Buy or other retailers on HDMI cables and coaxial patch cables. Charter supplies cables at no extra charge that work just fine.

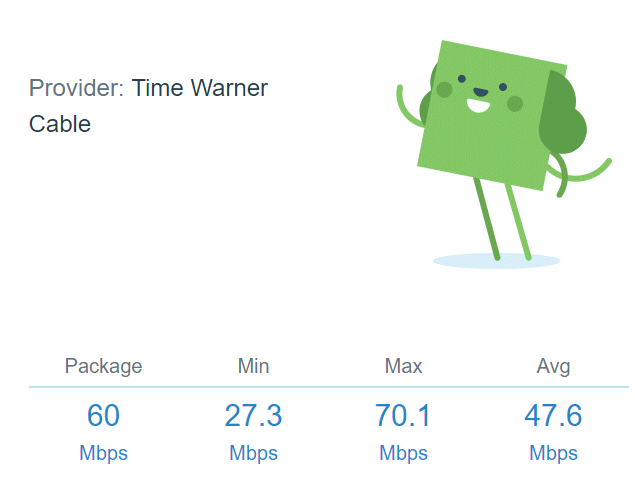

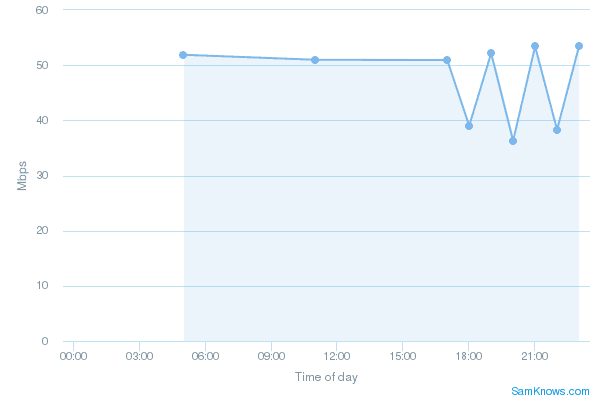

- Charter overprovisions broadband speeds to help the company meet FCC expectations that advertised speeds are comparable to actual speeds. Charter’s 60Mbps (100Mbps in some areas) basic internet service actually performs at around 70/6Mbps in most areas. Charter’s Internet Ultra package (100 or 300Mbps) is not worth the extra expense, particularly when factoring in the $199 setup fee. The more customers that reject upgrading because of the setup fee, the more likely Charter will eventually remove it. There is no justification for the fee other than to gouge consumers looking for faster speeds.

- If you are looking for Charter’s $14.99 Everyday Low Price Internet option and live in New York State, if Charter tells you it isn’t available we would like to know about it. We are monitoring Charter’s compliance with the state’s conditions included in the order granting Charter’s merger with Time Warner Cable and we will forward your complaints to both the state Public Service Commission and Attorney General’s office. If you do not live in New York, this plan is no longer an option unless you already have it.

- Charter’s phone service performs equivalently to Time Warner Cable, but includes a much smaller international toll-free calling area. Spectrum Voice International ($5/mo) gives toll-free calling to 70 countries and is a good value if you regularly call those places.

The following rates are effective April 2017 and packages and pricing will vary slightly in different regions of the country. All prices exclude applicable taxes, franchise fees, and the Broadcast TV Surcharge, which can vary considerably in different service areas (expect to pay an average of $4-7 a month). Charter does not appear to levy a sports programming surcharge.

TELEVISION PACKAGES

TELEVISION PACKAGES

$23.89 BASIC SERVICE (Local Channels, C-SPAN, Public, Educational and Government Access, Various Home Shopping Channels)

$64.99 SPECTRUM SELECT (Includes Basic Service, Expanded Service of 120+ basic cable networks)

$84.99 SPECTRUM SILVER (Includes Spectrum Select, Digi Tier 1, HBO, Cinemax and Showtime)

$104.99 SPECTRUM GOLD (Includes Spectrum Silver, Digi Tier 2, TMC, Starz, Encore and EPIX)

Optional Services

$12.00 DIGI TIER 1 (Available with subscription to Spectrum Select, Silver or Gold)

$12.00 DIGI TIER 2 (Available with subscription to Spectrum Select, Silver or Gold)

$38.00 EXPANDED SERVICE (does not include basic service channels)

$7.99 LATINO VIEW (adds additional Spanish language channels not included in Select, Silver, or Gold)

Premium Channels

Premium Channels

$15 each: Starz/Encore, EPIX, HBO, Cinemax, Showtime, The Movie Channel, or Starz

Subscription on Demand

$14.99 Too Much For TV On Demand

$6.99 Here TV On Demand

$4.99 Disney Family Movies On Demand

$3.99 Disney On Demand

Other Services (per month)

$9.99 Deutsche Welle Amerika (German)

$9.99 Deutsche Welle Amerika (German)

$24.99 Filipino Pass Plus

$9.99 TV5Monde (French)

$39.99 TVB Jade World (Hong Kong – Cantonese and Mandarin)

$19.99 Mandarin Language Pack (China)

$25.99 Russian Language Package

$19.99 TV Polonia and Polski Radio Warszawa (Polish)

$19.99 SBTN & TVBV (Vietnamese)

$9.99 RAI Italia (Italian)

$19.99-69.99 Hindi Language Networks

$24.99 TV Japan (Japanese)

$12.99 ART TV (Greek)

$12.95 Playboy TV

$12.95 Penthouse

$12.95 Real

$12.95 TEN

$12.95 Hustler

$12.95 VIVID

$24.95 Adult 3-Pack

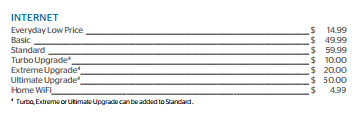

INTERNET PACKAGES

$14.99 Everyday Low Priced Internet (2/1Mbps) (New York State only)

$14.99 Everyday Low Priced Internet (2/1Mbps) (New York State only)

$14.99 Spectrum Internet Assist (30/4Mbps) (qualified low-income customers only)

$64.99 Spectrum Internet (60/5Mbps or 100/10Mbps depending on area)***

$104.99 Spectrum Internet Ultra (100/10Mbps or 300/20Mbps depending on area)***

$199 One-time Upgrade Fee for Spectrum Internet Ultra

$5 Wi-Fi Service****

SPECTRUM VOICE TELEPHONE SERVICES

$29.99 Spectrum Voice*** (includes unlimited local and long distance calling in U.S., Puerto Rico, Guam, U.S. Virgin Islands, Mexico, Canada, and Northern Marianas)

$19.99 Additional Line

$5 Spectrum Voice International (per line optional add-on; adds unlimited toll-free calling to 70 countries)

INSTALLATION/SERVICE CALL (PER ACTIVITY)

INSTALLATION/SERVICE CALL (PER ACTIVITY)

$49.99 Primary Installation/Reconnect (when truck roll required)*

$49.99 Trip Charge**

$49.99 Custom Work Hourly Service Charge

$49.99 Service Call Truck Roll

$49.99 Wall Fish

$49.99 Move Transfer

UNRETURNED EQUIPMENT FEES

$123 Spectrum Receiver

$22 CableCARD™

$130 Tuning Adapter

$496.46 Guide Narration Laptop

MISCELLANEOUS CHARGES (PER MONTH)

(Varies) Broadcast TV Service Charge (expect $4-6/mo on average)

$8.95 Late Fee

$4.99 Reconnection Fee if no truck roll is required

$20 Insufficient Funds/Returned Check Fee

$5 Making a payment over the phone with a customer service representative

* An amplifier may be required for a dwelling with multiple outlets (outlet = digital receiver/modem/eMTA). Technician assessment and professional installation required.

** Applicable when adding and/or relocating outlet, upgrading and/or downgrading services and picking up equipment in some cases.

*** Prices are for standalone service. Rates are lower when service is bundled with TV, internet and/or telephone service.

**** Applies when customers use a Charter-supplied internet modem equipped with built-in Wi-Fi. A $9.99 setup fee may also apply. No fee if you use your own internet router.

Charter Communications has a new argument for raising your cable bill: Time Warner Cable’s promotions were so low-priced, the company couldn’t afford upgrades. By ending promotional pricing and raising prices, Charter can finally afford to manage the upgrades Time Warner Cable never made.

Charter Communications has a new argument for raising your cable bill: Time Warner Cable’s promotions were so low-priced, the company couldn’t afford upgrades. By ending promotional pricing and raising prices, Charter can finally afford to manage the upgrades Time Warner Cable never made.

Subscribe

Subscribe