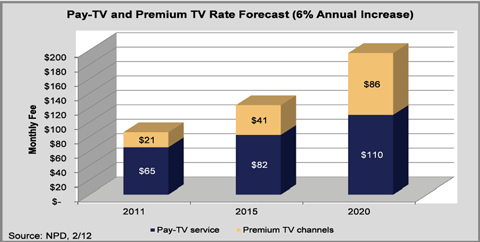

If you thought paying an average of $86 a month for basic pay television and premium movie channels in 2011 was out of line, just wait. A new report predicts you could pay $123 by the year 2015 and $200 by 2020 — and that only includes the TV portion of your bill.

If you thought paying an average of $86 a month for basic pay television and premium movie channels in 2011 was out of line, just wait. A new report predicts you could pay $123 by the year 2015 and $200 by 2020 — and that only includes the TV portion of your bill.

That is in keeping with typical annual rate increases, typically blamed on “increased programming costs,” which currently run an average of six percent a year.

The NPD Group, who published the findings, predicts consumers may not sit still for that kind of monthly cable television bill, especially as household incomes for the middle class continue to remain stagnant, even as high fuel and health care prices continue to march higher.

The pay television industry isn’t entirely responsible for the annual rate hikes that nearly always outpace the rate of inflation. The real money is in programming production and distribution, which is why giant companies like Comcast, Bell, Rogers, and Viacom are buying up programming studios, distributors, and networks at a rapid pace.

With new players like Netflix, Amazon, and Redbox joining traditional pay television and broadcast network bidders, auctions for exclusive licensing agreements bring higher and higher bids. Ultimately, consumers pay the price in the form of higher bills. Even cable networks, sensing an increase in the value of their programming, are extracting higher monthly fees at contract renewal time.

The last to arrive at the programming money party? Local over-the-air broadcasters that used to beg cable companies to carry their channels on the local lineup. Now some are demanding as much as $5 or more per month per subscriber to allow the cable operator to keep carrying the stations.

“As pay-TV costs rise and consumers’ spending power stays flat, the traditional affiliate-fee business model for pay-TV companies appears to be unsustainable in the long term,” said Keith Nissen, research director for The NPD Group. “Much needed structural changes to the pay-TV industry will not happen quickly or easily; however, the emerging competition between video on demand and premium-TV suppliers might be the spark that ignites the necessary business-model transformation of the pay-TV industry.”

In other words, the more consumers cut cable’s cord and go find other ways to watch their favorite shows, the more unsustainable the traditional pay television business model will become. Some industry watchers believe cord-cutting is not a major issue. Others believe continued rate increases will drive customers to cancel service, particularly when alternatives are available. But NPD believes economic factors are the biggest reason for cable cord-cutting. Those ex-customers are switching back to free “over the air” television, which now delivers better picture quality and often includes additional channels that increase the number of viewing options.

In other words, the more consumers cut cable’s cord and go find other ways to watch their favorite shows, the more unsustainable the traditional pay television business model will become. Some industry watchers believe cord-cutting is not a major issue. Others believe continued rate increases will drive customers to cancel service, particularly when alternatives are available. But NPD believes economic factors are the biggest reason for cable cord-cutting. Those ex-customers are switching back to free “over the air” television, which now delivers better picture quality and often includes additional channels that increase the number of viewing options.

NPD Group research shows most consumers don’t want to exert too much effort to hunt down online programming. Most will put up with their current provider as long as they deliver the shows they want at a price they can afford. What could change that? Easy-to-access to a-la-carte programming, perhaps available from services that may soon come built-in with the newest television sets.

“Pay-TV providers offer a convenient, one-stop shop for subscribers, and the majority of customers like it that way,” said Russ Crupnick, senior vice president of industry analysis for The NPD Group. “There is an open window for the industry to meet consumer needs and become to television what iTunes is to music; however, there is also a definite risk if pay-TV providers don’t capitalize on the opportunity — and soon.”

Subscribe

Subscribe