Five years ago, municipal Wi-Fi projects were enjoying a small boom. The concept of providing low-cost or free Internet access seemed like a winner because it could provide service to those who could not afford traditional broadband, would stimulate economic development downtown, and possibly attract business as shoppers stopped in cafes or stores to use their wireless devices. In some communities, just the spectacle of a city-wide high technology wireless network delivered worthwhile bragging rights that adjacent communities didn’t have.

Five years ago, municipal Wi-Fi projects were enjoying a small boom. The concept of providing low-cost or free Internet access seemed like a winner because it could provide service to those who could not afford traditional broadband, would stimulate economic development downtown, and possibly attract business as shoppers stopped in cafes or stores to use their wireless devices. In some communities, just the spectacle of a city-wide high technology wireless network delivered worthwhile bragging rights that adjacent communities didn’t have.

For most city or town officials pondering investment in a Wi-Fi network, the idea germinates from a perceived lack of service from private providers. If private companies were delivering the service, few communities would spend the time, effort, and money duplicating it.

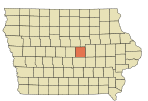

In the community of Marshalltown, public Wi-Fi in 2005 was a service only found in a small selection of stores and cafes in the central business district. The Marshalltown Economic Development Impact Committee sought to change that, promoting a plan to construct a free-to-use Wi-Fi network covering a 20-block radius centered on the Marshall County Courthouse. The community of 27,000 got a three month trial of the downtown Wi-Fi network in 1995, with the city and county sharing 50 percent of its cost, with the remaining 50 percent paid for by private donations.

Mediacom, the cable company serving Marshalltown, was incensed by the notion of a community-owned broadband provider delivering improved (and free) Internet access across the city. Even worse in their eyes, local government officials were pondering creating a public broadband utility.

Marshalltown (Marshall County), Iowa

It wasn’t long before new, shadowy groups with names like “Project Taxpayer Protection” showed up in town attacking the concept of municipal Internet access. After a blizzard of brochures and exaggerated claims about “government broadband,” the network became a point of controversy among the locals.

Only later would the community learn the group (whose status as a non-profit was later revoked by the Internet Revenue Service for failure to file timely reports on its funding and activities) was actually funded mostly by Mediacom itself, with the full support of the Iowa Cable Association.

The astroturf campaign against public involvement in Wi-Fi, which could threaten Mediacom’s broadband service profits, was effectively an investment against competition. It was an effort that paid dividends by late 2005, when the city and Mediacom suddenly announced a new “public-private partnership” to administer and expand the Wi-Fi network. There were a few important changes, however:

- Mediacom’s concept of “free” was markedly different than the designers’ original vision. The cable company had other ideas, placing restrictions on how much “free use” was allowed;

- Customers who used the newly-announced “free service” got it at speeds not much better than dial-up and definitely slower than 3G;

- Residential Mediacom broadband customers could get unlimited time on the formerly-free network, if they paid $19.95 a month for 256kbps access;

- To make the network seem business-friendly, business customers were told they could get up to 10Mbps service for $59.95 a month.

The goal of the partnership, according to Mike Miller, chairman of the Marshalltown Economic Development Impact Committee, was to see low-cost broadband Internet access citywide by the end of 2006.

Oh, and Mediacom insisted on something else: no more talk of a city-created municipal telecommunications provider, at least for a year anyway.

“We commend you on the foresight and vision to do this,” Bill Peard, Mediacom’s government affairs manager, told city officials at the time the deal was announced.

Friends until the community-owned...

Once Mediacom got its hands on the formerly community-owned network, it was the beginning of the end.

Business customers could not get Mediacom to sell them access at the promised price because representatives could not find the offer.

It was much worse for residential users.

Free Wi-Fi access soon became limited to one hour a day, up to 10 hours per month for non-Mediacom customers. After that, you paid if you wanted more.

City and company officials spent most of their time wrangling over the costs of the service and its future potential. What city officials were not planning for was the network’s virtual demise at the hands of the cable company.

...free Wi-Fi network is at an end.

Today, free access is a distant memory, as Mediacom pulled the plug claiming there was “limited interest.”

Effectively, Mediacom’s idea of a public-private partnership was the systematic decommissioning of a community’s public Internet alternative, all to protect its own broadband business.

That’s a lesson of caution for any community seeking to team up with private broadband providers. Marshalltown allowed that partnership to first and foremost serve Mediacom’s business interests, not the public. Now that network is effectively gone and largely-forgotten.

That suits Mediacom just fine.

Subscribe

Subscribe