Comcast and Charter Communications have no real interest in competing head-to-head in wireless with AT&T, Verizon, T-Mobile, or Sprint. Instead, the two cable companies hope to trap you in a bundled package of services too inconvenient to cancel.

Comcast and Charter Communications have no real interest in competing head-to-head in wireless with AT&T, Verizon, T-Mobile, or Sprint. Instead, the two cable companies hope to trap you in a bundled package of services too inconvenient to cancel.

Jeff Kagan, a longstanding telecommunications analyst specializing in the cable industry, believes Comcast, Charter, and other cable operators entering the wireless business have no intention of being a serious competitor to the country’s four largest mobile companies.

“The goal of XFINITY Mobile [from Comcast] is to offer their customers another service and to create a sticky bundle,” Kagan said. “It’s not to lead the wireless wars. It’s not to increase their market share for traditional reasons. It is simply to create a sticky bundle to stabilize and grow their customer base.”

Kagan

XFINITY Mobile and Spectrum Mobile (from Charter), both require customers to be signed up for their respective internet services. If a customer cancels internet service, they will lose their mobile service. That could prove to be a major hassle for wireless customers, because they will have to properly port out their existing phone number(s) to another provider before dropping broadband.

Kagan believes cable operators will use mobile service to further strengthen their bundle by tying discounts to the number of services each customer takes through the cable company.

“Customers who use one service find it easy to switch away to a competitor,” Kagan said. “However, when they use multiple services and get a discount for the bundle, they become sticky and generally stay put. And the more services a customer uses, the larger the discount, the stickier they get and the less likely they are to wander.”

That is also likely to be true with Altice, which operates Optimum (Cablevision) and SuddenLink and has partnered with Sprint to offer cell service.

Sprint and T-Mobile, which are planning to merge, have repeatedly argued cable operators will be aggressive new players in the mobile business, giving the potentially combined carrier fierce new competitors. But Kagan doubts that will prove true.

![]() “The problem is, the sticky bundle is not a low-cost solution,” Kagan offered. “With that said, the higher cost to the cable television companies is less than that of losing their customer base. So, the cost makes sense as simply a cost of doing business.”

“The problem is, the sticky bundle is not a low-cost solution,” Kagan offered. “With that said, the higher cost to the cable television companies is less than that of losing their customer base. So, the cost makes sense as simply a cost of doing business.”

The challenge cable operators face is that none plan to own and operate their own traditional cellular network. Comcast and Charter have partnered with Verizon Wireless to resell access to its 4G LTE network and Altice will rely on Sprint. Leasing access on an ongoing basis is likely to be more expensive that relying on your own network, but beyond offering Wi-Fi calling and experimental access to future 5G-type services in the emerging CBRS band, cable operators will remain almost completely dependent on their wireless provider partners, limiting their effective ability to compete.

Kagan believes the goals of the two industries are different. Wireless operators are trying to monetize their networks through usage, while cable operators are trying to find new services that will keep customers loyal and are willing to ignore monetizing their wireless side businesses to achieve that goal.

Subscribe

Subscribe

Charter is expecting it can distribute more of its revenue to shareholders, share buybacks, and debt payments as a result of the completion of its all-digital conversion project, which eliminated analog television signals from cable systems to make more room for revenue-enhancing internet service. The company also gets to lease more set-top boxes to customers seeking to view digital television signals on older analog TV sets.

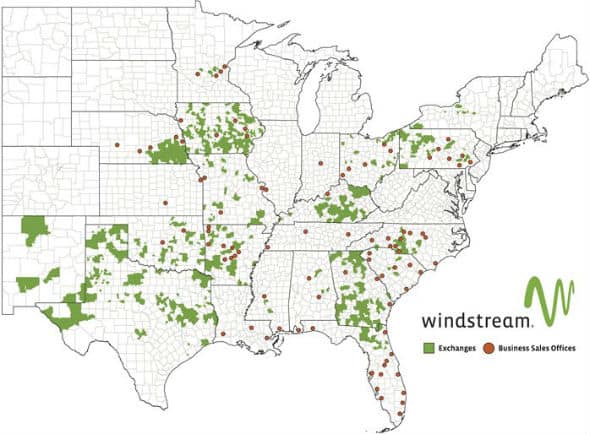

Charter is expecting it can distribute more of its revenue to shareholders, share buybacks, and debt payments as a result of the completion of its all-digital conversion project, which eliminated analog television signals from cable systems to make more room for revenue-enhancing internet service. The company also gets to lease more set-top boxes to customers seeking to view digital television signals on older analog TV sets. Windstream is relying on the Federal Communications Commission’s Connect America Fund to double the areas where it will offer 100 Mbps broadband service, expected to reach 30% of the company’s 18-state local service area by the end of the first quarter of 2019.

Windstream is relying on the Federal Communications Commission’s Connect America Fund to double the areas where it will offer 100 Mbps broadband service, expected to reach 30% of the company’s 18-state local service area by the end of the first quarter of 2019.

Forty companies, including hedge funds, phone companies, and wireless carriers have collectively bid $336,265,480 so far for about 2,500 28 GHz licenses (out of 3,072 available) that will be a part of the buildout of 5G millimeter wave wireless service.

Forty companies, including hedge funds, phone companies, and wireless carriers have collectively bid $336,265,480 so far for about 2,500 28 GHz licenses (out of 3,072 available) that will be a part of the buildout of 5G millimeter wave wireless service. California: Kern

California: Kern