AT&T’s idea of a small cell deployment on an existing utility pole in Oakland, Calif. (Image courtesy: Omar Masry, a city planner living in the area, who warns other city planners: “Don’t let this happen to you.”)

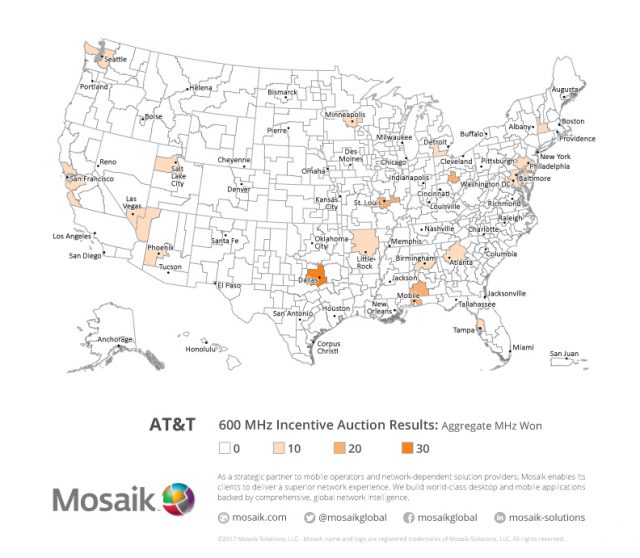

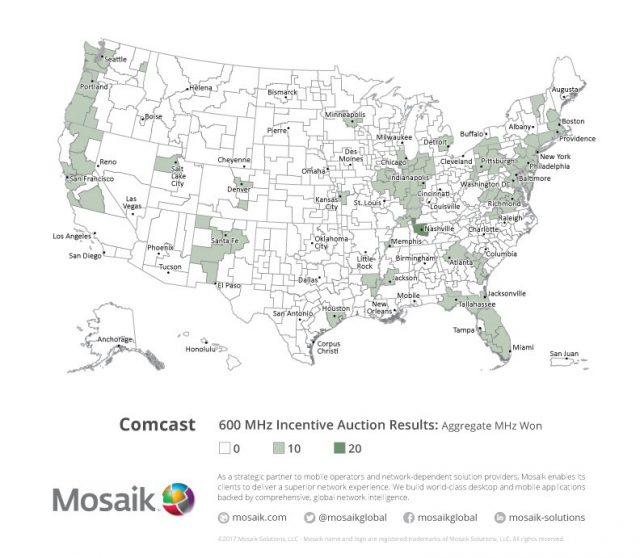

Some of America’s biggest wireless telecom companies are spending millions lobbying Washington and state legislatures for the right to place a myriad of new wireless transmitters and small cells in the public rights-of-way without local communities having much say about where they go and what they look like.

Utility Traffic Jam

Over the next five years, tens of thousands of new “small cell” devices are expected to be placed on utility poles to manage forthcoming wireless services, and that represents a conservative estimate. Every major wireless carrier is contemplating new line-of-sight 5G communications networks that will require a massive deployment of new wireless antennas that will serve a smaller audience of devices than traditional cell towers have. But wireless companies will not be alone. Cable operators are also expected to enter the wireless business, not only to resell other providers’ cellular services but also to deploy new low power, line of sight networks to manage the Internet of Things (IoT), which will wirelessly connect devices ranging from home appliances and heating/cooling systems to vehicles on the road, utility meters, shopping carts, for sale and street vendor signs, traffic signals, and much, much more.

It’s an entirely new world for local governments tasked with approving permit requests to place cellular and wireless infrastructure on private and public lands. With billions to be made managing machine-to-machine communications, smart cars, and expanded wireless internet, every player has a vested interest in making sure local governments don’t impede their potential profits.

That is why companies like AT&T are pushing hard for new limitations on local government objections to their sprouting wireless infrastructure. Their idea is to override local control and shift to their proposed statewide or federal guidelines conveniently favoring them by putting time limits on communities to contemplate an application, eliminating certain rights for local governments to object to those applications, and making certain wireless companies don’t have to pay what they consider excessive fees or taxes to local authorities for the right to use the public space.

For local governments, responsiveness to citizens who have to live next to wireless infrastructure is important, and not only because of pseudo-scientific fears of the health impacts of wireless signal radiation. Aesthetic issues alone often make or break current wireless antenna applications.

The POTs and PANs Blog notes that time is short for local communities to get their wireless infrastructure policies in place for the incoming boom of mini-cell sites and IoT networks.

Pole Refrigerators and 100-Foot Fake Pine Trees

Traditional cell towers are easy to spot because they are tall and very visible with wireless antennas often serving multiple carriers fixed up and down across the tower. The next generation of wireless networks will be powered by much smaller antennas attached to utility and light poles. In some cases where nearby trees can block signals, providers propose new 100-foot tall monopoles, sometimes disguised to resemble a tree — albeit a very, very tall one. To know how those trees could be removed with efficiency, you can learn this here now.

Some early generation “small cells” resemble a compact refrigerator and weigh several hundred pounds. These are usually mounted approximately half to two-thirds up a utility pole and are very visible. Some have loud cooling fans, others need additional infrastructure like external power that will busy-up the utility pole with more cables and supports. In a storm strong enough to take out a utility pole, you would not want to be underneath a falling “small cell.”

The Tree Trimming Flat-Top Haircut is Back

Arborists warn that some early 5G installations have taken a serious toll on nearby trees also in the right-of-way because the technology requires a direct line-of-sight to the antenna. This has resulted in aggressive tree-trimming to keep foliage far away from the small cell, and that trimming sometimes includes reducing the height of nearby trees.

A University of Surrey study found that small cells mounted 10 meters up a pole faced at least a 30% chance of having their signals blocked by trees. At 15 meters, that chance of signal blockage is reduced to 10%. At 25 meters, it is less than 1%. But that would require an 82-foot high utility pole in the neighborhood. The standard utility pole in the United States is about 40 ft (12 m) long. Either aggressive tree trimming or tall utility pole placement to avoid trimming is likely to create controversy in suburban residential neighborhoods.

City planners are being urged to contemplate what kind of enforceable policies they want to permit in the public space set aside for infrastructure, because as author Doug Dawson noted, it’s going to get busy up there:

I doubt that any city is prepared for the possible proliferation of wireless devices. Not only are there four major cellular companies, but these devices are going to be deployed by the cable companies that are now entering the cellular market along with a host of ISPs that want to deliver wireless broadband. There will also be significant demand for placement for connecting private networks as well as for the uses by the cities themselves. I remember towns fifty years ago that had unsightly masses of telephone wires. Over the next decade or two it’s likely that we will see wireless devices everywhere.

Subscribe

Subscribe