The Republican party platform on technology gives little credit to the Obama Administration’s handling of all-things-high-tech and demands a wholesale deregulation effort to free the hands of service providers, get rid of Net Neutrality, and sell off wireless spectrum to boost wireless communications.

The Republican party platform on technology gives little credit to the Obama Administration’s handling of all-things-high-tech and demands a wholesale deregulation effort to free the hands of service providers, get rid of Net Neutrality, and sell off wireless spectrum to boost wireless communications.

The platform authors are particularly incensed about Net Neutrality, a policy that requires providers to treat Internet content equally on their networks. Some Republicans have previously called that “a government takeover of the Internet,” telling providers what they can and cannot provide customers. Vice-presidential nominee Rep. Paul Ryan (R-Wis.) fiercely opposes Net Neutrality. In 2011, he supported a resolution disapproving of the policy and in 2006 he voted against an amendment to a bill that would have codified it into federal law.

“The most vibrant sector of the American economy, indeed, one-sixth of it, is regulated by the federal government on precedents from the Nineteenth Century. Today’s technology and telecommunications industries are overseen by the FCC, established in 1934 and given the jurisdiction over telecommunications formerly assigned to the Interstate Commerce Commission, which had been created in 1887 to regulate the railroads. This is not a good fit,” the Republican platform states. “Indeed, the development of telecommunications advances so rapidly that even the Telecom Act of 1996 is woefully out of date.”

Mitt Romney is an ardent deregulator. Under a plan favored by the Republican presidential candidate, agencies like the Federal Communications Commission would be required to offset the cost of any new regulations by eliminating existing regulations. Additionally, Romney plans to issue an executive order as president telling all agencies they must notify Congress about any forthcoming regulations and wait for the House and Senate to approve them before they could take effect. With the current level of Congressional gridlock, a consensus to approve any new regulatory policy is unlikely. The end effect would likely be a near-moratorium on government regulation.

The Republican platform also attacked the Obama Administration for failing to expand broadband to rural areas, but offered nothing beyond generalities about “public-private partnerships” on how to expand broadband to the unserved.

“That hurts rural America, where farmers, ranchers, and small business manufacturers need connectivity to expand their customer base and operate in real time with the world’s producers,” the platform said. “We encourage public-private partnerships to provide predictable support for connecting rural areas so that every American can fully participate in the global economy.”

One can infer from the language in the document Republicans are opposed to public broadband initiatives.

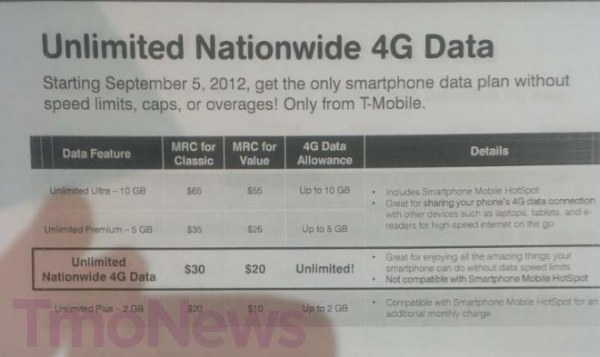

The Republicans also promise to accelerate public spectrum sell-offs to private companies through auctions to expand the number of frequencies available for wireless communications.

The Obama Administration defends its telecommunications policies, noting the FCC’s National Broadband Plan and the American Recovery and Reinvestment Act’s broadband stimulus program have identified unserved areas, despite provider obfuscation, and targeted funding to open up new broadband opportunities. The administration also says it has effectively reformed the Universal Service Fund into a new Connect America Fund that will underwrite prohibitively expensive rural broadband expansion projects.

The White House also defends its spectrum policies noting existing spectrum still has licensed users that face lengthy and often costly transitions to other frequencies to clear space for cell phone companies. Still, President Obama ordered the FCC to find 500MHz of spectrum to reallocate to wireless communications and the FCC plans the first ever incentive auction that will let TV stations voluntarily surrender their frequencies in return for financial incentives.

Both the Obama and Romney campaigns oppose efforts to internationalize Internet regulatory policy through organizations like the United Nations or the International Telecommunications Union. Some governments have stepped up their efforts to lobby for a transition away from Internet policies they see dominated by the United States.

Democrats are also considering Internet language in their party platform for the party’s upcoming convention next month.

Subscribe

Subscribe