“You’re giving it away… you are giving it all away!” — An unknown Wall Street analyst tossing and turning in the night.

“You’re giving it away… you are giving it all away!” — An unknown Wall Street analyst tossing and turning in the night.

America is simply not paying enough for wireless service. Thanks to dastardly competition introduced by T-Mobile and Sprint (potentially to be snuffed out in due course if their merger gets approved), wireless pricing is no longer a license to print money. Forced to offer one-size-fits-all affordable $40-50 unlimited plans, the prospects to grow Average Revenue Per User (ARPU) have never been worse because you can’t charge people for more service on an “unlimited plan” without admitting that plan is not exactly “unlimited.”

Wall Street analysts, already upset at the thought of carriers spending more than $100 billion on 5G network upgrades, are in a real tizzy about how companies are going to quickly recoup that investment. No matter that some wireless companies have profit margins in the 50% range and customers have paid providers for a service they were assured would keep up with the times and network demand. If there is to be a 5G revolution in the United States, some insist it must not come at the cost of reliable profits — so the industry must find a way to stick consumers with the bill.

It is not common for industry analysts to go public brainstorming higher prices and more customer gouging. After all, North Americans already pay some of the highest cell phone bills in the world, only mitigated (for now) by scrappy T-Mobile and Sprint. Mark Lowenstein, a leading industry analyst, consultant, and commentator, was willing to go public in the pages of Fierce Wireless, arguing “operators should be considering charging a premium price for what will hopefully be a premium service.” That is likely music to the ears of AT&T and Verizon, both frustrated their pricing power in the market has been reduced by credible competition from a significantly improved T-Mobile.

Lowenstein fears the prospects of a “race-to-the-bottom 5G price war” which could arrive if America’s wireless companies offer a credible home internet replacement that lets consumers tell the local phone or cable company to ‘take a hike.’ Since wireless operators will bundle significant discounts for those who subscribe to both home and mobile plans, telecommunications services may actually cost less than what Wall Street was banking on.

Something must be done. Lowenstein:

In mobile, there’s been premium pricing for premium phones. And Verizon Wireless, for a few years when it had a clear network lead, was sort of able to charge a higher price for its service (but not a premium price). But today, there isn’t really premium pricing for premium services. That should change when 5G really kicks into gear.

So how do you extract more cash from consumers’ wallets? Create artificial tiers that have no relationship to the actual cost of the network, but could potentially get people to willingly pay a lot more for something they will initially get for a simple, flat price:

One simple way would be a flat premium price, similar to the “tiers” of Netflix for a higher number of devices or 4K/Ultra HD. So, perhaps $10 per line for 5G, or $25 for a family plan. Another approach would be more akin to broadband, where there are pricing tiers for different levels of service performance. So if the base 4G LTE plan is $50 per month today, for an average 100 Mbps service, 5G packages could be sold in gradations of $10 for higher speeds (i.e. $60 for 300 Mbps, $70 for 500, $80 for 1 Gbps, and so on). An interesting angle on this is that some of the higher-end 4G LTE services such as Gigabit LTE (and beyond) could get incorporated into this, so it becomes less of a 4G vs. 5G discussion and more of a tier of service discussion.

I would also like to see some flexibility with regard to how one can purchase 5G capabilities. For example, a user might only need those premium 5G features occasionally, and might only be prepared to pay that higher price when the service is being used. Here, we can borrow from the Wi-Fi model, where operators offer a “day pack” for 5G, or for a certain city, location, or 5G-centic app or experience. 5G is going to be hot-spotty for awhile anyway, so why not use a Wi-Fi type model for pricing?

Even better, now with net neutrality in the ash heap of history, courtesy of the Republican-dominated FCC, providers can extract even more of your money by artificially messing with wireless traffic!

Even better, now with net neutrality in the ash heap of history, courtesy of the Republican-dominated FCC, providers can extract even more of your money by artificially messing with wireless traffic!

Lowenstein sees a brand new world of “app-centric pricing” where wireless carriers can charge even more to assure a fast lane for those entertainment, gaming, and virtual reality apps of the future, designed to take full advantage of 5G. Early tests have shown millimeter wave 5G networks can deliver extremely low latency traffic to customers from day one. That kills the market for selling premium, low-latency add-ons for demanding apps before companies can even start counting the money. So assuming providers are willing to purposely impede network performance, there just could be a market selling sub-100ms assured latency for an extra fee.

The potential of a Money Party only 5G can deliver is coming, but time is short to get the foundation laid for surprise toll lanes and “premium traffic” enhancements made possible without net neutrality. But first, the wireless industry has to get consumers hooked on 5G at a tantalizingly reasonable price. Charge too much, too soon and consumers may decide 4G LTE is good enough for them. That is why Lowenstein recommends operators not get carried away when 5G first launches.

“We don’t want to be setting ourselves up for a WiMAX-like disappointment,” Lowenstein writes. “The next 12-18 months are largely going to be ‘5G Experimentation’ mode, with limited markets, coverage, and devices. Heck, it’s likely to be two years before there’s a 5G iPhone in the United States, where iOS still commands nearly half the market.”

The disappointment will eventually be all yours, dear readers, if Lowenstein’s recommendations are adopted — when “certain milestones” trigger “rate adjustment” letters some day in the future.

The disappointment will eventually be all yours, dear readers, if Lowenstein’s recommendations are adopted — when “certain milestones” trigger “rate adjustment” letters some day in the future.

Lowenstein sees four signs to start the pillaging, and we’ve paraphrased them:

- Coverage: Wait until 30-40% of a city is covered with 5G, then jack up the price. As long as customers get something akin to 5G one-third of the time, they’ll moan about why their 5G footprint is so limited, but they will keep paying more for the scraps of coverage they get.

- Markets: Price the service differently in each market depending on how stingy customers are likely to be at different price points. Then hike those prices to a new “nationwide” standard plan when 5G is available in the top 20-30 cities in the country. Since there may not be much competition, customers can take it or leave it.

- Performance: AT&T and Verizon’s gotta gouge, but it’s hard to do it with a straight face if your 5G service is barely faster than 4G LTE. Lowenstein recommends waiting until speeds are reliably north of 100 Mbps, then you can let rip with those diamond-priced plans.

- Devices: It’s hard to extract another $50-100 a month from family plan accounts if there are an inadequate number of devices that support 5G. While your kids “languish” with 4G LTE smartphones and dad enjoys his 5G experience, mom may shut it all down when the bill comes. Wait until everyone in the family can get a 5G phone before delivering some good old-fashioned bill shock, just like companies did in the golden days of uncompetitive wireless.

These ideas can only be adopted if a lack of competition assures all players nobody is going to call them out for pickpocketing customers. Ajit Pai’s FCC won’t interfere, and is even subsidizing some of the operators’ costs with taxpayer dollars and slanted deregulation to let companies construct next generation 5G networks as cheaply as possible (claiming it is important to beat China, where 5G service will cost much less). Should actual competition remain in the wireless market, all the dreams of rate-hikes-because-we-can will never come true, as long as one carrier decides they can grow their business by charging reasonable prices at their competitors’ expense.

Comcast and Charter Communications are losing money on their cell service plans because their partner, Verizon Wireless, sets its wholesale rates too high, making certain the two companies cannot cannibalize Verizon’s own customers for long.

Comcast and Charter Communications are losing money on their cell service plans because their partner, Verizon Wireless, sets its wholesale rates too high, making certain the two companies cannot cannibalize Verizon’s own customers for long.![]() Moffett believes the two companies overestimated how often subscribers would offload traffic to Wi-Fi, and the future potential for more solid Wi-Fi coverage “looks cloudy.” The problem, as Moffett sees it, appears to be the cable industry’s loss of interest building out their metro Wi-Fi networks. Moffett called the joint CableWiFi project between Comcast, Charter, Cox, and Altice USA “a bust” because the members of the coalition have largely stopped investing in new hotspot installations. That leaves about 500,000 working hotspots around the country, a number that has remained unchanged for two years. Only in-business Wi-Fi continues to grow, as business cable broadband customers are offered the opportunity to provide Wi-Fi service for their customers. But those hotspots don’t typically offer outdoor coverage.

Moffett believes the two companies overestimated how often subscribers would offload traffic to Wi-Fi, and the future potential for more solid Wi-Fi coverage “looks cloudy.” The problem, as Moffett sees it, appears to be the cable industry’s loss of interest building out their metro Wi-Fi networks. Moffett called the joint CableWiFi project between Comcast, Charter, Cox, and Altice USA “a bust” because the members of the coalition have largely stopped investing in new hotspot installations. That leaves about 500,000 working hotspots around the country, a number that has remained unchanged for two years. Only in-business Wi-Fi continues to grow, as business cable broadband customers are offered the opportunity to provide Wi-Fi service for their customers. But those hotspots don’t typically offer outdoor coverage.

Subscribe

Subscribe Forty companies, including hedge funds, phone companies, and wireless carriers have collectively bid $336,265,480 so far for about 2,500 28 GHz licenses (out of 3,072 available) that will be a part of the buildout of 5G millimeter wave wireless service.

Forty companies, including hedge funds, phone companies, and wireless carriers have collectively bid $336,265,480 so far for about 2,500 28 GHz licenses (out of 3,072 available) that will be a part of the buildout of 5G millimeter wave wireless service. California: Kern

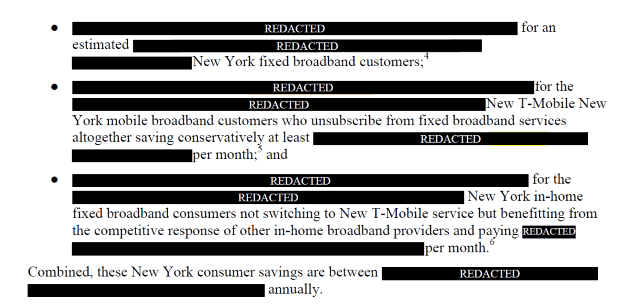

California: Kern A dispute is emerging in New York between Sprint and T-Mobile and the Communications Workers of America (CWA) and pro-consumer group the Public Utility Law Project (PULP) over the wireless companies’ attempt to argue for their merger deal in a partly secretive filing not open to review by the public.

A dispute is emerging in New York between Sprint and T-Mobile and the Communications Workers of America (CWA) and pro-consumer group the Public Utility Law Project (PULP) over the wireless companies’ attempt to argue for their merger deal in a partly secretive filing not open to review by the public.

The merger of the two wireless companies requires state and federal approval. Alaska, Colorado, Delaware, Georgia, Louisiana, Maryland, Minnesota, Nevada, Texas, Utah, West Virginia and the District of Columbia have already essentially “rubber-stamped” approval of the merger deal with little comment. Pennsylvania regulators submitted a series of questions that the two companies answered earlier this week.

The merger of the two wireless companies requires state and federal approval. Alaska, Colorado, Delaware, Georgia, Louisiana, Maryland, Minnesota, Nevada, Texas, Utah, West Virginia and the District of Columbia have already essentially “rubber-stamped” approval of the merger deal with little comment. Pennsylvania regulators submitted a series of questions that the two companies answered earlier this week. Property owners in New Zealand may have to trim back or remove trees if they are proven to interfere with Wi-Fi or wireless broadband services in the neighborhood, according to an interesting High Court

Property owners in New Zealand may have to trim back or remove trees if they are proven to interfere with Wi-Fi or wireless broadband services in the neighborhood, according to an interesting High Court

“You’re giving it away… you are giving it all away!” — An unknown Wall Street analyst tossing and turning in the night.

“You’re giving it away… you are giving it all away!” — An unknown Wall Street analyst tossing and turning in the night. Even better, now with net neutrality in the ash heap of history, courtesy of the Republican-dominated FCC, providers can extract even more of your money by artificially messing with wireless traffic!

Even better, now with net neutrality in the ash heap of history, courtesy of the Republican-dominated FCC, providers can extract even more of your money by artificially messing with wireless traffic! The disappointment will eventually be all yours, dear readers, if Lowenstein’s recommendations are adopted — when “certain milestones” trigger “rate adjustment” letters some day in the future.

The disappointment will eventually be all yours, dear readers, if Lowenstein’s recommendations are adopted — when “certain milestones” trigger “rate adjustment” letters some day in the future.