Defenders of FCC Chairman Ajit Pai are rushing to defend the Republican majority’s likely support for an initiative to roll back the FCC’s 25/3Mbps speed standard embraced by his predecessor, Thomas Wheeler.

Defenders of FCC Chairman Ajit Pai are rushing to defend the Republican majority’s likely support for an initiative to roll back the FCC’s 25/3Mbps speed standard embraced by his predecessor, Thomas Wheeler.

Johnny Kampis, writing for Watchdog.org, claims that broadband speed standard has had an adverse affect on solving America’s rural broadband gap.

After raising that standard, suddenly those areas with speeds below 10 mbps were lumped into the same group with those who could access speeds of 10-25 mbps, resulting in diminished focus on those areas where the broadband gap cut the deepest.

Raising the standard meant, too, that fans of big government could point to the suddenly higher percentage of the population that was “underserved” on internet speeds and call for more taxpayer money to solve that “problem.”

Kampis is relying on the talking points from the broadband industry, which also happens to support the same ideological interests of Watchdog.org’s benefactor, the corporate/foundation-funded Franklin Center for Government & Public Integrity. The argument suggests that if you raise broadband standards, that opens the door to more communities to claim they too are presently underserved, which then would qualify them for government-funded broadband improvements.

Kampis’ piece, like many of those published on Watchdog.org, distorts reality with suggestions that communities with 50Mbps broadband service will now be ripe for government handouts. He depends on an unnamed source from an article written on Townhall.com and also quotes the CEO of Freedom Foundation of Minnesota, which is closely associated with the same Franklin Center that hosts Watchdog.org. Kampis’ piece relies on sourcing that is directly tied to the organization hosting his article.

Kampis’ piece, like many of those published on Watchdog.org, distorts reality with suggestions that communities with 50Mbps broadband service will now be ripe for government handouts. He depends on an unnamed source from an article written on Townhall.com and also quotes the CEO of Freedom Foundation of Minnesota, which is closely associated with the same Franklin Center that hosts Watchdog.org. Kampis’ piece relies on sourcing that is directly tied to the organization hosting his article.

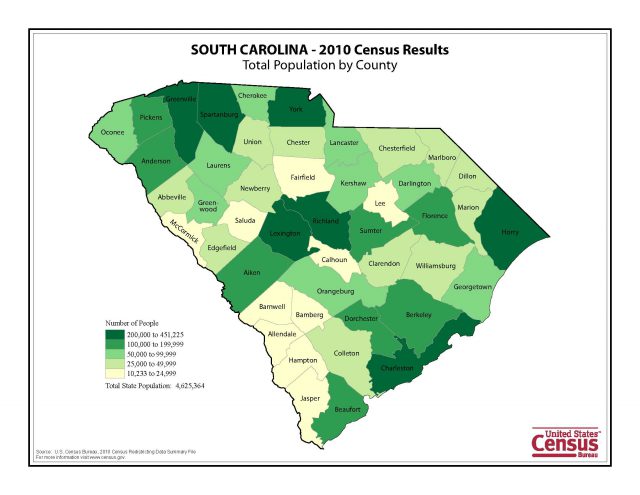

In reality, rural broadband funding has several mechanisms in place which heavily favor unserved, rural areas, not communities that already have 50Mbps internet access. ISPs also routinely object to projects proposed within their existing service areas, declaring them already served, and much of the funding doled out by the Connect America Fund (CAF) Kampis suggests is a government handout are being given to telephone companies, not municipalities.

Kampis

Kampis is satisfied free market capitalism will eventually solve the rural broadband problem, despite two decades of lackluster or non-existent service in areas deemed unprofitable to serve.

“So while Pai’s critics denigrate him because his FCC is considering lowering that broadband standard, he’s just correcting an earlier mistake, with the realization that the free market, not big government, will solve the rural broadband gap if given enough time,” Kampis writes. “And returning to the old standards will help ensure that the focus will be placed squarely on the areas that need the most help.”

Kampis suggests that free market solution might be 5G wireless broadband, which can potentially serve rural populations less expensively than traditional wired broadband service. Communities only need wait another 5-10 years for that to materialize, if it does at all.

Kampis claims to be an investigative reporter, but he didn’t venture too far beyond regurgitating press releases and talking points from big phone companies and opponents of municipal broadband. If he had spent time reviewing correspondence sent to the FCC in response to the question of easing broadband speed standards, he would have discovered the biggest advocates for that are large phone companies and wireless carriers that stand to benefit the most from the change.

Kampis claims to be an investigative reporter, but he didn’t venture too far beyond regurgitating press releases and talking points from big phone companies and opponents of municipal broadband. If he had spent time reviewing correspondence sent to the FCC in response to the question of easing broadband speed standards, he would have discovered the biggest advocates for that are large phone companies and wireless carriers that stand to benefit the most from the change.

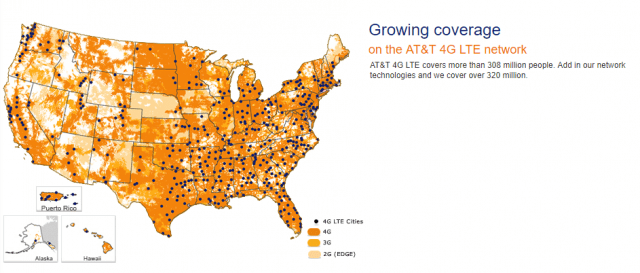

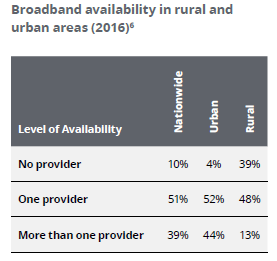

Following the money usually delivers a clearer, more fact-based explanation for what motivates players in the broadband industry. In this case, the 25Mbps speed standard has regularly been attacked by phone and wireless companies hoping to tap into government funds to build out their networks. Traditional phone companies are upset that the 25Mbps requirement means their typical rural broadband solution – DSL, usually won’t cut it. Wireless companies have also had a hard time assuring the FCC of consistent 25Mbps speeds, making it difficult for them to qualify for grants. AT&T wasn’t happy with a 10Mbps standard for wireless service either.

Incidentally, these are the same companies that have failed to solve the rural broadband gap all along. Most will continue not serving rural areas unless the government covers part of their costs. AT&T illustrates that with its own fixed wireless rural broadband solution, which came about grudgingly with the availability of CAF funding.

The dark money ATM network hides corporate contributions funneled into advocacy groups.

The free market broadband solution is rooted in meeting Return On Investment metrics. In short, if a home costs more to serve that a company can recoup in a short amount of time, that home will not be served unless either the homeowner or someone else covers the costs of providing the service. By wiping out the Obama Administration’s FCC speed standard, more ratepayer dollars will be directed to phone and wireless companies that will build less expensive and less-capable DSL and wireless networks instead of investing in more modern technology like fiber optics.

Mr. Kampis, and others, through their advocacy, claim their motive is a reduction in government waste. But in reality, and not by coincidence, their brand of journalism hoodwinks readers into advocating against their best interests of getting fast, future-proofed broadband, and instead hand more money to companies like AT&T. The Franklin Center refuses to reveal its donor list, of course, but SourceWatch reported the Center is heavily dependent on funding from DonorsTrust, which cloaks the identity of its corporate donors. Mother Jones went further and called it “a dark money ATM.”

Companies like AT&T didn’t end up this lucky by accident. It donates to dark money groups that fund various sock puppet and astroturf operations that avoid revealing where the money comes from, while the groups get to claim they are advocating for taxpayers. By no coincidence, these groups frequently don’t attack corporate welfare, especially if the recipient is also a donor.

New York’s rural broadband initiative is on track to deliver near 100% broadband coverage to all New York homes and has speed requirements and a ban on hard data caps.

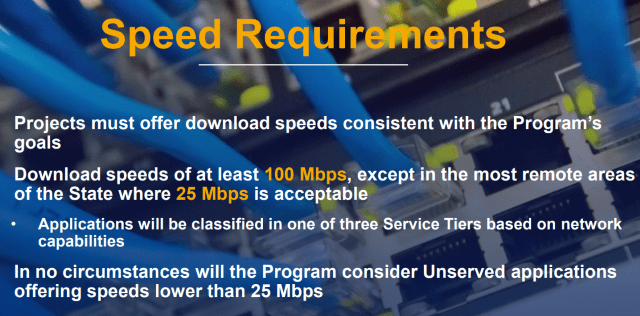

Raising speed standards does not harm rural broadband expansion. In New York, Gov. Andrew Cuomo’s broadband expansion campaign is on track to reach the remaining 150,000 homes still without broadband access by sometime next year. His program relies on broadband expansion funding that comes with requirements that insist providers offer internet access capable of at least 25Mbps (with a preference for 100Mbps) for $60 or less and a ban on hard usage caps. Kampis claims the 25Mbps speed standard hampers progress, yet New York is the first state in the nation moving towards 100% broadband availability for its residents at that speed or better.

Chairman Pai’s solution is little more than a gift to the country’s largest phone and wireless companies that would like to capture more CAF money for themselves while delivering the least amount of service possible (and keep money out of the hands of municipalities that want to build their own more capable networks). The evidence is quite clear — relying on the same companies that have allowed the rural broadband crisis to continue for more than 20 years is a stupendously bad idea that only sounds brilliant after some corporation writes a large check.

Subscribe

Subscribe